EIA Storage Data Fails to Move Natural Gas Futures Needle Much; Spot Gas Mixed

Natural gas futures continued to trade mostly sideways Thursday as much of the expected cold that was forecast to arrive this weekend has likely already been priced into the market. Meanwhile, a reported storage withdrawal that came in on the lower end of estimates sapped early gains, and the Nymex April gas futures contract went on to settle at $2.812, up just 1.3 cents. The balance of summer (May-October) also rose less than 2 cents to average $2.89.

Spot gas prices were mixed as some areas were already beginning to turn chillier, as several weather systems were seen moving across the West, Rockies and into Texas. The NGI Spot Gas National Avg. ultimately moved up 6 cents to $3.185.

After two days of sitting in the prompt-month position, the Nymex April gas futures contract has so far failed to make a splash as daily swings have been more reflective of shoulder-season dynamics rather than premium winter season. This has occurred even as some of the coldest weather for early March is set to arrive this weekend.

But with weather models showing the frigid air moving in for the last week or so, much of the cold risk had already been priced in and with warmer weather expected around the corner, futures have struggled to put up any additional gains.

Furthermore, overnight forecast changes were in the warmer direction in the central United States versus the previous outlook, according to Radiant Solutions. This comes in the middle of the six- to 10-day period and is associated with a weak disturbance separating the colder air masses. The first of the air masses is pressing eastward at that time, “providing a round of strong belows into the eastern third of the country,” the firm said.

Any colder changes are early on in the East, as a lobe of the polar vortex makes its way through eastern Canada, and is associated with a trough along the West Coast. The changes along the coasts are smaller in magnitude, Radiant said.

Meanwhile, the weather models have been inconsistent for March 9-15, struggling to resolve how quickly warming across the southern and eastern United States would take place after several frigid late winter cold blasts sweep across the country this weekend through next week, according to NatGasWeather.

Flip-flopping continued in the midday Global Forecast System run as it slightly warmed for next week, but trended notably colder for the second week of March. Data showed the ridge over the Ohio Valley and eastern United States only lasting a day before a quick cold shot follows March 13 and where nine heating degree days (HDD) were added to the 16-day run total compared to Wednesday’s data.

“If colder trends for March 10-15 hold, it could push deficits versus the five-year average to near or over 600 Bcf. If this were to occur, will current prices be viewed as too cheap?” NatGasWeather said.

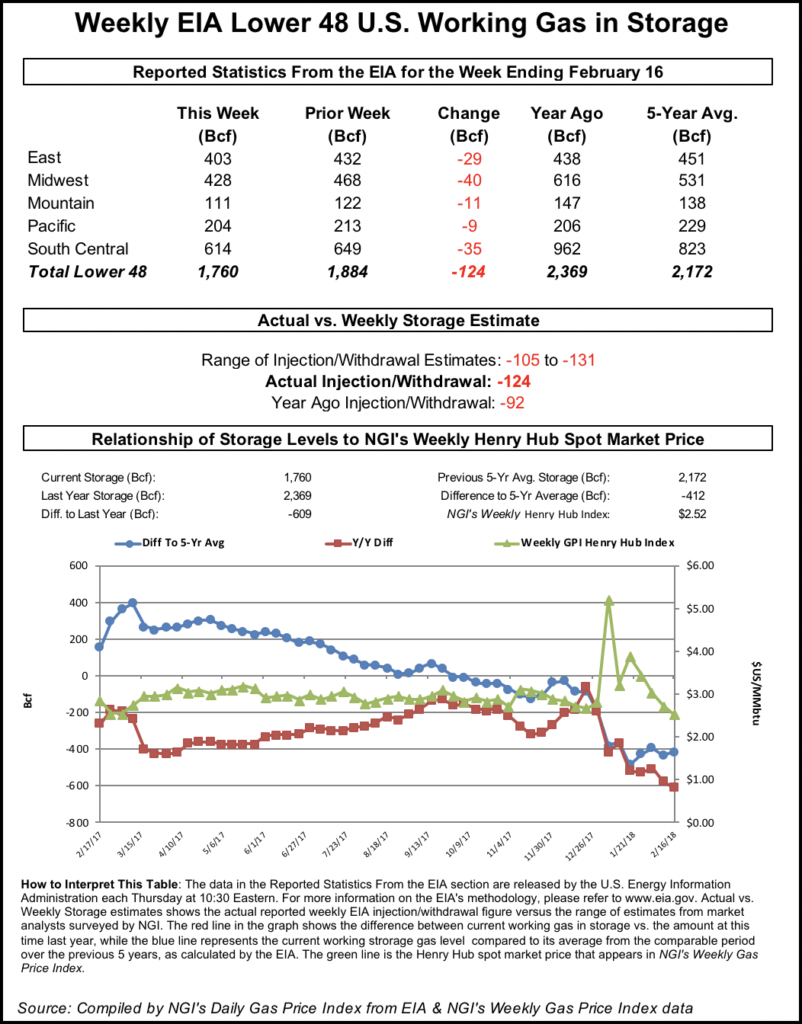

On Thursday, the Energy Information Administration (EIA) reported a 166 Bcf withdrawal from storage inventories for the week ending Feb. 22 that left stocks at 1,539 Bcf, 154 Bcf below last year and 424 Bcf below the five-year average.

The reported draw compared to the year-ago draw of 85 Bcf and the five-year average draw of 104 Bcf. The print was also on the lower end of a rather tight range of estimates that ranged from a 160 Bcf to 180 Bcf pull. NGI’s model predicted a withdrawal of 167 Bcf.

“This was at the lower end of expectations and indicates slightly more holiday impact last week than expected,” said Bespoke Weather Services, which had called for a 174 Bcf withdrawal.

A Reuters poll of 19 market analysts showed a withdrawal range of 160 Bcf to 179 Bcf, and a median of 171 Bcf, while a Bloomberg survey of 13 analysts showed a withdrawal range of 165 Bcf to 180 Bcf, with a median draw of 173 Bcf.

The draw across the East underperformed, which Dominion Energy Transmission and Columbia Gas Transmission storage data showed was a risk, according to Bespoke. Elsewhere, the firm viewed the 166 Bcf as a healthy draw, although said it’s solidly looser than the prior week.

“This is due primarily to the holiday and slightly looser demand-side data, and there may be a small implicit revision following a very bullish number last week as well. Overall, we do not see this number as very bearish as we still see storage levels headed sub-1.1 Tcf by later in March, though tightness is not quite the concern it was before, and increasingly, we see mid-March warmth being able to increase resistance around the $2.85 level,” Bespoke chief meteorologist Jacob Meisel said.

Broken down by region, the EIA reported a 51 Bcf withdrawal in the Midwest, a 51 Bcf draw in the South Central, a 41 Bcf pull in the East and a 16 Bcf pull in the Pacific.

Genscape Inc., which had predicted a 169 Bcf withdrawal, said its daily supply and demand estimates showed a 0.6 Bcf/d production increase week/week for the period, along with a 0.3 Bcf/d increase in imports from Canada.

“Demand was relatively flat week on week, with a modest uptick in power burn” and liquefied natural gas sendout “somewhat offset by lower residential/commercial demand and flat industrial demand and exports from Mexico,” Genscape said.

While the overall 166 Bcf draw was not all that surprising to market observers, the large pulls in the South Central region and Pacific did give some pause, according to a discussion on Enelyst, an energy-focused social media platform hosted by The Desk.

The Pacific region specifically has seen significant storage drawdowns in recent weeks as wet, chilly conditions continue to drive up demand at the same time that import restrictions have been in place.

And in the South Central region, salt storage inventories — which had been at a nearly 50 Bcf surplus just last week — saw that overhang shrink to just 17 Bcf, according to EIA.

“This asset class started the winter with a 75 Bcf storage deficit, peaked at a 136 Bcf storage surplus and could be back to neutral by the middle of March,” Mobius Risk Group said.

Considering overall inventory is now tracking toward an end-of-March carryout of 1.2 Tcf or less, flat salt storage or a deficit would favor market bulls in the demand doldrums of shoulder season, the Houston-based firm said.

“Longer term, the focus will be on whether or not sequential production growth resumes,” Mobius said.

For reference, dry gas production has been relatively flat for more than three months, and if this were to continue through the summer months, then 4Q2019 would be flat year/year. “It is a given that year/year demand will increase on liquefied natural gas exports alone, with debatable but likely gains from Mexican export, industrial consumption, and power demand also contributing,” Mobius said.

Spot Gas Mixed

Spot gas prices were a mixed bag Thursday as some areas in the western half of the United States were already experiencing chilly, wet weather ahead of the more widespread cold forecast for this weekend. Notable declines were seen in the Northeast, however, as mild conditions were expected in the Ohio Valley and East during the next few days, with high temperatures reaching the 40s and 50s.

Algonquin Citygate next-day gas tumbled 77.5 cents to $4.93, while Tenn Zone 5 200L plunged 67 cents to $3.42.

Appalachia spot gas prices shifted mostly a few cents, although the return of a portion of a major gas artery in that region appeared to be nearing. Genscape’s latest aerial recon of the Texas Eastern Transmission (Tetco) Berne explosion site suggests the pipeline is nearing the tail end of pipe replacement and a return-to-service could be close.

Imagery gathered on Tuesday showed only a few sections of pipe remain to be installed, “which could signal a return to service within the next week or so, judging by the swiftness of previous repairs on similar lines and the progress week/week,” Genscape natural gas analyst Colette Breshears said.

That timeline, however, assumes that the remaining installations and all testing go smoothly and quickly, and no additional issues are discovered during the process, she said.

Midwest cash prices softened, although most losses were limited to less than a nickel. In the Midcontinent, where chilly, icy conditions were boosting demand, spot gas prices rose as much as 36 cents at OGT, which averaged $2.71.

Texas spot gas prices were on the rise at most pricing locations, with Houston Ship Channel climbing 8.5 cents to $2.85 and Waha edging up more than a nickel to $1.035.

On the West Coast, prices were mixed as SoCal Citygate jumped more than a quarter to $5.165, while PG&E Citygate slid 13.5 cents to $4.27.

Northwest Sumas in the Rockies rebounded Thursday, climbing $12.64 to $25.19.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |