Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Adds One Natural Gas Rig, but 10 Oil Rigs (Mostly Permian) Dropped

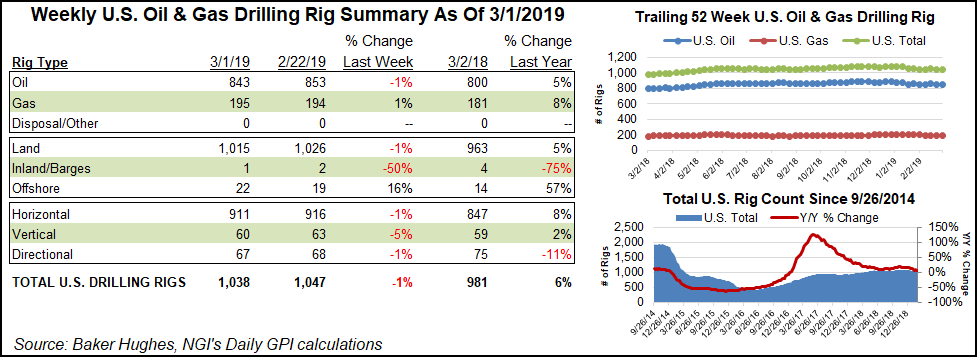

The Permian Basin took the brunt of the domestic rig losses for the week ending Friday (March 1), but one rig was added to the U.S natural gas patch to bring the tally to 195, 14 more than a year ago, Baker Hughes, a GE Company (BHGE), reported.

The loss of 10 domestic oil rigs overall, including seven in the Permian, reduced the oil rig count to 843, still 43 more than a year ago.

The total U.S. rig count stood at 1,038 for the week, versus 981 a year ago, according to BHGE data. Nearly all of the domestic rigs are land-based at 1,015, with one in inland waters and 22 at work in the Gulf of Mexico.

As of Friday, Canada had three more gas rigs at work to end at 71, versus 91 a year earlier, while the oil count fell by four to 140. A year ago, Canada was running 211 oil rigs.

The North American rig count overall ended the week at 1,249, down from 1,283 a year ago. Of the overall count, 911 rigs are horizontals, with 67 directional and 60 vertical.

There were minute gains, with the Barnett Shale in North Texas doubling its rig count with the addition of one rig, and in the Haynesville Shale, which added one rig to total 58.

The Permian, which straddles West Texas and southeastern New Mexico, lost the most rigs, but the total was still overwhelming any other area of North America at 466, which is higher than a year ago, when 434 rigs were in operation.

Losing one rig each were the Denver-Julesburg/Niobrara and Williston basins, as well as the Mississippian Lime. In all other regions, the rig count was flat week/week.

There were only two states gaining rigs overall last week, with California up three to 15, and Louisiana, which added one rig to bring its count to 65.

Given that the Permian lost the most rigs for the week, it may have not been a surprise that Texas also came out on the losing end in the count, with five rigs overall dropped in state territory to end at 503, versus 483 for the same period a year ago.

Oklahoma, which lost two rigs for the week, stood at 115 total from 124 a year ago. Alaska also dropped two rigs to stand at 11, exactly where it was last year. Also losing one rig each were New Mexico, North Dakota and Wyoming.

Drilling down, NGI’s rig count data for other U.S. basins showed only one true gainer for the week, California, whose rig count ended at 15, a 25% increase week/week. The Tuscaloosa Marine Shale dropped one rig to end at one, while the San Juan Basin was down one rig to end at two.

Nabors Industries Ltd., which owns and operates one of the world’s largest land-based drilling rig fleets, as well as offshore rig platforms, reported that in 4Q2018 daily margins in the U.S. drilling segment increased by $700 million from the third quarter as dayrates moved higher in the onshore and Gulf of Mexico activity strengthened.

“Rig count in the Lower 48 has held up much better than industry observers expected,” CEO Anthony Petrello said during a quarterly conference call. “Although more operators than usual did not renew expired contracts at the beginning of the year, the rigs were rapidly picked up by other customers…

“Essentially all of our super-spec rigs remain contracted, albeit with some short periods of idle time between contracts. In addition, spot pricing remains firm at the peak levels attained during the fourth quarter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |