Natural Gas Futures Retreat as Production Overshadows Lean Stockpiles; Cash Continues Slide

No longer able to draw support from elevated cash prices, and with the shoulder season fast-approaching, natural gas futures retreated Wednesday. In the spot market, the prospect of rising temperatures saw prices fall across the eastern two thirds of the Lower 48, while heavy snow and rain accompanied gains in the West; the NGI Spot Gas National Avg. dropped 34.0 cents to $3.205/MMBtu.

The April Nymex futures contract settled at $2.841 Wednesday, down 4.3 cents on the day after trading as high as $2.896 and as low as $2.822. The May contract settled at $2.850, down 3.4 cents.

Seasonal factors and a bearish supply backdrop suggest the bulls could be running out of steam, according to Powerhouse President Elaine Levin.

“We’ve had this last little shot of cold, and perhaps that got us up off of $2.60 to where we are now,” but the weather forecast doesn’t offer a lot to get excited about, Levin told NGI. In the eight- to 14-day forecast period “there’s still below-normal temps, but they’re getting later into March. I don’t think March is going to turn out too bad for people who sell natural gas, especially for the West, but we can see the end of winter.

“…The technicals show you’ve had this big slow recovery from the lows” in February, but this is “doing nothing more than relieving oversold,” Levin added. “If bulls were going to push it further, I think you would have to have seen a little more momentum behind it.”

In terms of the broader supply/demand picture, production is overshadowing stockpiles that remain depleted by historical standards, she said.

“If we had seen storage tight like this in previous years, before we had all this shale, it would have been a lot more scary…while not minimizing storage, it does lessen its impact,” Levin said.

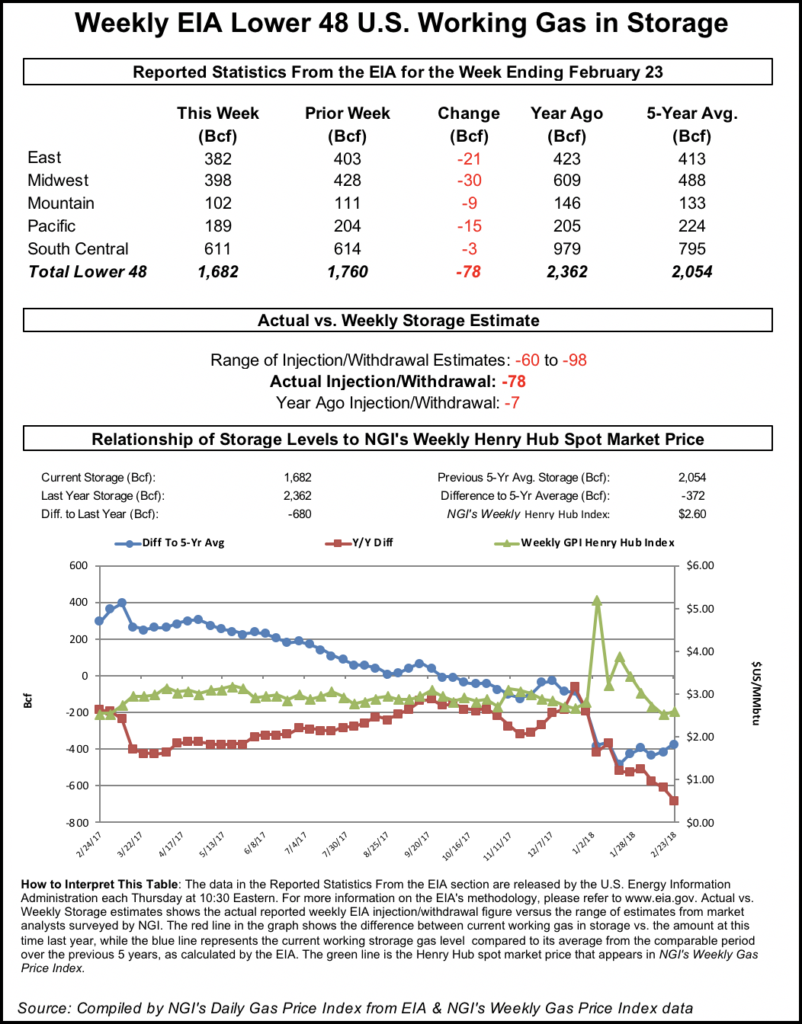

Predictions ahead of Thursday’s Energy Information Administration (EIA) storage report showed market participants expecting a third consecutive larger-than-average weekly withdrawal.

As of Wednesday afternoon, a Bloomberg survey showed a median prediction for a 145 Bcf pull for the week ended March 1, with a range of minus 123 Bcf to minus 155 Bcf based on nine estimates. A Reuters survey pointed to a 141 Bcf pull, based on 20 responses falling within the same range of minus 123 Bcf to minus 155 Bcf.

Intercontinental Exchange (ICE) EIA financial weekly index futures settled at a withdrawal of 150 Bcf. NGI’s storage model predicted a 136 Bcf withdrawal.

Last year, EIA recorded a 60 Bcf withdrawal for the period, and the five-year average is a pull of 109 Bcf.

Meanwhile, ICE end of draw index futures settled at 1,060 Bcf Tuesday, down more than 40 Bcf from last Friday’s settlement.

Heading into Wednesday’s session, Radiant Solutions noted “similar themes” in its latest six- to 10-day forecast compared to the previous day’s outlook.

“This includes a pair of disturbances that deepen a trough over the West during the early stages before sending energy downstream into the Eastern Half,” the forecaster said. “…A colder air mass also supplies a day or two of belows during the early stages from the Midwest to East, but ahead of a storm tracking through are aboves at mid-period in the eastern Midwest and along the East Coast late.”

As for Radiant’s 11-15 day outlook, “below normal temperatures are common in the Plains, Midwest, Mid-Atlantic and South during this time frame, and the forecast trends additionally colder in these details versus yesterday’s outlook. Any above normal coverage is along the West Coast and in parts of Canada.”

Forecasts advertising cooler-than-normal weather later this month helped the April contract move slightly higher Tuesday, noted EBW Analytics Group CEO Andy Weissman.

“As has been true for the past two weeks, gains were muted, due to both a lack of any storage deficiency risk and basic oversupply condition in the gas market,” Weissman said. “At this point, the main issues for natural gas are how quickly and how far cash market prices will fall.”

After rallying above $4 on Monday, Henry Hub day-ahead prices gave back most of those gains Tuesday, falling $1.020 to average $3.100. Henry Hub spot prices retreated further Wednesday, sliding 16.5 cents to $2.935.

Cash Continues Slide

The falling prices at benchmark Henry Hub coincided with broad declines throughout demand centers in the Midwest and East Wednesday as the early March cold blast that drove elevated prices going back to last week looks to subside by the weekend.

Northeast locations saw the steepest losses. Transco Zone 6 NY fell $1.430 to $3.100. Further south Transco Zone 5 slid 99.0 cents to $3.090.

Below-normal conditions were expected to linger along the Interstate 95 corridor through the end of the work week before giving way to milder temperatures by the weekend and into next week, according to Radiant.

After lows in the teens in New York City Wednesday and Thursday, the Big Apple was expected to see temperatures climb into the mid 30s to upper 40s by the weekend. Further south, Washington, DC, was expected to see highs climb into the 60s by Sunday, according to the forecaster.

Prices also moderated further upstream in Appalachia, where Texas Eastern M-3, Delivery tumbled $1.400 to $3.050, while Texas Eastern M-2, 30 Receipt was off 15.0 cents to $2.815.

As restoration work continues following a January pipeline explosion in Noble County, OH, Texas Eastern Transmission (Tetco) said in a notice Tuesday it could restore service for part of its mainline impacted by the incident within three weeks.

Tetco said it is “currently evaluating the integrity of Line 15 immediately south” of its Berne compressor, along with Line 10 between the Athens and Uniontown compressors. “Depending on the results of the integrity investigations, Tetco anticipates the earliest Line 15 immediately south of the Berne compressor station could be placed back in service is approximately two to three weeks.”

The pipeline also said it “determined that further investigations on Line 10 between its Athens and Uniontown compressor stations are required. Tetco is continuing these investigations along Line 10 and will post any changes to capacity resulting from these investigations. Due to the proximity of Line 10 to Line 15 and/or Line 25 in various locations along this section, additional isolations of Line 15 or Line 25 may be required to safely investigate Line 10.”

While various factors such as weather could impact the overall restoration timeline, Tetco said it projects eastbound flows through Uniontown could be restored to full capacity within six weeks, with southbound capacity through Berne potentially fully restored in eight weeks.

According to Genscape Inc., which has conducted flyovers to assess the progress of Tetco’s restoration work, the latest aerial recon of the Berne explosion site conducted Monday suggested there were “only a few days of repair remaining. Construction progress, though significant week/week, was slower than previously expected compared to repairs and construction observed during better weather conditions, and the pipeline was in the process of being reburied.”

In the Midwest, prices sold off as Radiant was calling for below-normal temperatures in Chicago, Minneapolis and St. Louis Wednesday to rise to normal and above-normal levels by Saturday, including highs in the mid to upper 40s in the Windy City this weekend.

Chicago Citygate shed 11.5 cents to average $2.975 Wednesday. That’s a far cry from prices recorded at the location last Friday, when deals for weekend and Monday delivery averaged nearly $9 as traders braced for the arrival of this week’s cold.

In the West, prices strengthened at a number of Rockies and California locations as forecasts called for heavy precipitation to continue hammering those regions.

“Multiple rounds of precipitation will impact the western U.S. through the end of the work week, as upper-level energy and slow-moving fronts will help form lower elevation rain and higher elevation snow,” the National Weather Service (NWS) said. “The heavy rainfall threat in California will lessen through Wednesday evening as moisture decreases, but the threat of heavy snowfall remains across the mountain ranges of the West.”

In California, Malin picked up 22.5 cents to $3.625.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |