NGI Archives | NGI All News Access | NGI Mexico GPI

Mexico Central Bank Lowers 2019, 2020 Growth Forecasts — Bonus Coverage

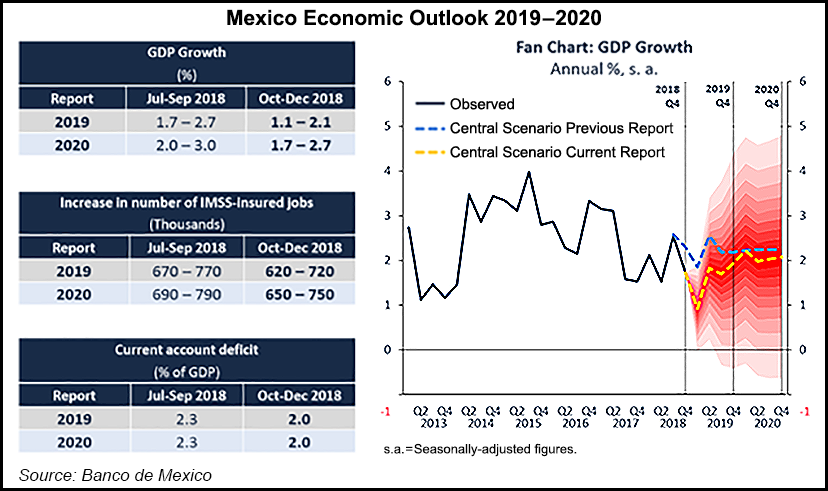

Mexico’s central bank (Banxico) has downwardly revised its 2019 and 2020 economic growth forecasts for the country, citing both external factors and uncertainty over the government’s policies at home, as well as concern over the outlook for national oil company Petróleos Mexicanos (Pemex).

In its fourth quarter 2018 report published last week, Banxico said it is projecting growth of between 1.1 and 2.1% for 2019, down from last quarter’s forecast range of 1.7 to 2.7%.

Read the Full Article.

Fitch Ratings in January downgraded Pemex’s debt by two notches, “which will mean higher financing costs for the company,” Banxico said. The downgrade also reflects “the challenges that [Pemex] faces, highlighting its importance for the country’s economy and, in particular, public finances.”

Fitch cited Pemex’s onerous tax burden, inability to stabilize oil and gas production, and diversion of capital allocation from exploration and production to the less profitable refining segment, as factors that led to the downgrade.

Read the Full Article.

Local industry groups in Mexico, meanwhile, have warned that declining natural gas output by Pemex, combined with delays facing seven gas pipeline projects commissioned by state power utility Comisión Federal de Electricidad (CFE), could lead to a slowdown in productive activity as well. Gas shortages in the second half of 2018 reportedly forced large industrial consumers in south and southeastern Mexico to burn costlier fuel oil, diesel, and liquid petroleum gas in order to compensate for lacking natural gas supplies, particularly in the country’s south and southeastern regions.

According to newspaper El Financiero, Pemex has instructed industrial gas consumers in central Mexico to reduce their consumption by 27%, “due to distribution problems” at one of its gas processing centers in Veracruz state.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |