Infrastructure | NGI All News Access

NGV Sector Pushing to Ensure Continued Growth of RNG

The future potential of renewable natural gas (RNG) as an alternative transportation fuel may depend on how the federal renewable fuel standard (RFS) program is revised, according to two industry groups.

The American Petroleum Institute (API) released a study Tuesday on renewable identification numbers (RIN) and contended that the RFS program is “broken.” Still, the RNG Coalition contends volumes of RNG distributed nationwide are growing every year.

API Vice President Frank Macchiarola, who leads downstream and industry operations, said the Trump administration should allow time to let recent RFS changes work. The recent federal government shutdown caused the Environmental Protection Agency (EPA) to delay issuing proposed reforms for RIN and future (2020-23) biofuel volumes.

“It is clear that the administration’s reformed approval for biofuel credits…under the RFS has misdiagnosed the problem and provided misguided and counterproductive cures,” Macchiarola said.

Covington & Burling LLP prepared the 34-page white paper concluding that the RFS has not met congressional goals, and that attempts to change the RIN market will only make things worse. Macchiarola was unsure if changes could impact the RNG market.

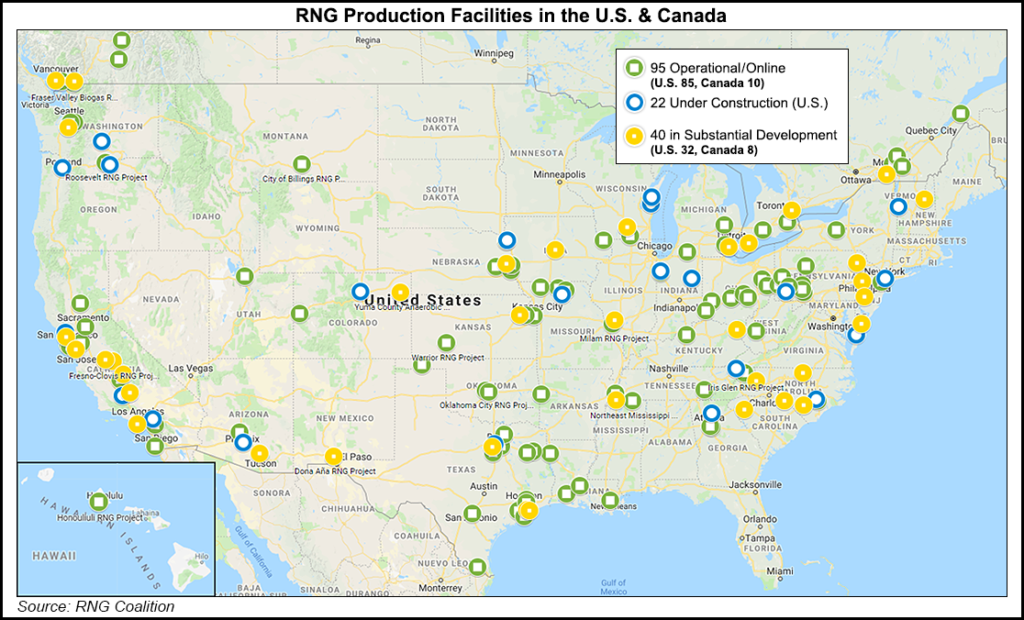

RNG transportation fuel volumes, used within the natural gas vehicle (NGV) market, increased to an estimated 300 million ethanol gallon equivalents (EGE) last year from 245 million EGE in 2017, according to RNG Coalition general counsel David Cox. Total RNG production, including transportation fuel, most recently was more than 39 billion BTUs. Cox said there are 95 operational RNG production sites nationwide, 40 developers and 11 fueling companies now active in the sector.

In terms of API’s concerns about EPA and the RFS, Cox thinks it is “premature to know the impact of the proposal” since details have not been released.

NGVAmerica President Dan Gage called RINs “a critical part of growing the RNG market.”

Meanwhile, Clean Energy Fuels Corp. said Tuesday it would dispense only RNG by 2025 under its brand Redeem in its network of nationwide NGV fueling stations.

“By transitioning exclusively to Redeem by 2025 and by achieving zero-carbon intensity, Clean Energy would outdistance other alternative fuels, including electric vehicles, which are not expected to hit that mark until 2045,” said spokesperson Raleigh Gerber.

The city of Fresno, CA, recently signed a two-year agreement with Clean Energy to use RNG in liquefied natural gas form, i.e. RLNG, to power 140 municipal refuse trucks. The Central California city expects to use about 1.6 million RLNG gallons, the equivalent of slightly more than 1 million gasoline gallon equivalents (GGE).

In Southern California, three other fleet and fueling operators have collectively signed contracts for 975,000 GGE of Redeem, with 225,000 for Long Beach; 400,000 for Montebello and 350,000 for Burrtec.

Separately, NGVAmerica member Saratoga, NY-based American Natural Gas (ANG), is leading efforts in New York to promote a low carbon fuel standard (LCFS), similar to existing programs in California and Oregon, to decarbonize heavy-duty fleets.

ANG, the operator of 40 NGV fueling stations in 14 states, is backing Assembly Bill A 5262, legislation that would amend New York’s environmental conservation laws to require the development of a LCFS. A companion bill is expected to be introduced in the state Senate.

“Creation of an LCFS system will encourage an influx of new RNG biodigesters and support upstate New York agriculture — namely the state’s sizable dairy industry — as well as address solid waste challenges throughout New York, especially downstate,” said NGVAmerica’s Gage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |