E&P | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania Unconventional Natural Gas Production Sees Biggest Increase Since 2014

Unconventional natural gas production in Pennsylvania increased 14.2% in 2018 year/year, exceeding 6 Tcf for the first time and notching the largest annual increase since 2014, according to the state’s Independent Fiscal Office (IFO).

Based on data collected by the Pennsylvania Department of Environmental Protection, unconventional operators produced 6.1 Tcf last year. IFO said from 2011-2018, production volumes increased at an average rate of 28.6%.

In the fourth quarter, statewide production was 1.651 Tcf, up 17.7% from the year-ago period and 5% higher than in 3Q2018, when production rose sharply as the second half of the year got underway.

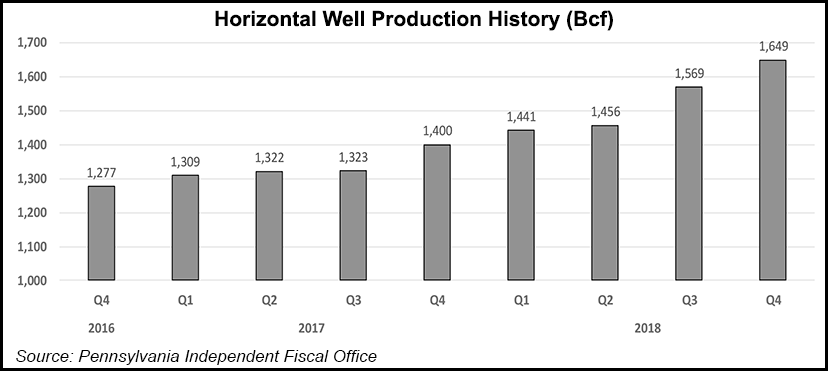

IFO said all of the production growth from the quarter was from wells spud in 2017. Wells spud in 2016 and 2017 accounted for more than one-third of all unconventional production during the fourth quarter, or 39.5%. The bulk of production came from horizontal wells, which comprised 1.649 Tcf in the period. Vertical wells drilled to unconventional formations accounted for the remaining output.

Overall, there has been a sequential production increase from horizontal wells in eight consecutive quarters.

The office also said from 4Q2016 to 4Q2018 average production per well increased by 57% to 481 MMcf. The number of producing unconventional horizontal and vertical wells also increased by 9.9% to 9,091 in the fourth quarter.

Meanwhile, wells that had been spud in 2015 showed the largest decline in production during 4Q2018, a 23.4% drop. Production from wells spud in 2014 declined by 12.2%, IFO said.

The state’s well inventory, which IFO defines as those shut in or drilled but uncompleted, added just three wells sequentially to reach 1,462 in the fourth quarter.

In order, the state’s top producing counties were Susquehanna, Washington, Greene, Bradford and Lycoming. Greene County, in the southwestern part of the state, inched ahead of Bradford County, which is in the northeastern part of the state, however.

The IFO’s latest quarterly unconventional production reports show that since late 2016, as commodity prices and industry sentiment began to rebound from the downturn two years earlier, horizontal production has steadily increased. New pipeline capacity that has come online throughout the basin, better technology and improved gas prices last year helped drive production gains.

The aggressive growth could be pared this year, however, as the pipeline buildout slows, demand ebbs and producers plan to curb spending and have narrowed their growth outlook in response to various market factors, including shareholders that expect better returns.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |