Markets | NGI All News Access | NGI The Weekly Gas Market Report

New Pemex Team Faces Same Old Issues

The new management team at Mexico’s state-run Petróleos Mexicanos (Pemex), in its first conference call with investors on Wednesday, discussed the same issues its predecessors frequently faced: huge financial losses, an even larger debt and upstream results that were somewhat less than scintillating.

Pemex reported that it was able to reduce its net fourth quarter losses by 58% year/year, to 125.5 billion pesos, or about $6.4 billion. Cash flow rose by 2% to hit 94.9 billion pesos in 4Q2018 compared to 93 billion pesos in the comparable quarter in 2017.

Pemex also narrowed its full year losses. The company reported a net loss of 148.6 billion pesos in 2018 compared to net loss of 280.9 billion pesos in 2017.

The current Mexican administration of President Andrés Manuel López Obrador began Dec. 1, and as is normal in Mexico, the change in administration led to a management and ideological reshuffle within Pemex under the guidance of the new president and its senior advisers. López Obrador has promised to boost government support for Pemex, currently the world’s most indebted oil company, with obligations of some $106 billion, and aims to stamp out corruption and massive fuel theft.

In January, fuel theft fell to 17,600 b/d on average, compared to a high of 126,000 b/d on Dec. 4, evidence that measures including sending military personnel to guard fuel infrastructure have been effective, Pemex said.

López Obrador also plans to build a refinery in his home state of Tabasco that would cost at least $8 billion to build. Management said construction of the refinery is expected to start by the end of this year. It would be Pemex’s seventh refinery. The refinery capacity utilization rate was a mere 40% in 2018. The aim is to raise that figure to 60% in 2019, Pemex said.

During the fourth quarter, production of both oil and gas fell significantly, said UlÃses Hernández, director of resources and reserves at Pemex. Output of natural gas was 3,809 MMcf/d, down by 5.5% from 4Q201. Almost all of the decline was in associated gas concentrated on the onshore and shallow offshore fields of southeastern Mexico, such as AbkatuÌn-Pol-Chuc, Tabasco Littoral, Bellota-Jujo, Samaria-Luna and Macuspana-Muspac, where water seepage has been a problem in mature fields.

The Burgos Basin in northern Mexico, across the border from Texas, and the onshore Veracruz Basin jointly produced 781 MMcf/d, some 16% of the national total and 82% of Pemex’s non-associated gas.

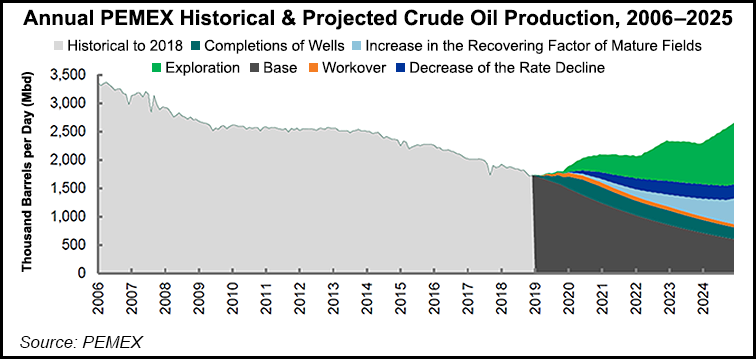

Crude output was 1.738 million b/d in 4Q2019, down by 7.6% year/year, largely because of water-oil contact in the Xanab field offshore Tabasco, and also as a result of natural decline of mature fields.

Hernández reported good news from the Ixachi field, the most significant onshore discovery in Mexico in recent years. Ixachi lies in the southern Gulf state of Veracruz. “The dimensions of Ixachi are substantially greater than what had originally been reported,” he said. “The 3P reserves amount to more than 1 billion boe. Preliminary estimates show that this field will provide more than 80,000 b/d of condensates and more than 700 MMcf/d of gas.”

Perhaps a more significant result in terms of exploration came from the Kokitl-1EXP exploratory well in the deep waters of the Perdido Fold Belt close to the maritime border with the United States. Water depth was at 1,936 meters below sea-level and the report accompanying the call said that “The type of hydrocarbon is gas and condensates.”

Meanwhile, during the quarter, the gas production chain was affected by a shortage of wet gas. As a result, gas processing fell to 2,830 MMcf/d, down by 3.7% year/year.

Pemex plans to ramp up natural gas production by 50% in the next six years, to reach 5.7 Bcf/d by the end of 2024. This growth will mainly be driven by associated gas, as Pemex plans to boost crude oil production to 2.4 million b/d from 1.75 million b/d over the same span.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |