E&P | NGI All News Access | NGI The Weekly Gas Market Report

Additional Production Said Needed as Mexico Industry Faces Natural Gas Shortages

Business leaders, analysts and politicians have joined a chorus of warnings that shortages of natural gas could strangle the ambitions of the Mexican administration to boost economic growth and create greater opportunities for the nation’s poor.

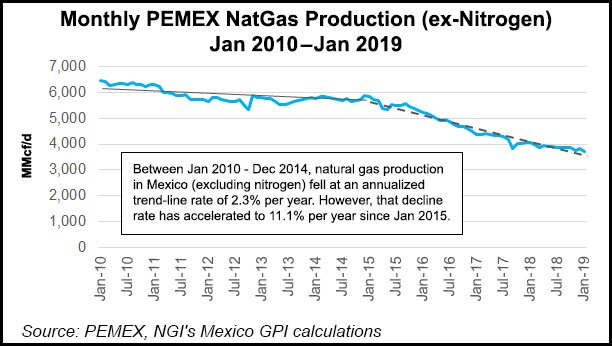

Community protests have delayed the conclusion of seven pipelines to bring gas from the United States. Moreover, national oil company Petróleos Mexicanos (Pemex) hasn’t been able to stem its long-standing decline in the output of gas, and Pemex remains almost Mexico’s sole gas producer. The combination of these factors has led to the threat of gas shortages to industry.

“The biggest problems that are facing industrial users right now are in central and west-central Mexico,” said Ramsés Pech, a partner of the Tabasco-based consultancy Caraiva y Asociados. “These are the areas that are more dependent on imports while Pemex is putting its budget and its efforts into increasing oil output.”

Mexican employers’ association Confederación Patronal de la República Mexicana (Coparmex) said that its members received warnings from Pemex some months ago that supplies of natural gas would be restricted from time to time for reasons of force majeure.

Consejo Coordinador Empresarial (CCE) president Juan Pablo Castañón told newspaper El Financiero that while the business group’s members expected gas rationing from Pemex in early 2019, “we are feeling it with a bit more intensity than we expected.”

“Our members fear that their gas supplies will be cut by about 20%,” he told reporters at a recent event.

Opposition politicians have questioned the government’s resolve on the issue. The pro-business Partido Acción Nacional (PAN) said in a statement that “We are facing a real time bomb. On the one hand, Pemex is raising prices of natural gas to an excessive level, while on the other we have problems over imports and falling domestic production.”

The statement went on to say that there “can be no doubt that if an appropriate solution cannot be found, this will hit industry and launch a cascade effect of price hikes in all sorts of products.”

Some cite a lack of focus at Pemex on natural gas production, instead prioritizing oil.

“Big investments were made to boost pipeline imports from the US during the last two Mexican administrations,” Mexico City-based analyst Arturo Carranza told NGI’s Mexico GPI. “But little or nothing was done to stem the decline in domestic production.”

The only project of significance in Pemex’s natural gas upstream portfolio is Ixachi, onshore in the southern Gulf state of Veracruz. Recently Pemex announced that forecasts of production from Ixachi have been raised to 700 MMcf/d.

There are other possibilities, Carranza said. One could be the revival of the deep-water natural gas Lakach project that was abandoned on grounds of cost some six years ago, though most of the infrastructure remains in place, including a delivery point at the fishing port of Alvarado in Veracruz.

“That could provide a rapid response to many industrial users, but Lakach would not provide a total solution. What’s really needed is to pull out all the stops, using all the instruments and resources available in order to match the growing demand,” Carranza said.

David Shields, editor and publisher of the magazine EnergÃa a Debate, agrees.

“In order to meet Mexican industry’s demand for natural gas, you need capital,” says Shields, “and there are only two ways of doing it in the current circumstances [in Mexico]. One is to pick out the ‘plums’ of the projects and then find finance for them in the stock market.

“The other is to have a series of farm-outs or associations with big companies that have advanced technology and plenty of capital. A massive promotional effort of associations with national and foreign private capital would send a powerful message on the future of Pemex.”

The current administration of Andres Manuel Lopez Obrador has said it is against Pemex farm-outs. The president has also been critical of hydraulic fracturing for shale gas in the north of the country, where its most prospective gas resource lies.

Pemex natural gas production in January was 3.696 Bcf/d, down from 4.057 Bcf/d in the same month of last year, a fall of 8.9%.

“We don’t see a bottom yet,” PointLogic’s Warren Waite told NGI’s Mexico GPI recently.

Gas sourced from the United States, including both piped gas and liquefied natural gas imports, currently accounts for about 64% of Mexico’s demand needs, a figure Waite said will likely surpass 70% over the coming years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |