Marcellus | E&P | NGI All News Access | Utica Shale

Montage Eyeing Shorter Appalachian Laterals to Reduce Costs

Appalachian pure-play Montage Resources Corp. plans to spend its first year focused on cutting costs, generating free cash flow (FCF) and modestly growing production, management said recently during its first earnings call since Eclipse Resources acquired Blue Ridge Mountain Resources to form the new company.

Former Blue Ridge CEO John Reinhart was tapped to lead Montage, taking over for Eclipse CEO and co-founder Benjamin Hulburt. Reinhart said the kind of 20,000-foot super laterals that had come to define Eclipse would be a thing of the past. The company wants to optimize operations, in part by reducing planned lateral lengths to an average of 11,700 feet and lowering pad sizes in most instances to about four wells each.

Reinhart said shrinking laterals would help reduce cycle times, get wells online faster, bring in revenue quicker and ultimately help accelerate the company’s goal of generating organic FCF.

“Decreasing our cycle times while continuing to build scale will allow the company to enhance its operating margins, lower its cost of capital, be well positioned in terms of base production and significantly improve its cost structure,” the CEO added.

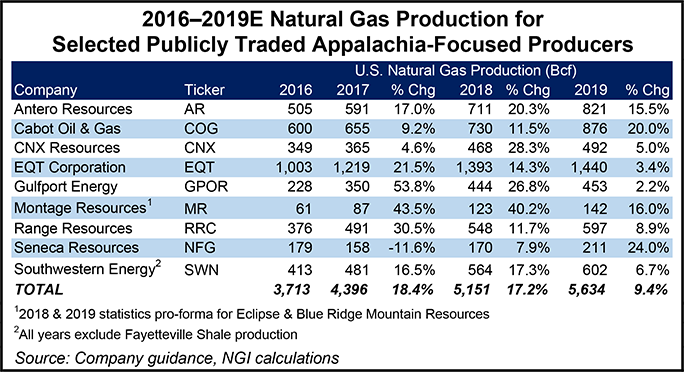

The company released a 2019 capital budget of $375-400 million earlier this month after the merger closed. The company is forecasting production to come in at 500-525 MMcfe/d, or 16% year/year pro forma growth.

Reinhart offered more information during the year-end earnings call, which mostly detailed Eclipse’s operational performance. But he said Montage plans to allocate 25% of its capital to an underdeveloped portion of the Marcellus Shale in eastern Ohio’s Monroe County, where the company brought online some of its first Marcellus condensate wells early last year. Reinhart said those have performed well, and he noted that there is midstream infrastructure in the area to support more.

Another 25% of the budget would go toward the Utica condensate window in Ohio, and the rest is earmarked for the core acreage in the dry gas area of southern Monroe County. Executive Vice President Matt Rucker, who oversees Resource Planning, said Montage plans to drill up to 32 net wells this year.

Production growth is forecast for the second half of the year after a joint venture with Sequel Energy Group LLC begun in late 2017 is scheduled to end.

In the company’s Flat Castle Area of north-central Pennsylvania, Reinhart said the management team continues to monitor its first Utica well in Tioga County. The Painter 2H came online late last year at 32 MMcf/d. Reinhart said the well’s production continues to align with the company’s estimated ultimate recovery of 2.2 Bcf/1,000 feet feet of lateral.

“We will continue to watch this well’s performance closely in order to refine the long-term potential for this area,” he said of the assets acquired early last year. “As previously stated, the company will be assessing strategic options for the Flat Castle prospect, which targets acceleration of value for this high-quality acreage in the company’s portfolio.”

Prior to the merger closing in the fourth quarter, Eclipse produced 404.5 MMcfe/d, up from 311.7 MMcfe/d in the year-ago period and 346.6 MMcfe/d in 3Q2018. For the full year, Eclipse produced 343.2 MMcfe/d, compared with 310.7 MMcfe/d in 2017.

The company reported fourth quarter net income of $36.5 million ($1.81/share), compared with a net loss of $13.1 million (minus 75 cents) in 4Q2017.

For 2018, Montage said Eclipse earned $18.8 million (94 cents/share), versus $8.5 million (49 cents) in 2017. Full-year revenue was $515 million, compared with $384 million in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |