Natural Gas Futures Steady After On-Target Natural Gas Storage Data; West Texas Cash Lowers the Floor

An on-target Energy Information Administration (EIA) storage report, along with a mix of bearish and bullish macro factors heading into the shoulder season, left the natural gas futures market stuck in neutral Thursday.

In the spot market, gas prices in West Texas, already discounted into oblivion, continued to search for a bottom Thursday; the NGI Spot Gas National Avg. slipped 4.0 cents to $2.490/MMBtu.

The April Nymex futures contract settled 0.1 cents higher at $2.821 after trading in a narrow range from $2.796 to $2.839. Further along the strip, May added 0.2 cents to $2.827, while June climbed 0.5 cents to $2.877.

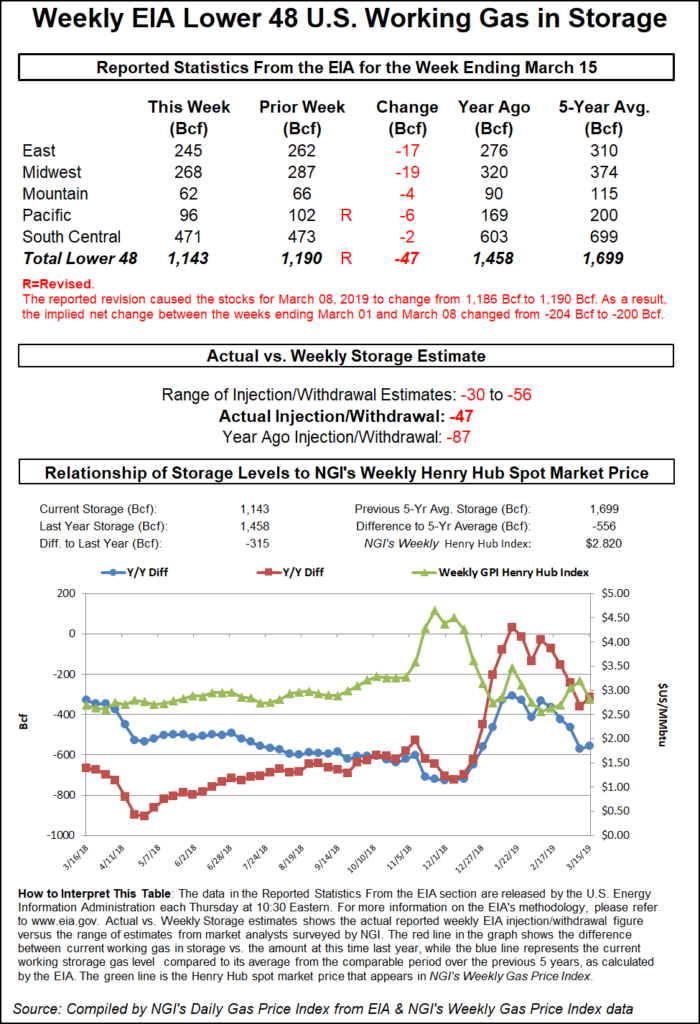

The Energy Information Administration (EIA) on Thursday reported an on-target 47 Bcf weekly withdrawal from U.S. natural gas stocks, and the recently range-bound futures market found little reason for any sudden moves in response.

Thursday’s EIA report, covering the period ended March 15, also included a small bearish revision to the prior week’s data. Due to a 4 Bcf revision to South Central region nonsalt stocks, the net withdrawal for the week ended March 8 was actually 200 Bcf, not 204 Bcf as originally reported, EIA said.

As for the week ended March 15, the 47 Bcf withdrawal largely validated the market consensus leading up to the report, as major surveys and Intercontinental Exchange futures had landed on a pull in the 48-50 Bcf range. NGI’s model predicted a 44 Bcf withdrawal.

Last year, EIA recorded an 87 Bcf withdrawal, and the five-year average is a withdrawal of 56 Bcf.

During a discussion on energy-focused social media platform Enelyst, Genscape Inc. analyst Eric Fell described the 47 Bcf figure as “much looser” than the five-year average when factoring in weather-driven demand during the report period.

According to Fell’s calculations, “There were 14 more degree days than the five-year average, but the draw was lower than the five-year by 7 Bcf…Year-to-date stats have been loose versus weather by a little less than 2 Bcf/d. This is despite freeze-offs that have averaged close to 1 Bcf/d and hydro coming in near five-year minimums.”

While analysts see looseness in the market on a weather-adjusted basis, inventories remain at a deficit to historical norms. Total Lower 48 working gas in underground storage stood at 1,143 Bcf as of March 15, 315 Bcf (21.6%) below year-ago levels and 556 Bcf (32.7%) below the five-year average, according to EIA.

Looking at the trends for freeze-offs in early 2019 versus a year ago, Fell said 1Q2018 saw weather events such as the January bomb cyclone that resulted in larger single-day impacts to production compared to this year.

But in 1Q2019 “we have seen a larger average impact, as we have had more freeze-off events (more cold events in producing areas versus last year) and the freeze-offs have been more persistent,” Fell told Enelyst chat participants Thursday. “I’m talking absolute numbers, not percentages. Jan. 1-March 21 last year, freeze-offs were closer to 0.8 Bcf/d on average, with a peak close to 5 Bcf/d.

“For Jan. 1-March 21 in 2019, freeze-offs have been larger on average (0.9 Bcf/d), but the peak single-day impact was much smaller at 2.4 Bcf.”

Meanwhile, the anticipated ramp-up in U.S. liquefied natural gas (LNG) exports this year remains supportive on the demand side of the equation.

In a recent blog post, RBN Energy LLC analyst Sheetal Nasta estimated that start-up activities at the Cameron LNG, Elba Island LNG and Freeport LNG terminals could account for close to 1.2 Bcf/d of incremental feed gas demand by July, bringing total demand to 6.7 Bcf/d based on an average 5.5 Bcf/d over the past week.

Toss in another roughly 600 MMcf/d of demand from Train 2 of Corpus Christi LNG by August or September, and U.S. LNG feed gas demand could reach 7.4 Bcf/d by the fall, more than twice the 3.3 Bcf/d recorded in the second half of 2018, Nasta said.

“That doesn’t even include Cameron’s Train 2 and 3, which are expected online in the fourth quarter of 2019 and first quarter of 2020, respectively,” she said. “Nor does it include the two additional trains under construction at Freeport, whose start-ups were both pushed to 2020. That much export demand growth in a relatively short time — and largely concentrated in one geographic area, the Louisiana and Texas Gulf Coast — is bound to have significant market effects, from pipeline flows to price relationships.

“Moreover, as these first-wave projects are commercialized and feed gas flows stabilize at their newly elevated levels, that demand is here to stay, becoming a year-round mainstay of Lower 48 gas supply/demand balance.”

Looking beyond the Lower 48, BofA Merrill Lynch Global Research said the onslaught of U.S. LNG supply could be too much for the Asian market to digest. That means increasing European demand may become ever more important to balance the global market.

BofA’s Clifton White and his team of analysts noted that Asian spot prices have collapsed by more than 50% from their 2018 highs, even as oil prices have recovered.

LNG export supply growth of an estimated 22 million metric tons/year (mmty) during 2018 “proved too much to handle,” said the BofA team. “Now, we expect another 46 mmty supply in 2019 and 27 mmty in 2020, with most of the volumes coming from the U.S. America’s market share will likely reach 17% in 2020, joining Australia and Qatar as a top LNG supplier.”

The domestic LNG export arbitrage “might need to close for brief periods in order to balance the global gas markets,” White said. “But we think any closure would likely be temporary due to the size of the U.S. LNG supply and the flexibility of the contracts.”

All of the gas supply ready to sprout may put more scrutiny on European gas demand, according to BofA. U.S. LNG economics “will provide a pricing floor. An influx of LNG this winter already has European inventories at seasonal highs heading into the summer and will limit the ability of Europe to import additional cargoes.”

Rising U.S. gas storage levels over the next few months “may lead to distressed late summer global gas prices and a further disconnect from oil prices, in our view.”

Turning to the spot market, the situation in West Texas only seemed to be getting worse Thursday, as nearly every pricing location NGI reports in the region saw trades in the negatives. Waha saw some of the lowest prices, as trading there averaged in the negatives, collapsing 27.0 cents to negative 1.5 cents on the day.

Things weren’t much better at El Paso Permian, which gave up 29.0 cents on the day to average 19.0 cents, but with some trades going as low as minus 30.0 cents. The El Paso Permian average might have finished even lower if not for the El Paso – Plains Pool location averaging 97.5 cents on the day. El Paso – Plains Pool has consistently traded higher than other West Texas locations as physical prices have weakened in the region this week.

Driven by limited pipeline capacity for the surging associated gas output from the Permian Basin, West Texas has typically traded at a wide negative basis differential to Henry Hub in recent months.

The usual constraints have been exacerbated this week by a force majeure in southern New Mexico on El Paso Natural Gas affecting westbound flows out of the Permian. El Paso’s Plains compressor is located further north in the Permian, interconnecting with the portion of El Paso’s system that flows in a northwesterly direction through central New Mexico.

Last week, Waha basis improved to average just a 52 cent discount to the Hub, the strongest spot basis at the location in more than a month. The strengthening basis corresponded to a reported dip in Permian production. Subsequent reports have indicated production has since rebounded, another factor that could be applying downward pressure on prices this week.

Negative prices in West Texas are not unprecedented. As recently as Feb. 4 Waha traded as low as negative $1.50, although the average price for that trade date remained in the positives at 8.5 cents, Daily GPI historical data show.

The issues driving deep discounts in West Texas appeared to have a ripple effect on other regions farther west Thursday. In the Rockies, locations near the Colorado/New Mexico border sold off heavily. El Paso Bondad tumbled 54.0 cents to $1.285, while Transwestern San Juan gave up 62.0 cents to $1.255.

Elsewhere, most locations across the Midwest, Gulf Coast and East posted small day/day adjustments as forecast maps showed temperatures hovering near seasonal averages across much of the Lower 48 in the coming days.

In the Midwest, Joliet eased 2.0 cents to $2.665, while further south in the Gulf, Henry Hub dropped 4.0 cents to $2.790.

Genscape’s real-time monitoring of liquefied natural gas (LNG) volumes was showing an unexpected drop in deliveries to Cheniere Energy Inc.’s Sabine Pass, LA, terminal for Thursday. Delivery nominations to Sabine Pass had dropped 617 MMcf/d day/day from Wednesday to Thursday (March 20 to March 21), according to the firm.

“Evening cycle nominations showed the greatest declines in scheduled capacity on the Kinder Morgan Louisiana and Creole Trail pipelines, with scheduled deliveries to the terminal via each pipeline falling 310 MMcf and 249 MMcf, respectively,” Genscape analyst Allison Hurley said. “Scheduled deliveries to Sabine Pass LNG have averaged 3.9 Bcf/d over the last seven days.”

Hurley said the drop in volumes did not correspond to any scheduled maintenance on either Kinder Morgan Louisiana or Creole Trail.

A few locations inched higher in the Northeast Thursday, where a spring storm was expected to deliver heavy precipitation, including snowfall in some areas. PNGTS added 20.5 cents to $4.040.

The National Weather Service was calling for a low pressure system located over southeast Virginia to track up the East Coast Thursday and into Friday.

“Moderate to locally heavy rainfall will accompany this system across the Mid-Atlantic and Northeast with flash flooding a marginal and local threat, particularly for highly urbanized areas. A handful of flood watches are in effect across parts of the Mid-Atlantic,” the forecaster said. “Accumulating snowfall is likely well inland across portions of the interior Northeast.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |