Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

EIA Sees ’19 Henry Hub Averaging $2.85 as Production Growth Keeps a Lid on Prices

Strong growth in domestic natural gas production will keep a lid on prices in 2019, resulting in Henry Hub natural gas prices averaging $2.85/MMBtu for the year, a 30-cent decline from 2018, according to the Energy Information Administration (EIA).

That price forecast, included in a Short-Term Energy Outlook (STEO) released by EIA Tuesday, is up just 2 cents from the $2.83 forecast in the agency’s previous STEO.

New York Mercantile Exchange natural gas contract values for June 2019 delivery traded during the five-day period ending March 7 suggest a price range of $2.40-3.51/MMBtu, encompassing the market expectation of Henry Hub prices in June at the 95% confidence level, EIA said.

The front-month natural gas futures contract for delivery at Henry Hub settled at $2.87/MMBtu on March 7, an increase of 13 cents from Feb. 1, EIA said.

“After showing much higher volatility since September, front-month futures prices in February traded within a range of 37 cents/MMBtu, the narrowest range for that month in 19 years,” EIA said. “Colder-than-normal temperatures in the second half of the month contributed to larger inventory draws and rising prices.

“Storage withdrawals for the three weeks ending March 1 totaled 492 Bcf, which was 131 Bcf (36%) higher than the five-year average (2014-2018). The higher-than-average withdrawals caused the inventory deficit to the five-year average to reach 464 Bcf (25%) on March 1.”

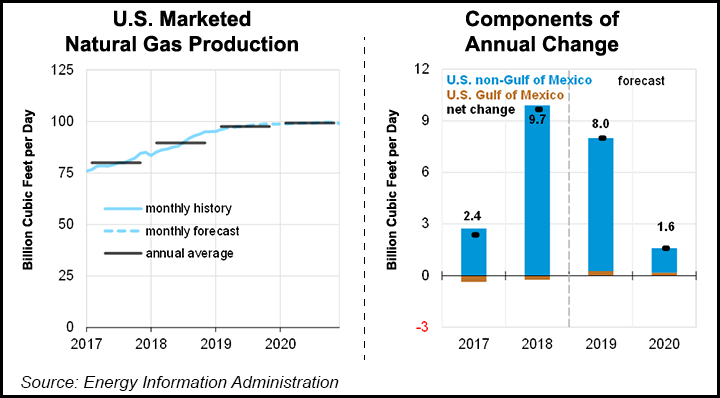

U.S. natural gas production will set record highs this year and next, and new liquefied natural gas capacity due to come online this year will contribute to rising exports, EIA said.

“As a result of the ongoing production growth, however, the 12-month moving average of supply is forecast to exceed demand through the forecast period. EIA forecasts that the higher supply growth will bring inventory levels back near five-year averages and help to keep price levels moderate.”

Dry natural gas production will average 90.7 Bcf/d in 2019, up 7.4 Bcf/d from 2018, according to EIA, which expects production will continue to rise in 2020 to an average of 92.0 Bcf/d.

EIA reported a 149 Bcf withdrawal last Thursday for the week ending March 1, bringing underground storage to 1,390 Bcf, down 243 Bcf from a year ago and a hefty 464 Bcf deficit compared with the five-year average. The total supply of gas will outpace demand through the end of next year, according to the STEO.

EIA expects inventories will end March at 1.2 Tcf, which would be 14% lower than levels from a year earlier and 28% lower than the five-year average, and injections are expected to outpace the five-year average during the April-through-October injection season.

Inventories are expected to reach 3.6 Tcf at the end of October, which would be 12% higher than October 2018 levels and 2% below the five-year average.

In January, the 12-month average natural gas supply — production combined with imports — exceeded the 12-month average of demand — consumption combined with exports — for the first time since December 2017, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |