Infrastructure | E&P | NGI All News Access

Oklahoma Rigs Down, North Dakota Up as Overall U.S. Count Steady, Says BHGE

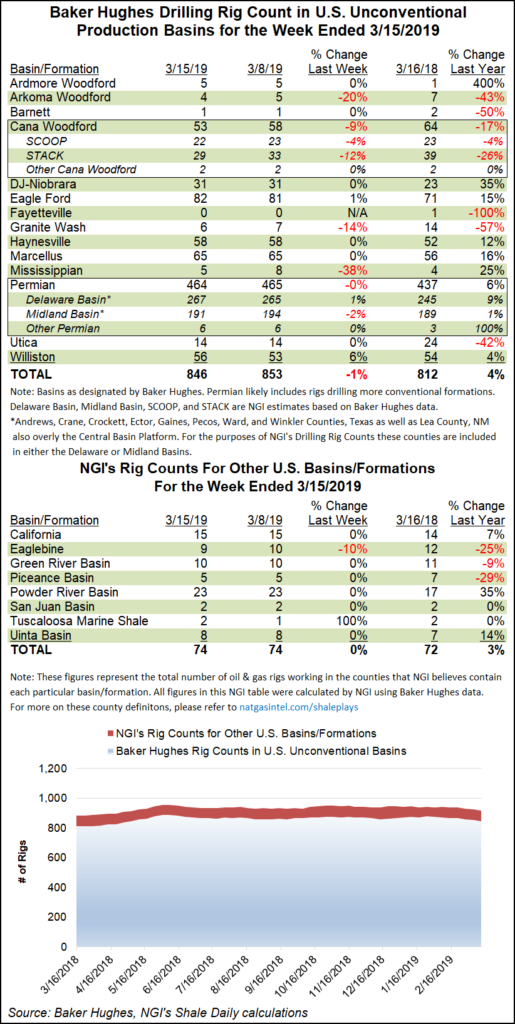

The overall U.S. rig count held steady for the week ended Friday (March 15), though regionally there were some notable changes in activity, including gains in North Dakota and a slowdown in Oklahoma, according to data from Baker Hughes, a GE Company (BHGE).

The United States ended the week with 1,026 rigs, down one week/week. The net decline came from oil-directed drilling, with natural gas-directed rigs holding flat at 193. The domestic rig count finished the week 36 units ahead of the 990 units active a year ago.

Three horizontal units returned to action, while two directional units and two vertical units packed up shop in the United States. Total land rigs fell by three, offset partially by the addition of two rigs in inland waters. Gulf of Mexico activity was static at 22 rigs, up from 13 a year ago, according to BHGE.

Canada’s rig count fell sharply for the week, dropping 28 units overall, including 20 oil-directed and eight gas-directed. The Canadian count ended the week at 161, down from 219 in the year-ago period. The combined North American rig count finished at 1,187 rigs, lagging the 1,209 rigs running at this time last year.

Among plays, the biggest change occurred in the Cana Woodford of Oklahoma, where five units departed on the week, putting the play at 53 active rigs, down from its year-ago tally of 64.

Other big movers for the week included the Williston Basin, which added three rigs, and the Mississippian Lime, where three rigs pack up shop. The Eagle Ford Shale added one rig to its total, while the Arkoma Woodford, Granite Wash and Permian Basin each dropped one rig from their respective totals.

Among states, Oklahoma recorded a net loss of five rigs, dropping its overall count to 111, roughly corresponding with the slowdown in the Cana Woodford. Louisiana and Texas each saw one rig depart for the week.

With growing activity in the Williston, North Dakota saw three rigs return to action, and Alaska also added three rigs. New Mexico added one rig to its tally, according to BHGE.

Earlier in the week, thousands of participants from around the world gathered in Houston to kick off CERAWeek by IHS Markit, where they discussed a range of issues facing the oil and gas industry.

In its annual forecast, unveiled on the first day of CERAWeek, the International Energy Agency (IEA) predicted the United States will drive global oil supply growth over the next five years, surpassing Russia and closing in on Saudi Arabia, on the “remarkable strength” of oil and natural gas resources.

Over the next five years, the United States is forecast to account for about 70% of global oil growth and nearly 75% of liquefied natural gas (LNG) export expansions.

“The second wave of the shale revolution is coming,” IEA Director Fatih Birol said. “It sends a lot of shock waves.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |