Stubborn Cold Lifts Natural Gas Forwards for Fourth Straight Week

Natural gas forward prices rose for a fourth consecutive week as frigid air blanketed much of the country and with more cold air possibly returning later this month, renewed storage fears emerged. April prices climbed an average 7 cents from March 1-5 while May and the summer strip (April-October) each tacked on an average of 6 cents, according to NGI’s Forward Look.

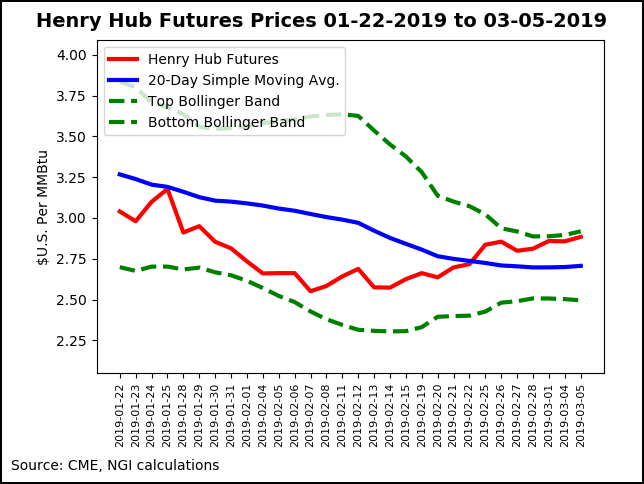

Those gains are largely in line with the Nymex futures curve, where the April contract edged up 7 cents to $2.884, May picked up 6 cents to $2.884 and the summer strip climbed 6 cents to $2.942.

The current cold blast that began sweeping across the United States during the past weekend had been expected for weeks. Recent weather data has indicated a warming trend would emerge by Thursday, however, especially over Texas and the southern part of the country, according to NatGasWeather. Milder temperatures were then expected to move into the eastern United States by the weekend.

“The data remains consistent with very cold conditions easing across the country the next several days, followed by a mix of cold shots and mild breaks this weekend through next week, warmest across the important southern and eastern regions,” NatGasWeather said.

Most important, however, is that a majority of the weather data continues to favor cold conditions over the central United States spreading into the East March 16-20, setting the stage for a return to stronger-than-normal national demand. “If cold can prove to cover all regions east of the Rocky Mountains March 16-20, weather sentiment going into the second half of March will be to the bullish side,” the forecaster said.

The potential for lingering cold into spring has reignited storage fears for some market observers, especially as deficits to the five-year average are already running at more than 400 Bcf and were expected to widen further on Thursday when the Energy Information Administration released its weekly storage inventory report.

A wide range of market estimates pegged the withdrawal between 123 Bcf and 155 Bcf, which would be larger than both last year’s 60 Bcf pull and the five-year draw of 109 Bcf. A Bloomberg survey of nine market participants showed a median pull of 145 Bcf. A Reuters survey of 20 analysts showed a median draw of 143 Bcf. NGI’s model pegged the draw at 136 Bcf.

Despite a sell-off across the Nymex futures curve on Wednesday, Bespoke Weather Services noted that the front of the curve was hit hardest. “While the whole curve is down, summer is the relative stronger spot, as low storage concerns remain in play there,” Bespoke chief meteorologist Jacob Meisel said.

Indeed, the late-season chill has resulted in strong demand and rising prices, which have prompted many storage operators to release larger quantities of gas, thereby lowering the storage trajectory and tightening the 2019 injection season picture, according to EBW Analytics.

After trading as high as $3.178 during the last week of January, the front-month natural gas contract shed 60 cents by mid-February before being revived by very cold early-March weather. Meanwhile, the year/year storage deficit was cut to only 30 Bcf as of the storage week ending Feb. 7, and from the vantage point of early February, it appeared mild weather would allow fundamentals to weigh further on natural gas. Instead, bullish weather forecasts for late February and early March helped lead a moderate recovery in Nymex futures, EBW said.

“Natural gas prices reacted slowly to building weather-driven demand in late February, but a lower storage trajectory reduces anticipated downside price risks this spring and tightens the entire 2019 injection season by 0.9 Bcf/d,” EBW CEO Andy Weissman said.

Even with the rise in the Nymex curve, price increases have not fully offset higher-than-expected demand on the storage trajectory, resulting in a 200 Bcf decline in the end-of-March storage projection, according to EBW. All else equal, this increases storage refill demand during the 2019 injection season by 0.9 Bcf/d and boosts the firm’s fundamentally calculated projected price by 30 cents.

Tudor, Pickering, Holt & Co. (TPH) analysts also revised their end-of-March storage projections lower by about 200 Bcf because of the chilly February, which they said was the coldest since 2015. While the firm still sees 2019 balances crossing the five-year average, it now views this as a 3Q2019 event.

TPH was expecting a 147 Bcf withdrawal in the latest EIA storage report, which would pull inventories to down to 26% below the five-year average. An early look at the current week’s demand data suggested the market could get a similar draw reported for the week ending Friday (March 8). If this plays out, the firm expected inventories to push toward a 30% deficit to the five-year average.

“We still see a market that is 1-2 Bcf/d oversupplied with peak storage expected to be more than 500 Bcf above last year’s mark, meaning gas isn’t out of the woods yet, but with continued strong weather demand, the outlook could be a lot less dire,” TPH analysts said.

Meanwhile, midday data from the Global Forecast System was colder trending for the March 16-20 period, adding another four to five heating degree days and making it a fair bit colder than the European model, according to NatGasWeather. With only a modest change in the outlook, the Nymex April gas futures contract went on to settle Wednesday at $2.841, down 4.3 cents, while May fell 3.4 cents to $2.85. The summer strip, meanwhile, was down about 3 cents to $2.902.

Record Cash Boosts Sumas Forwards

Taking a look across the North American forward market landscape, only a few pricing locations stood out from the rest. Unsurprisingly, one of those was Northwest Sumas, which has continued to experience extreme volatility in recent weeks from record cold in the region, as well as various import and storage restrictions.

The March 1-5 period was no different as Northwest Sumas cash prices skyrocketed to a record $200 last Friday before going on to average $161.330. Since then, prices have plunged back down to earth, averaging just $5.625 in Tuesday trading.

The recent spike is just the latest instance of turmoil in the Pacific Northwest gas market since last fall, when a rupture on Enbridge Inc.’s Westcoast Transmission disrupted Canadian gas exports to Washington at the Sumas border crossing point, according to RBN Energy.

“Ongoing testing on the Westcoast system and the resulting capacity reductions for deliveries to Sumas, along with reduced deliverability at the region’s largest storage facility, Jackson Prairie, over the past month have made the Pacific Northwest more of a demand ”island’ than ever, especially as those issues coincide with this week’s polar-vortex weather,” RBN analyst Sheetal Nasta said.

The perfect storm of strong demand and import restrictions has been a boon for forward prices as well. Northwest Sumas April prices shot up 30 cents from March 1-5 to reach $3.151, May rose 9 cents to $2.467 and the summer strip tacked on 7 cents to hit $2.80, according to Forward Look.

Like the Nymex futures strip, concerns about low storage appear to be factoring into summer prices at Northwest Sumas. Just three weeks ago, the summer strip was barely pricing above $2, and but it was sitting 73 cents higher as of Tuesday.

Still, with much of this winter bringing increased precipitation, there is downside risk to the summer strip once warmer weather arrives, as a projected boost in hydro-electric generation is expected to keep a lid on gas demand.

Other notable pricing hub standouts were in West Texas/southeastern New Mexico, where recent weakness in the cash market has pressured the forward curve. Both Waha and El Paso-Permian cash prices averaged below $2 on Tuesday, and with warmer weather expected to arrive relatively soon, forward prices have already sunk to shoulder-season levels as pipeline capacity remains tight in the region.

Waha April fell 8 cents from March 1-5 to reach just 94.4 cents, May slipped 4 cents to just 99.2 cents and the summer strip stayed flat at $1.26, Forward Look data show.

El Paso-Permian April was down a dime to $1.064, May was down 3 cents to $1.154 and the summer was down a penny to $1.46.

The sub-$1 prices are not so far-fetched. Cash prices dropped to as low as minus 25 cents at Waha and as low as 0.0 cents at El Paso-Permian in late November, NGI data show. And as long as crude oil prices support continued crude production growth in the Permian, large volumes of associated gas will likely keep flowing as well, according to RBN.

“It doesn’t really matter how low natural gas prices go as long as there is transportation capacity available for crude and gas to flow,” RBN analyst Housley Carr said.

On the gas side, the Kinder Morgan Inc. (KMI) Gulf Coast Express is expected to start operations in October, transporting up to 2 Bcf/d of Permian gas to the Texas Gulf Coast. During its recent rollout of 4Q2018 results, KMI revealed that it’s seeking shipper commitments for 100 MMcf/d of incremental capacity on its planned Permian Highway Project after 4Q2018 natural gas transport volumes grew 15% year/year. That project is slated for a 2020 in-service.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |