Natural Gas Futures Traders Hold Positions After Mixed Weather Data; Spot Gas Sinks

Wednesday was another choppy day for natural gas futures, as traders didn’t quite know what to make of the latest weather outlooks for early March and what may be another supportive storage Energy Information Administration (EIA) storage report.

After spending much of the day in negative territory, the Nymex April gas futures contract settled its first day in the prompt-month position at $2.799, up three-tenths of a cent. Similar minute gains were seen through 2020.

Spot gas prices were overwhelmingly lower as much of the United States was set to enjoy a couple of days of mild weather before a cold blast was forecast to hit the country this weekend. The NGI Spot Gas National Avg. fell 41 cents to $3.125.

While market direction in the spot gas market was clear, the same could not be said for futures prices as the overnight weather data offered mixed signals. The Global Forecast System (GFS) added 15 heating degree days (HDD) to the outlook while the European model trended warmer to drop 7-8 HDDs compared to Monday’s data, according to NatGasWeather.

“The overall timeline of major weather features to impact the U.S. remains intact, with frigid cold blasts arriving this weekend through next week, but still with a warm ridge favored across the southern and eastern U.S. March 10-13 and where the data is neutral to slightly bearish,” the forecaster said.

Milder trends that showed up in Wednesday’s forecasts likely sapped some of the momentum the bulls had built up to that point, according to NatGasWeather. The midday GFS data provided more bearish pressure as it moved more in line with the European weather model, trending milder in its latest run.

However, the latest afternoon European model trended colder by 12-13 HDDs versus Tuesday night’s run, especially for late this weekend into early next week and again March 10-12, where warming was favored to be a little slower arriving across the eastern United States, NatGasWeather said.

With March futures expiring near their intraday low and April futures failing to get off the ground, the weakness — despite a several 100 Bcf storage deficit and the potential for one of the coldest starts to March ever — is not as surprising as it initially might seem, according to EBW Analytics. This late in the heating season, there is no longer any risk of a storage squeeze.

“Further, with supply likely to exceed demand for much of 2019, the April contract is selling at a discount to March. When the coldest weather hits next week, marketers holding gas in storage are likely to be quick to liquidate their holdings, keeping cash prices in check,” EBW CEO Andy Weissman said.

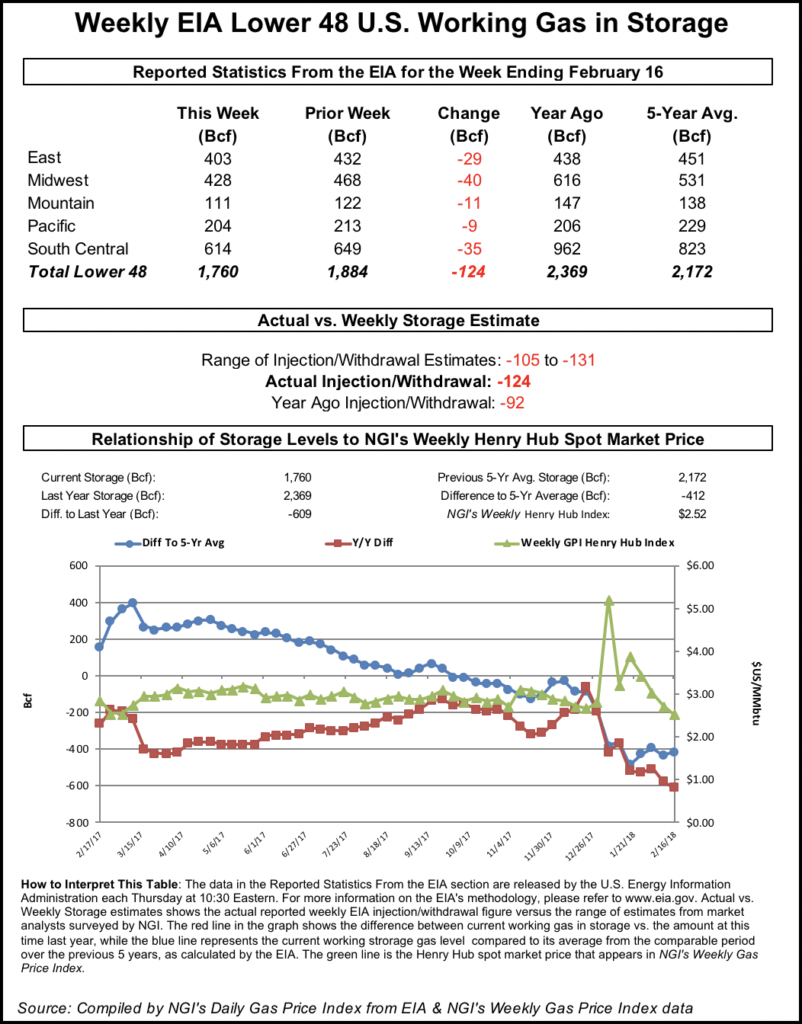

That’s not to say all eyes won’t be on Thursday’s EIA weekly storage report as a much larger-than-normal withdrawal is all but certain for the week ended Feb. 22. A Reuters poll of 19 market analysts showed a withdrawal range of 160 Bcf to 179 Bcf, and a median of 171 Bcf.

The projection compares with a year-ago withdrawal of 85 Bcf and a five-year average decrease of 104 Bcf for the period. If estimates are on target, the decline would cut stockpiles to 1.534 Tcf, the lowest level for that week since 2014, according to EIA.

A Bloomberg survey of 13 analysts showed a withdrawal range of 165 Bcf to 180 Bcf, with a median draw of 173 Bcf. NGI estimated a withdrawal of 167 Bcf.

With more cold on the way, deficits are likely to expand even further. With a structurally oversupplied market and bearish weather relative to April 2018’s record-setting cold, however, the market may erase the entirety of the deficit by May, according to EBW.

“As this picture begins to clarify, Nymex prices are likely to trend lower and retest early February lows,” Weissman said.

Spot Gas Falls

Spot gas prices across the United States fell as conditions look to moderate across the Ohio Valley and East during the next few days, with highs reaching the 40s and 50s, according to NatGasWeather. It is expected to remain warm across the southern United States and Mid-Atlantic Coast through Friday with highs of 60s to 80s, but then cool this weekend into next week. The West will be cool and stormy as weather systems continue to bring rain and snow, the forecaster said.

The mild break comes ahead of this weekend’s blast of frigid air that is forecast to last throughout next week, sending overnight lows down to the minus 20s to 20s in the East and into the 20s and 30s into Texas and portions of the southern United States.

The late-season cold snap has pipelines serving Midwest and East markets bracing for a ramp-up in demand heading into next week, with several starting to issue system flexibility limitations, according to Genscape Inc. The firm’s daily supply and demand data showed Midwest region demand at 25 Bcf/d as of Wednesday, with that number expected to exceed 30 Bcf/d by next week. East region demand is expected to top 40 Bcf/d Monday and continue climbing.

In the Midwest, pipelines including ANR, Mississippi River Transmission and Northern Natural Gas had issued notices as of Wednesday warning shippers of restrictions or limitations on their respective systems amid higher demand, according to Genscape senior natural gas analyst Rick Margolin.

Meanwhile, several pipelines further East, including Columbia Gas Transmission (TCO), Dominion Energy Carolina Gas Transmission, Equitrans, East Tennessee, Iroquois and Millennium similarly warned shippers of system restrictions ahead of the upcoming cold, including a number of operational flow orders, Margolin said.

For Thursday, though, a much milder setup in store helped soften prices across the board, most significantly in the Rockies as Northwest Sumas gave back all of Tuesday’s gain and then some. Northwest Sumas next-day gas plunged nearly $27 to average just $12.55, a far cry from Tuesday’s $50 high.

The volatility at Sumas may be attributed to record cold that continues to drive record demand at the same time that storage and flowing supply to the region are constrained. Another cold wave has arrived, pushing this month’s population-weighted daily average temperatures down to 10-year lows at just 35 degrees, according to Genscape.

“Accordingly, regional demand remains well above 2.6 Bcf/d. Nominated demand for Wednesday is at 2,680 MMcf/d, a record high for this date. This is the 18th day out of 27 days so far this month where a new daily high for the date has been set,” Genscape natural gas analyst Joe Bernardi said.

Yet, even without extreme cold, demand and prices would be strong, he said. Weather-normalized demand this month is averaging 2.68 Bcf/d, virtually 0.5 Bcf/d greater than demand at the same temperatures last February, and nearly 0.7 Bcf/d stronger than the February five-year average weather-adjusted demand average.

“Serving this demand has necessitated net imports of more than 2.5 Bcf/d, about 0.5 Bcf/d more than last February and the prior five-year average,” Bernardi said.

Imports from British Columbia at Sumas were averaging just 0.7 Bcf/d, about 0.2 Bcf/d below last February from ongoing issues at Westcoast Transmission. To make up for this, the region is bringing in more gas from the Rockies and Alberta, and sending less gas to Northern California through Malin, according to Genscape.

Prices amid strong demand are also challenged by limitations on storage gas. Deliverability issues out of Jackson Prairie have effectively prevented storage withdrawals this month from outpacing normal and last February levels. Further contributing to the situation has been lower hydro output increasing demand on gas-fired generation, according to Genscape.

“Regional precipitation amounts are running drier than normal. In addition, what precipitation has fallen has generally come in the form of snow due to the cold weather, which delays the conversion of the precipitation into flowing water for hydro generation,” Bernardi said.

Meanwhile, most pricing hubs on the West Coast posted significant declines. Malin tumbled 42 cents to $4.19, and PG&E Citygate plunged 58.5 cents to $4.405.

Texas spot gas prices were down across the board, with Waha sliding below $1 as flow restrictions remain in place out of Natural Gas Pipeline Company of America’s Permian Zone following a leak detection.

Prices in the Midwest slid mostly between 5 and 10 cents, while Midcontinent prices dropped as much as 22 cents. Declines in Louisiana and across the Southeast were limited to a dime at the majority of pricing hubs.

Northeast prices fell hardest in New England, although Transco Zone 6 non-NY dropped more than 20 cents to $2.875.

Over in Appalachia, Texas Eastern M-3, Delivery spot gas was down more than 20 cents to $2.88, and Columbia Gas fell by a dime to $2.75.

On the pipeline front, federal regulators have authorized TCO to bring on all remaining facilities of its Mountaineer XPress project, including the remaining mainline, White Oak and Mt. Olive compressors and the Ripley Regulating Station. This would allow Mountaineer XPress capacity to reach the full 2.7 Bcf/d from the Leach XPress and Sherwood areas south to the TCO mainline leading to Leach, KY.

Genscape expects the capacity to enter service in the next two to three days.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |