E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower 48 DUC Count Overstated in EIA Data, Says Raymond James

The absolute number of uncompleted wells in the U.S. onshore has increased in the past two years, but the count is “normal” and in line with the swell in overall activity, Raymond James & Associates Inc. said Monday.

The large number of drilled but uncompleted wells, aka DUCs, have been overstated in data issued by the Energy Information Administration (EIA), according to analyst J. Marshall Adkins and his team. The data may concern investors, but the underlying data need to be reviewed, analysts said.

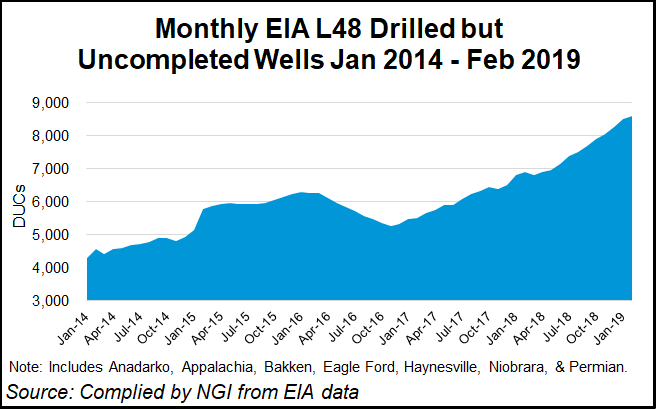

Each month EIA issues a Drilling Productivity Report (DPR) detailing Lower 48 activity by exploration and production (E&P) companies, including the estimated DUC count. The count across the seven biggest unconventional plays ended February at 8,576, an increase of 93 from January, according to EIA. Most of the DUCs in February were in the Permian Basin, which jumped 88 to 4,004, and in the Eagle Ford Shale, which increased 16 to 1,543.

The EIA data “overstates the true amount of DUCs,” according to Raymond James analysts. “That is because the EIA includes thousands of ”Forgotten UnCompleted wells’ that were drilled years ago and are never likely to be completed in the future.”

The Raymond James team estimated that the EIA DUC data was overstated by almost 30%, or about 2,000 wells.

“The vast majority of DUCs are simply a function of new ”manufacturing’ methodologies that E&P companies have adopted to reduce costs and optimize returns,” analysts said.

“Likewise, the increase in ”days of DUC inventory’ over the past five years is more attributable to changes in pad drilling, increasing wells per pad and fracture crew optimization than any intentional (oil and gas price driven) delaying of completions.”

Using EIA’s data, Raymond James estimated that the “normal” level of DUC inventories is closer to four months rather than the historical level of about two months. Analysts reason that the appropriate standard to judge the appropriate level of DUCs is “months of inventory,” or the amount of time completions could continue unheeded without additional wells being drilled.

Raymond James said the “normal” level of DUC inventory has doubled to four months of inventory because of more pad drilling, more wells per pad and the need for maximum fracture crew hours pumped without waiting on well delays.

“Keep in mind that any delay a fracture crew encounters due to a low backlog of wells to be completed creates massive cost inefficiencies,” analysts said. “Because of this, today’s operators are working more closely than ever with dedicated fracture crews to maximize

the pumping time of dedicated fracture crews. This requires more wells in inventory or a higher ”months of inventory’ of DUCs.”

Completions activity is now poised to outpace drilling activity by a modest amount this year, which means the “abnormal” inventory would normalize fairly quickly.

“This should give a slight tailwind to completions-oriented service companies early this year, but the bigger impact should begin to show in 2020, as higher oil prices drive more activity and fracture fleet attrition lead to fracture crew shortages next year,” Adkins said.

In any case, he said investors need to dismiss the idea that an onslaught of DUC production is going to flood the oil market and drive prices down.

“Those fears are quite simply quacky.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |