Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Oil Production to Overtake Russia, Near Saudis in Five Years, Says IEA

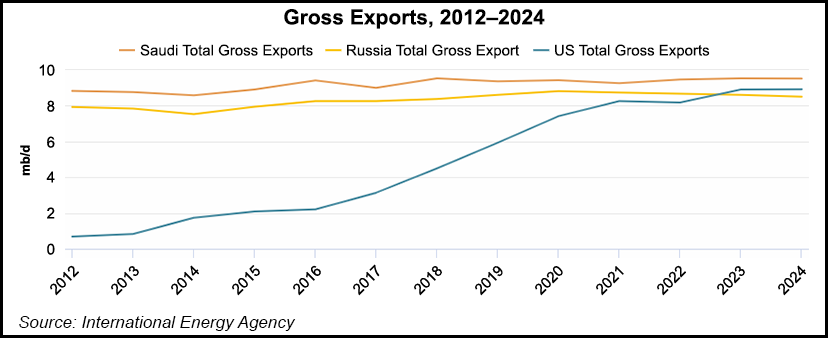

The United States will drive global oil supply growth over the next five years, surpassing Russia and closing in on Saudi Arabia, on the “remarkable strength” of oil and natural gas resources, the International Energy Agency (IEA) predicted Monday in its annual forecast.

The global energy watchdog’s forecast was unveiled in Houston on the first day of CERAWeek by IHS Markit, an event that draws thousands of participants from around the world to the Bayou City.

Over the next five years, the United States is forecast to account for about 70% of global oil growth and nearly 75% of liquefied natural gas (LNG) export expansions.

“The second wave of the shale revolution is coming,” IEA Director Fatih Birol said. “It sends a lot of shock waves.”

Led by the powerful Permian Basin, the United States increasingly will send more oil and gas via Gulf Coast hubs overseas, while the race to build more infrastructure along the Texas coast continues.

Last year, the United States took the lead in global oil production. By 2021, IEA predicts the United States will be a net crude oil and refined crude product exporter. By 2024, the United States will have surpassed Russia and nearly matched Saudi Arabia in crude exports.

In discussing IEA’s Oil 2019, Birol noted that Lower 48 natural gas resources were also turning the LNG trade on its head.

“This will shake up international oil and gas trade flows, with profound implications for the geopolitics of energy.”

In the longer term, supply security will be linked to upstream investment, which on the conventional production side is on the rise for the first time in four years, according to IEA.

“Preliminary investment plans by major international oil companies indicate that upstream investment is set to rise in 2019 for the third straight year. For the first time since the 2015 downturn, investment in conventional assets could increase faster than for the shale industry.”

Global oil demand growth is set to ease, in particular as China slows down, but it still increases an annual average of 1.2 million b/d to 2024, according to the report.

Still, researchers forecast no peak in oil demand, as petrochemicals and jet fuel are seen as the key drivers of growth, particularly in the United States and Asia, which more than offsets a slowdown in gasoline from efficiency gains and electric cars.

“Global oil markets are going through a period of extraordinary change, with long-lasting implications on energy security and market balances throughout our forecast period to 2024,” Birol said. “The United States is increasingly leading the expansion in global oil supplies, with significant growth” by other producers outside the Organization of the Petroleum Exporting Countries (OPEC), including Brazil, Norway and new producer Guyana.

“The story of how the United States transformed itself into a major exporter within less than a decade is unprecedented,” resulting from “the ability of the U.S. shale industry to respond quickly to price signals by ramping up production.

“The United States accounts for 70% of the total increase in global capacity to 2024, adding a total of 4 million b/d. This follows spectacular growth of 2.2 million b/d in 2018.”

Iraq also reinforces its position as one of the world’s top producers over the next five years.

“As the world’s third-largest source of new supply, it also drives growth within OPEC to 2024. The increase will have to compensate for steep losses from Iran and Venezuela, as well as a still-fragile situation in Libya. The implications of these developments on energy security are significant and could have lasting consequences.”

In the downstream sector, the product markets “are on the eve of one of the biggest shake ups ever, with the implementation of the International Maritime Organisation’s new rules governing bunker fuel quality in 2020. Although the shipping and refining industries have had several years notice, there have been fears of shortfalls when the rules come into effect.”

The updated analysis, however, indicates industry players are in a strong position to comply in the medium term.

“As for the first year, the situation will be tight. Prices for gasoil could rise as demand from the marine sector increases. The industry is adjusting, with the largest incremental volumes coming from the United States, the Middle East and China.”

The U.S. unconventional revolution is also altering the picture for refiners, with oil barrels that generally are lighter and sweeter than the average crude slate. They require less complex refining processes to turn them into final products.

“These are extraordinary times for the oil industry as geopolitics become a bigger factor in the markets and the global economy is slowing down,” said Birol. “Everywhere we look, new actors are emerging and past certainties are fading. This is the case in both the upstream and the downstream sector. And it’s particularly true for the United States, by far the stand-out champion of global supply growth.”

For the first time in decades, the United States is also leading the globe in oil demand growth from increases in consumption in the petrochemical, jet fuel and marine vessel industries.

However, to secure the viability of fossil fuels in the future, the industry has to do a better job in reducing emissions and pollution, including methane emissions from Lower 48 production, the IEA chief said.

“This is important homework for the oil executives,” said Birol. “The production techniques need to improve.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |