NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Natural Gas Forwards Continue to Climb as Late-Season Chill to Lower Storage

For the third week in a row, natural gas forward prices strengthened across the curve as what is expected to be one of the coldest starts to March in U.S. history could drive current storage deficits far lower before the start of the traditional injection season.

The gains seen at pricing hubs across the country were mostly in line with increases along the Nymex futures curve. April, which took over the prompt-month position on Wednesday, rose 7.5 cents from Feb. 21 to 27 to reach $2.799. May was up 6.9 cents to $2.744.

Most other pricing locations followed suit, while points out West and in the Rockies put up far more substantial increases amid continued record cold and various import restrictions in place in those regions.

Indeed, continued chilly air continues to grab headlines as weather outlooks show frigid cold blasts with Arctic air spreading across the central and northern United States this weekend, sending lows down to the minus 20s to 20s and then gradually moving into the East late this weekend, according to NatGasWeather. The blast was expected to last through next week, making for “very strong national demand” as overnight temperatures as far as Texas and portions of the southern United States were forecast to plunge into the 20s and 30s, the firm said.

What remains uncertain, however, is the period beginning March 10, when mild high pressure is expected to build across the southern and eastern United States, bringing with it above-normal temperatures but remaining cold over much of the rest of the country.

“Just how long this mild ridge over the South and East that sets up March 10-13 lasts is now of considerable importance and where we see the data suggesting cold could push back over the East around March 14-16,” NatGasWeather said.

Bespoke Weather Services said even if colder weather pans out for mid-March, gas-weighted degree days (GWDD) become less impressive by then. Furthermore, “the eastern ridging looks likely to increase into Week 3 as the Madden-Julian Oscillation influence becomes more apparent, meaning GWDD losses appear more likely from here on out,” Bespoke chief meteorologist Jacob Meisel said.

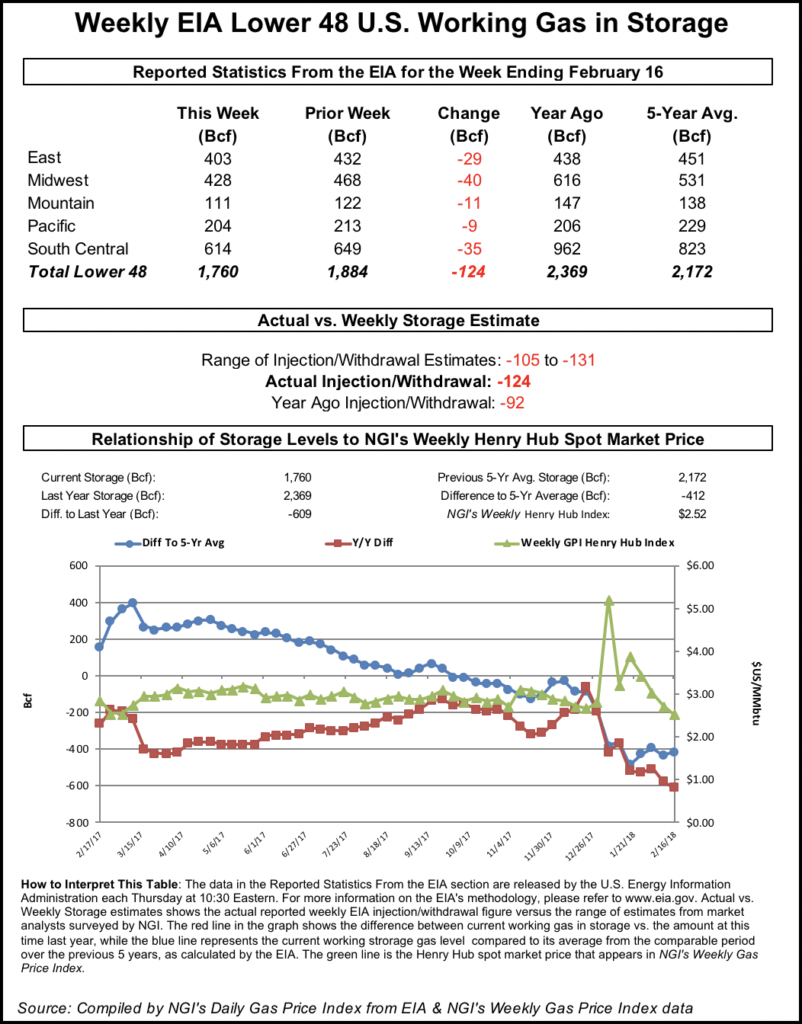

Regardless of the outlooks for mid-March, storage deficits are expected to widen significantly in the coming weeks. On Thursday, the Energy Information Administration (EIA) reported a 166 Bcf withdrawal that left inventories for the week ending Feb. 22 at 1,539 Bcf, 154 Bcf below last year and 424 Bcf below the five-year average.

The reported draw compared to the year-ago draw of 85 Bcf and the five-year average draw of 104 Bcf. The print was also on the lower end of a rather tight range of estimates that ranged from a 160 Bcf to 180 Bcf pull. NGI’s model predicted a withdrawal of 167 Bcf.

The draw across the East underperformed, which Dominion Energy Transmission and Columbia Gas Transmission showed was a risk, according to Bespoke. Elsewhere, the firm still viewed the 166 Bcf pull as a healthy draw, although it is solidly looser than the prior week.

“This is due primarily to the holiday and slightly looser demand-side data, and there may be a small implicit revision following a very bullish number last week as well. Overall, we do not see this number as very bearish as we still see storage levels headed sub-1.1 Tcf by later in March, though tightness is not quite the concern it was before, and increasingly, we see mid-March warmth being able to increase resistance around the $2.85 level,” Meisel said.

Broken down by region, the EIA reported a 51 Bcf withdrawal in the Midwest, a 51 Bcf draw in the South Central, a 41 Bcf pull in the East and a 16 Bcf pull in the Pacific.

The large pulls in the South Central region and Pacific did give some pause to market observers on Enelyst, a social media platform hosted by The Desk. The Pacific region specifically has seen significant storage drawdowns in recent weeks as wet, chilly conditions continue to drive up demand at the same time that import restrictions have been in place.

Working gas in storage as of Feb. 22 stood at 1,539 Bcf, 154 Bcf below last year and 424 Bcf below the five-year average of 1,963 Bcf, according to EIA.

Looking ahead, market observers said the coming span of frigid air could potentially lead to another 200-plus withdrawal before the end of March. The March 1-7 period will be the second coldest week on a GWDD basis, coming in at around 235, according to independent weather forecaster Corey Levkof.

Including Thursday’s 166 Bcf print, and early estimates for the next two storage reports, inventories could shrink by more than 550 Bcf in just a three-week span, analysts said.

“Clearly, the background state is bullish,” NatGasWeather said.

But flip-flopping continued in the latest weather models as the midday Global Forecast System (GFS) slightly warmed for next week, but trended notably colder for the second week of March, according to the forecaster. Data pointed to the ridge over the Ohio Valley and eastern United States only lasting a day before a quick cold shot follows March 13 and where nine heating degree days were added to the 16-day run total compared to Wednesday night’s run.

“If colder trends for March 10-15 hold, it could push deficits versus the five-year average to near or over 600 Bcf. If this were to occur, will current prices be viewed as too cheap?” NatGasWeather said.

The Nymex April gas futures contract settled Thursday at $2.812, up 1.3 cents. The May-October strip also rose less than 2 cents to $2.89.

Record Cold Keeping West, Rockies Strong

The western United States continued to be hammered by weather systems that brought wet, wintry conditions that spread across the Rockies for the Feb. 21-27 period, boosting cash and forward markets alike.

Meanwhile, Westcoast Transmission in British Columbia implemented a new round of restrictions on southbound flows that were expected to continue for the next week or so. Westcoast Station 4B South capacity was limited to 1,074 MMcf/d beginning Thursday, essentially cutting about 548 Bcf from month-to-date average flows, according to Genscape Inc.

Given the ongoing cold and import limitations, Northwest Sumas April forward prices shot up 37 cents to reach $2.862, while May jumped a quarter to $2.37. The balance of summer (May-October) was up 22 cents to $2.68, according to Forward Look.

The sub-$3 prices, while strong week/week, paled in comparison to prices seen in the cash market in recent days. Northwest Sumas cash spiked as high as $50 Tuesday before going on to average $39.405. Prices plunged a day later.

Over in California, SoCal Citygate April shot up 34 cents from Feb. 21-27 to reach $3.564, May climbed 23 cents to $3.33 and the balance of summer picked up 24 cents to $4.34. While the sharp uptick at the Southern California pricing hub comes as no surprise, prices farther north also posted substantial gains across its curve.

PG&E Citygate April forward prices surged 22 cents to $3.453, May tacked on 19 cents to hit $3.437 and the balance of summer edged up 14 cents to $3.63, according to Forward Look.

Despite the high cash prices the Rockies and California have experienced in recent weeks, a bearish picture has emerged for the summer, according to Genscape. While California snowpack levels had been well below normal since early December, the state began to get pounded by an “atmospheric river” in mid-January that has boosted Sierra snowpack levels to 144% of normal for this time of year.

“Current snowpack levels are at their second highest level for this time of year in the past 10 years. This is also just the third instance where mid-February snowpack has exceed 100% of normal,” Genscape senior natural gas analyst Rick Margolin said.

The last two times that February snowpack exceeded 100% of normal corresponded with notably higher hydro generation and lower gas-fired generation in the subsequent summer.

“As with all things California, we caution overly weighting history as prologue since the grid continues to evolve so rapidly. This year, the bearish impact of a high hydro season may be slightly more pronounced given sustained growth of renewables: Genscape’s CAISO power group noted in its recent Spring Outlook about 700 MW of new solar and nearly 200 MW of new wind will be brought online this spring,” Margolin said.

While gas markets out West will likely see reduced price spikes once spring weather arrives, West Texas pricing hubs are already pricing at shoulder-season levels. Waha April prices rose 6 cents between Feb. 21 and 27 to reach just $1.034, about a dime below cash prices for Thursday’s gas day. May climbed 8 cents to $1.049 and the balance of summer edged up 4 cents to $1.31, according to Forward Look.

The weakness in at Waha comes as Natural Gas Pipeline Company of America (NGPL) has restricted gas flows out of its Permian Zone because of a suspected pipeline leak and subsequent repairs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |