Natural Gas Forwards Slip Without a Spring in Their Step

With mild sunny weather already blanketing much of the country, natural gas forward prices retreated for a second week, although losses were small as brief periods of chilly air were still expected to pop up during the next few weeks.

The entire forward curve saw declines of less than a nickel for the March 14-20 period, with April falling an average of 3 cents and the summer strip slipping 2 cents on average, according to NGI’s Forward Look.

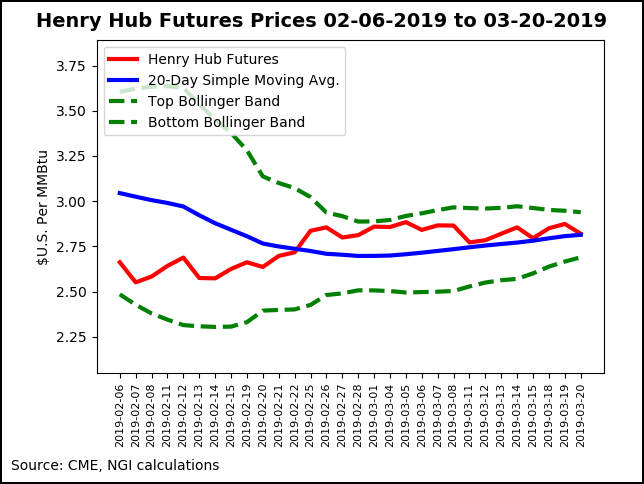

The modest shifts in forward prices mimicked the declines seen in the Nymex futures strip, which flip-flopped throughout the four-day period despite the generally bearish sentiment in the market.

Wednesday’s action, however, could prove to be a sign of what’s to come for prices after the prompt month dropped about a nickel to $2.82, although traders stopped for a breather on Thursday as overnight weather model guidance moved in a modestly warmer direction, according to Bespoke Weather Services.

European ensemble guidance remained the steadiest, with overnight runs showing only a few heating degree day losses and actually a more intense shot of cold air in the short term. “Other models have been backing off the intensity of cold through next week, though we note that volatility is far above normal for the time of year,” Bespoke chief meteorologist Jacob Meisel said.

American guidance has now swung too far in a warm direction after swinging dramatically in a colder direction last Tuesday, and Bespoke continues to weight European model guidance higher because of its consistency. “If anything, we could see slight cooling of the forecast later in Week 2 with the lingering negative Eastern Pacific Oscillation, though confidence remains below average.”

Indeed, midday American model guidance was cooler for the March 30-April 3 period, although it remained warmer than the more aggressive European data.

On Friday, there were no major changes in the weather data as swings in national demand every few days through the first week of April were expected because of weather systems tracking across the country with showers and cooling, according to NatGasWeather. “With that said, the latest data is to the warmer/bearish side April 3-6, which if it were to hold through the weekend could give a bearish tilt to weather sentiment to start next week.”

Weather aside, storage concerns that had briefly re-emerged in recent weeks appeared to dissipate once again. On Thursday, the Energy Information Administration (EIA) reported a 47 Bcf withdrawal from storage inventories for the week ending March 15. The reported draw fell in line with expectations and was much lighter than both the year-ago draw of 87 Bcf and the five-year 56 Bcf average.

A Reuters survey showed participants expecting a 48 Bcf withdrawal, with estimates ranging from a pull of 30 Bcf to 56 Bcf. As of Wednesday afternoon, a Bloomberg survey showed a median estimate for a 50 Bcf pull, with responses ranging from minus 42 Bcf to minus 56 Bcf. NGI’s storage model predicted a 44 Bcf withdrawal.

Bespoke said the reported withdrawal indicated “a strong reading of current balance by its current supply/demand balance.”

Broken down by region, the EIA reported a 19 Bcf pull in the Midwest, a 17 Bcf draw in the East and a 2 Bcf net draw in the South Central after nonsalt facilities withdrew 8 Bcf and salt injected 6 Bcf. The South Central data came with an asterisk, though, as the EIA said regional inventory was revised 4 Bcf higher for nonsalt facilities for the week ending March 8. That means total inventories were at 1,190 Bcf for that week.

Market observers on Enelyst, an energy chat room hosted by The Desk, generally shrugged off the revision, as it was not “overly impactful.” Traders felt similarly as the Nymex April contract was down about a penny ahead of the 10:30 a.m. ET report and continued to trade near that level for much of the day. The Nymex April contract went on to settle Thursday at $2.821, up a mere one-tenth of a cent. Similarly minute gains were seen across the curve.

Bespoke said the revision has it seeing the last two EIA prints combined as being about 1 Bcf/d loose to the five-year average, and while the most recent data does confirm some recent loosening, it was not particularly pronounced.

“While salts did build, it was rather muted as well, and we are seeing decent support by later contracts along the futures curve that have us see $2.80 support as still likely to hold post-print, even though the print does not provide much of a bullish catalyst moving forward,” Meisel said.

Gas stocks for the week ending March 15 stood at 1,143 Bcf, 315 Bcf below last year and 556 Bcf below the five-year average.

Meanwhile, overnight trading action on Thursday was more explicit after a sharp and sudden nearly 10-cent drop in prices sent the April contract from just above $2.810 to as low as $2.721 in a matter of minutes.

“We have seen some wild price action over the last 12 hours, as April natural gas prices briefly plunged all the way to $2.721,” Bespoke said early Friday. “…The move appears algo-driven as opposed to organized selling, as prices did bounce back as high as $2.80 overnight.

April went on to settle Friday at $2.753, down 6.8 cents. May dropped 6 cents to $2.767.

The recent blasts of cold air this month — with another scheduled to hit the Northeast on Friday — shifted end-of-March storage estimates lower, which may delay the projected downward pressure on Nymex futures, according to EBW Analytics.

“Although the market remains confident in the ability to rapidly rebuild storage supplies when needed — as evidenced by the relatively low seasonal spreads — it is difficult for bearish sentiment to emerge when storage is at a multi-year low,” EBW CEO Andy Weissman said.

It is possible that it may take weeks of eroding the storage deficit before prices begin to turn south, according to EBW. In 45 days, however, it may become evident that the year/year deficit is rapidly eroding and price declines may be needed to avert building a substantial year/year surplus.

“The summer forecast will become increasingly significant by early May. Last year, an early start to the cooling season helped to push natural gas higher throughout the month,” Weissman said.

Various forecasts currently show a cooler May versus last year, but another structural demand factor is likely to emerge in the coming weeks.

Feedgas deliveries to liquefied natural gas (LNG) export facilities are set to more than double by the end of the summer. Deliveries to currently operating export facilities have averaged above 5 Bcf/d in recent days, according to RBN Energy.

Sempra Energy’s Cameron LNG has said it is ready to introduce feedgas to its fuel system and is awaiting federal approval. Meanwhile, liquefaction projects at Kinder Morgan Inc.’s (KMI) Elba Island LNG and Freeport LNG terminals are gearing up to take feedgas in the next month or so, according to RBN.

KMI confirmed to NGI on Thursday that the in-service for the first of 10 trains at Elba Island is being pushed back to “late April” because of construction delays. Management had expected the first unit to enter service in the first quarter, already later than originally planned after twice halting construction due to hurricanes Florence and Michael last year.

The in-service date of the remaining nine units is expected to follow sequentially, with one each month after the other, according to KMI spokeswoman Lexey Long. The first export cargo will likely go out “when sufficient LNG is accumulated in tank storage after the first unit is in service”, but the timing of that shipment will ultimately be decided by Royal Dutch Shell plc, which has subscribed to 100% of the liquefaction capacity at Elba Island.

“When the first unit is in service, 70% of the revenue associated with this project will be recognized,” Long said.

KMI’s export project is expected to be the fourth major LNG export terminal in the United States after Cheniere Energy Inc. received federal approval earlier this month to start commercial operations on its Corpus Christi facility. The fifth train at its Sabine Pass export project in Louisiana started service earlier this month.

However, Genscape Inc.’s real-time monitoring of LNG volumes showed an unexpected drop in deliveries to the terminal for Thursday. Delivery nominations to Sabine Pass had dropped 617 MMcf/d day/day from Wednesday to Thursday (March 20 to March 21), according to the firm.

“Evening cycle nominations showed the greatest declines in scheduled capacity on the Kinder Morgan Louisiana and Creole Trail pipelines, with scheduled deliveries to the terminal via each pipeline falling 310 MMcf and 249 MMcf, respectively,” Genscape analyst Allison Hurley said. “Scheduled deliveries to Sabine Pass LNG have averaged 3.9 Bcf/d over the last seven days.”

Hurley said the drop in volumes did not correspond to any scheduled maintenance on either Kinder Morgan Louisiana or Creole Trail.

Cheniere has indicated that Sabine Pass would undergo “higher than average” maintenance this summer, although no details have been announced and it is unclear whether this reduction in gas flows to the facility are part of that planned maintenance.

Genscape said deliveries continued to fall on Friday, and the firm’s infrared cameras detected that Train 2 at Sabine Pass had been shut down.

Forward curves across the country were in firm shoulder-season mode for the March 14-20 period, with little deviation in price changes from one market hub to the next. Most April contracts priced within a nickel of Henry Hub, although a couple of points in the Midcontinent and California moved outside of that range.

NGPL S. Texas April forward prices rose 8 cents to $2.735, an 11.5-cent premium to the benchmark. May slipped a penny to $2.87 and the full summer strip (April-October) held steady at $2.92, both of which priced within a nickel to Henry Hub.

A cold front that moved into California last Wednesday swept through the Southwest on Thursday and brought rain and mountain snows to California, the Central Great Basin and into the Southwest/Four Corners region, according to the National Weather Service.

Pacific Gas & Electric (PG&E) temperatures were forecast around 53-54 degrees through the end of the work week, near seasonal averages. Southern California Gas Co. was forecasting composite weighted average temperatures in the upper 50s to low 60s during the same time period.

The crisp air sent cash prices back above $4 at SoCal Citygate. That strength spilled over into the forward markets, where April shot up 17 cents to $3.854, May rose 9 cents to $3.652 and the summer jumped a dime to $4.66, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |