Markets | Infrastructure | NGI All News Access

Natural Gas Futures Take Hit After Somewhat Bearish EIA Storage Miss

The Energy Information Administration (EIA) on Thursday reported a 204 Bcf withdrawal from U.S. gas stocks, on the low side of survey ranges, and the news ate into early morning gains in the natural gas futures market.

The 204 Bcf pull for the week ended March 8 — a week that saw unseasonably frigid temperatures and elevated prices in the cash market — is bullish compared to the five-year average 99 Bcf withdrawal and last year’s 88 Bcf pull.

But market observers had been looking for a hefty withdrawal from this week’s EIA report. Major surveys had pointed to a withdrawal in the 208-210 Bcf range, and some estimates approached 220 Bcf. Intercontinental Exchange EIA financial weekly index futures had settled on a pull of 205 Bcf, while NGI’s model had predicted a 222 Bcf withdrawal.

The April Nymex futures contract had been trading a few cents higher early Thursday, up around $2.840-2.850. As the final number crossed trading screens at 10:30 a.m. ET, the front month quickly shed a couple pennies, trading as low as $2.826. By 11 a.m. ET, April was back up to around $2.840, 2.0 cents higher versus Wednesday’s settle.

Bespoke Weather Services had been looking for a 209 Bcf pull and viewed this week’s EIA report as neutral.

“Weekly data continues to be noisy, as last week’s draw was 6 Bcf larger than our expectation while this week’s was 5 Bcf smaller, indicating we continue to have a strong read of balance on a two-week rolling basis,” Bespoke said. “Though the number was slightly bearish to the market consensus we saw risk to the bearish side and still saw a very significant salt draw that can keep a bid under day-ahead cash.

“This keeps us from seeing the number as all that bearish, though following the significant cold last week we should see significant loosening in future numbers as we look to just barely dip below 1.1 Tcf. The market has been bid up on worries of stagnant production and a large draw, and now one of those worries can be put behind us.”

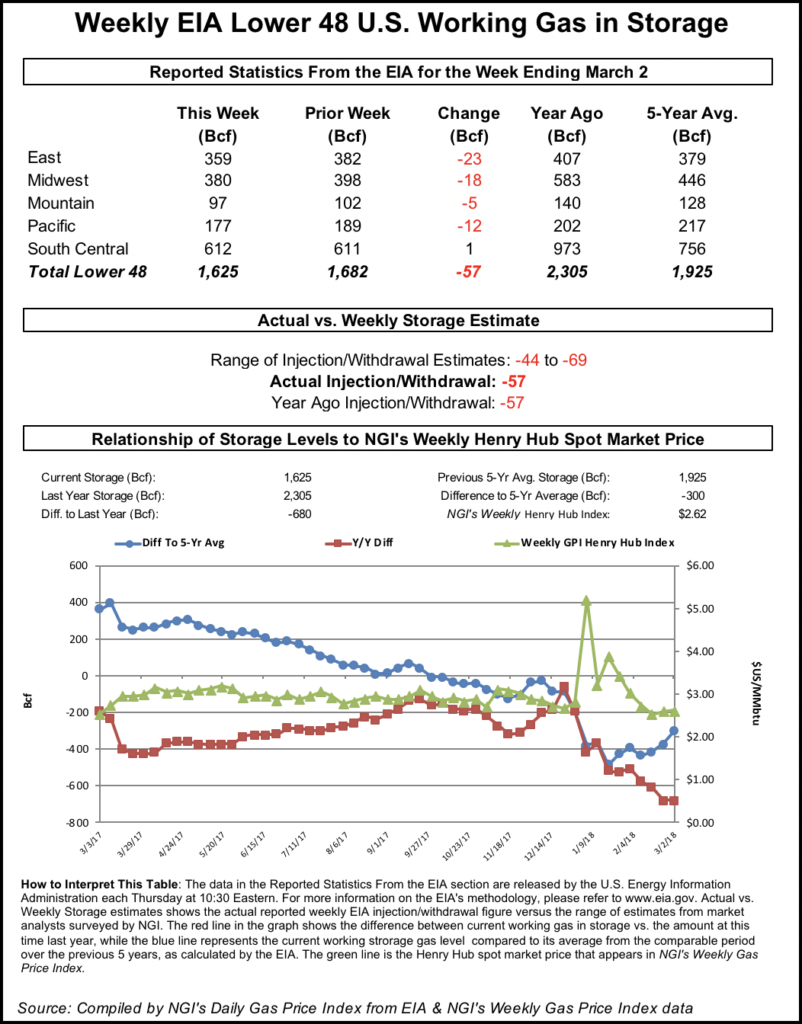

Total working gas in underground storage stood at 1,186 Bcf as of March 8, 359 Bcf (23.2%) below year-ago inventories and 569 Bcf (32.4%) below the five-year average.

By region, EIA reported a 51 Bcf withdrawal in the Midwest, with the East pulling 49 Bcf from stockpiles. The Pacific saw a 10 Bcf pull for the week, while 7 Bcf was withdrawn in the Mountain region. The South Central saw 88 Bcf pulled from stocks, including 51 Bcf from salt and 37 Bcf from nonsalt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |