Markets | Infrastructure | NGI All News Access

EIA Storage Withdrawal Close to Consensus, Keeping Natural Gas Futures Steady

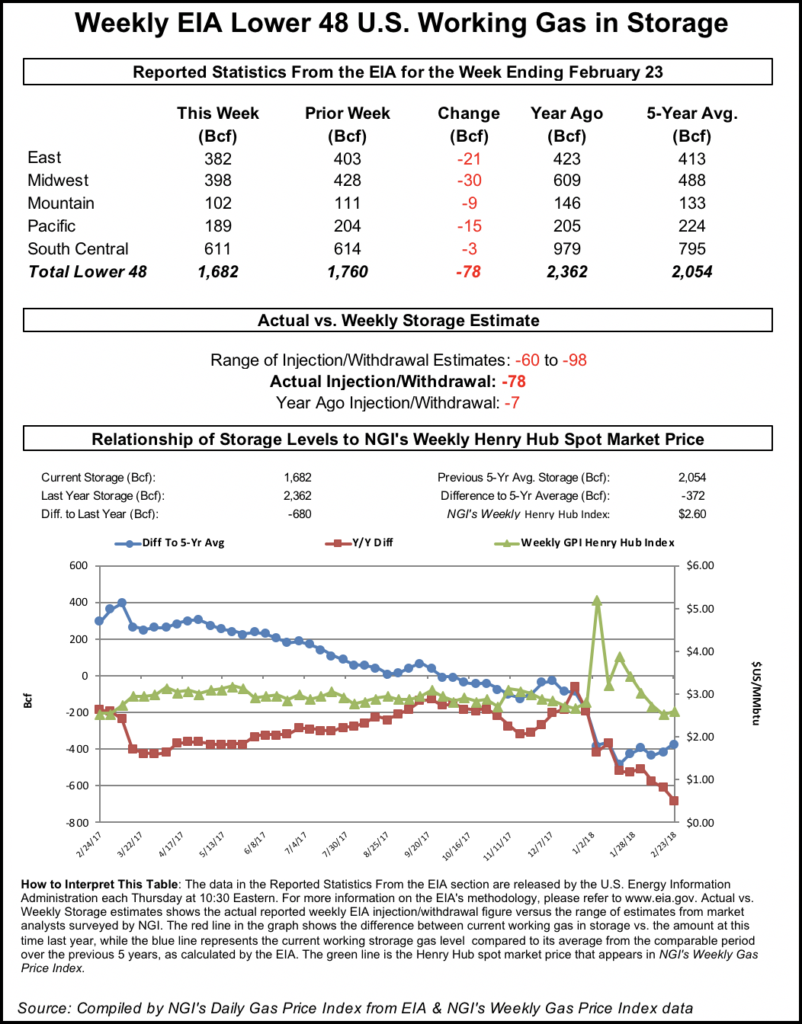

The Energy Information Administration (EIA) on Thursday reported a larger-than-average 149 Bcf withdrawal from U.S. natural gas stocks that came close to market expectations, prompting a muted reaction from the futures market.

The 149 Bcf pull for the week ended March 1 compares with a 60 Bcf withdrawal for the year-ago period and a five-year average pull of 109 Bcf. It also fell on the higher side of consensus expectations.

Shortly after the report’s 10:30 a.m. ET release, the April Nymex contract went as high as $2.860 before dropping down into the $2.835-2.845 area, around 1-3 cents lower than the pre-report trade. By 11 a.m. ET, April was trading at $2.842, roughly even with Wednesday’s settlement.

Prior to Thursday’s report, major surveys had pointed to a number in the 141-145 Bcf range, with estimates as high as 155 Bcf and as low as 123 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled at a withdrawal of 150 Bcf. NGI’s storage model predicted a 136 Bcf withdrawal.

Bespoke Weather Services, which had called for a 143 Bcf pull this week, said the 149 Bcf figure “simply indicates that we assumed last week’s looseness was a bit more structural as opposed to holiday-driven, as clearly last week’s number was loose due to significant holiday demand destruction.

“…Given recent market action it seemed traders were afraid of a more bullish miss. We see this instead as neutral overall, and would expect rapid loosening over the coming few weeks to limit upside for prices even though storage levels should approach 1060 Bcf by March 22 and could briefly dip below 1040 Bcf overall.”

Shortly after EIA data crossed trading screens, the discussion on energy social media platform Enelyst showed market observers looking ahead to a larger withdrawal from next week’s report, with estimates generally topping 200 Bcf.

A large withdrawal next week driven by colder-than-normal weather to start March would bring stocks that much closer to a 1 Tcf end-of-season carryout. ICE EIA end of draw index futures settled Wednesday at 1,045 Bcf, down 15 Bcf from the previous settle.

Total Lower 48 working gas in underground storage stood at 1,390 Bcf as of March 1, down 243 Bcf (15%) year/year and 464 Bcf (25%) below the five-year average, according to EIA.

By region, the Midwest posted a 47 Bcf week/week withdrawal, while 43 Bcf was withdrawn in the East. In the South Central, EIA reported a 41 Bcf pull, including 19 Bcf withdrawn from salt stocks and 22 Bcf taken from nonsalt. The Pacific saw a 10 Bcf pull, with 6 Bcf withdrawn in the Mountain region, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |