E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower 48 Rig Count Holding Up Better than Expected, Says Nabors CEO

Nabors Industries Ltd., which owns and operates one of the world’s largest land-based drilling rig fleets, as well as offshore rig platforms, got clobbered on the international front during the fourth quarter, but U.S. operations benefited from better daily margins.

Daily margins in the U.S. drilling segment increased by $700 million from the third quarter as dayrates moved higher in the onshore and Gulf of Mexico (GOM) activity strengthened.

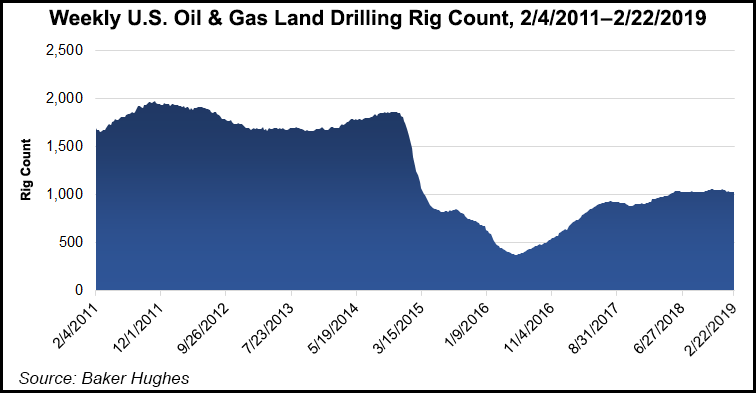

“Rig count in the Lower 48 has held up much better than industry observers expected,” CEO Anthony Petrello said during a quarterly conference call. “Although more operators than usual did not renew expired contracts at the beginning of the year, the rigs were rapidly picked up by other customers…

“Essentially all of our super-spec rigs remain contracted, albeit with some short periods of idle time between contracts. In addition, spot pricing remains firm at the peak levels attained during the fourth quarter.”

Average daily margins “to continue improving in the Lower 48,” the CEO added.

During 4Q2018, the company averaged 224 rigs operating at an average gross margin of $11,851/day, down sequentially from 226 rigs at $12,028. The decrease from the third quarter figures primarily reflected the sale of workover rigs in Argentina and a reduction in the Venezuela rig count, which offset a sequential increase in U.S. activity.

“The U.S. drilling segment was once again the highlight of the quarter, demonstrated by further improvement in the Lower 48 drilling operations,” Petrello said. “In addition to higher rig count, average daily rig margins in the Lower 48 exceeded $9,400 — a sequential increase of nearly $700 — due primarily to increased revenue per rig as day rates continued to increase during the quarter.”

Nabors has strengthened its U.S. fleet, which now counts 100 super-spec rigs, with more than one-third contracted by oil majors. “In addition, the U.S. offshore and Alaska markets have started to recover with additional rigs working,” Petrello said.

As Nabors has done in the past, it conducted a Lower 48 customer survey earlier this year of its top 20 Lower 48 customers, which account for 36% of the domestic industry rig count.

“The results…are more mixed than we have seen in recent quarters,” said the CEO. “On balance, the survey indicates a modest net reduction among these 20 operators. This includes large planned declines in two respondents, partially offset by increases in several others. This same survey of 20 customers accounts for about 60% of Nabors’ working Lower 48 fleet.”

Nabors is fielding several requests for super-spec rigs, which “leads us to to believe our rig count will grow in 2019,” if West Texas Intermediate oil prices remain constructive.

The Lower 48 customers, he said, “are largely in manufacturing mode as they develop their resources…The steep drop in oil prices in the fourth quarter no doubt causes a reevaluation of capital spending plans, but as the survey indicated, at this time most of our customers are maintaining prior plans…

“Within the industry rig fleet, the most capable rigs continue to see the strongest demand and pricing on those rigs has remained intact. We can see weakness in less capable rigs, where price competition has traditionally been more aggressive.”

The U.S. drilling segment in the fourth quarter reported a 15% sequential increase on the strong activity in the Lower 48 and U.S. GOM. Nabors’ average rig count in the Lower 48 increased by five, reflecting the operational startup of “multiple upgraded rigs.”

Canada drilling operations also posted a sequential seasonal increase, with the gross margin higher at nearly $6,500/day.

In the rig technologies segment, Nabors posted a loss related to “the burden for two pre-commercial technology initiatives for our rotary steerable system and robotic drilling systems.”

The international results were “somewhat lower than expected,” Petrello said, in part because of uncertainty in Venezuela, where a fight for the presidency is underway. The turmoil led to a “temporary idling of our fleet there.”

The rig technology segment also was adversely impacted in the final three months because of “customer concerns as a result of the volatility in oil prices.”

For its overseas operations, including in the volatile Venezuela market, expectations are for a higher rig count which would offset “somewhat lower margins, as almost all of our fleet has now rolled into contracts with lower pricing than at the last activity peak.”

One bright sign in the results was the sharp reduction in net debt, which decreased by $245 million, above internal guidance of $230 million. Capital expenditures (capex) totaled $122 million in 4Q2018. During 2018, capex totaled $453 million.

“For 2019, we will remain focused on generating cash flow and have taken several steps to strengthen our liquidity, including a reduction in our quarterly dividend on our common shares, a substantial cut in planned capital expenditures and further reductions in our overhead expenses,” CFO William Restrepo said. “Based on assumptions for our operating results and expectation of low capital spending, we are aiming to reduce net debt by an additional $200-250 million during 2019.”

Net losses in 4Q2018 totaled $188 million (minus 55 cents/share), versus a year-ago loss of $116 million (minus 40 cents) and a 3Q2018 loss of $105 million (minus 31 cents). During 4Q2018 Nabors recorded one-time impairments and other income tax-related charges during 4Q2018 that together totaled $104 million (30 cents/share).

In 2018, net losses totaled $653 million (minus $1.99/share), compared with 2017 losses of $547 million (minus $1.90).

Fourth quarter operating revenues totaled $782 million, versus $708 million in 4Q2017 and $779 million in 3Q2018. U.S. operating revenue climbed year/year to $304 million from $233 million. For the year, domestic operating revenue increased to $1.1 billion from $805 million in 2017.

Canadian operating revenue also was higher in the fourth quarter at $29 million, up from $20 million in 4Q2017. For the year, Canadian revenue increased to $105 million from $83 million in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |