Marcellus | E&P | NGI All News Access

Diversified Reaches Agreement with Pennsylvania on Well Plugging

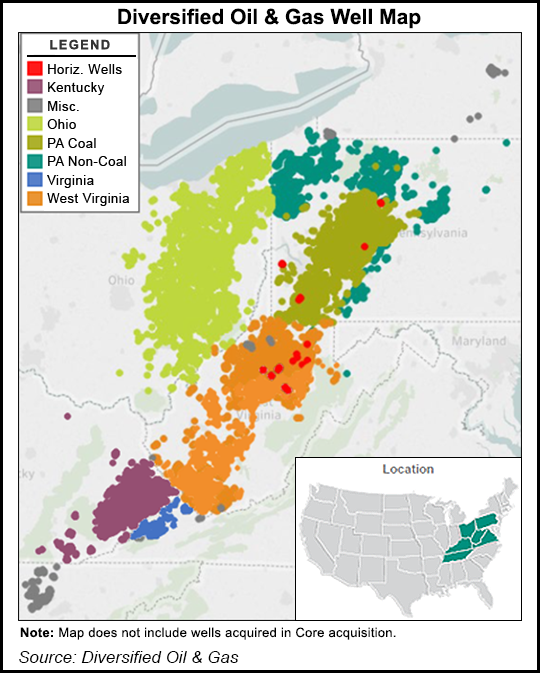

Diversified Gas & Oil plc has reached a 15-year agreement with the Pennsylvania Department of Environmental Protection that addresses asset retirement obligations in the state, where about 40% of all its wells are located.

The deal follows others the company recently finalized with Ohio, West Virginia and Kentucky, completing a process with the states where Diversified primarily operates to outline well plugging liabilities. Over the last two years, Diversified has amassed a massive asset base of 60,000 older conventional wells across the four states, as well as Tennessee and Virginia.

The company, which operates 23,000 wells in Pennsylvania, agreed to plug a minimum of 20 per year and either return to production or plug another 30 wells annually.

By February 2021, Diversified said it would complete an assessment of wells within Pennsylvania for which no production was reported in 2017. It would then submit a report to the DEP listing those wells that it intends to return to production or plug. By February 2024, the company said it would complete another assessment of all its other operated wells, adding any nonproducing to the list of those that are to be placed back on production or plugged.

The company said within 30 days of the agreement, it would post a $7 million bond to ensure its liabilities are met. Combined with Ohio and West Virginia, Diversified has posted more than $10 million in bonds, surpassing what’s required by laws in each state.

“We now have formal, multi-year agreements covering virtually all of the wells we operate, which provides us with clear asset retirement parameters within which we can budget comfortably from the stable operating cash flows” generated from the 70,000 boe/d the company produces, CEO Rusty Hutson said.

The average well depth of Diversified’s portfolio is 4,200 feet and consists of 99% conventional assets. Last year, the company plugged 41 wells across the basin at an average cost of $23,800 each.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |