Pemex Natural Gas Production Down in January; Oil Hits New Low

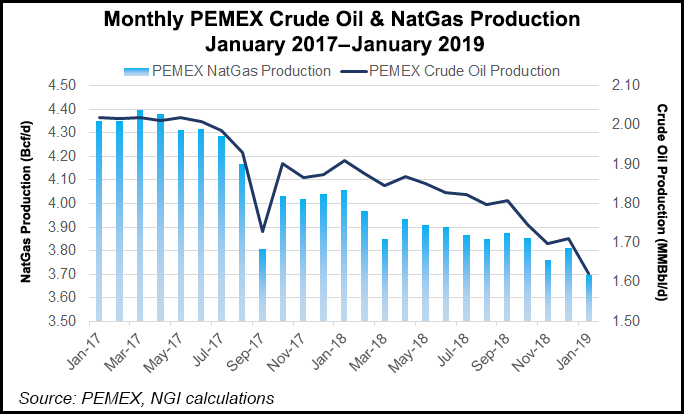

Natural gas production at Mexico’s state-owned oil and gas giant Petróleos Mexicanos (Pemex) fell 8.9% year/year in January to 3.696 Bcf/d.

The figure is in step with a longer term trend of declining gas production in Mexico. Pemex produced 3.886 Bcf/d in 2018, 4.205 Bcf/d in 2017 and 4.866 Bcf/d in 2016, according to company statistics.

Associated gas from oil production accounted for the majority of January output, hitting 2.713 Bcf/d.

Pemex produces nearly all of Mexico’s natural gas. Gas production from independent companies that won contracts through Mexico’s energy reform process was 175 MMcf/d in December, according to the Centro Nacional de Información de Hidrocarburos (CNIH).

Meanwhile, Pemex produced 1.62 million b/d of crude in January, its lowest monthly figure since the state firm began keeping public records in 1990. During 2018, Pemex averaged 1.81 million b/d.

In December, President Andrés Manuel López Obrador said Pemex would increase natural gas production by 50% by 2024, reaching about 5.64 Bcf/d, mainly from projected gains in oil production.

However, many analysts suggest increasing gas production will be difficult given productivity and cash flow restraints at the state company — despite an increased 2019 budget and the financial bailout package announced by the new government earlier this month.

“The capital injection is small,” Capital Economics’ Edward Glossop told NGI’s Mexico GPI. Even with the extra cash, “Pemex’s tax burden will stay extremely high, preventing it from increasing investment into exploration and production.”

Pemex’s tax burden is significantly above other state oil companies, and is even slightly higher than the figure at Venezuela’s besieged Petróleos de Venezuela SA (PDVSA). Nearly all (95%) of Pemex pre-tax earnings over the past two decades have gone to the Mexican government.

Productivity at Pemex is also significantly lower than at other state oil firms. Pemex oil output per employee is about 15,000 b/d, according to Glossop, compared to 35,000-40,000 b/d per worker at Russia’s state-owned OAO Rosneft and Brazil’s Petroleo Brasileiro SA (Petrobras), and 80,000 b/d per worker at Colombia’s Ecopetrol SA and Norway’s Equinor ASA.

“Pemex can’t can’t be fixed without wholesale fiscal and labor reform,” Glossop said.

New restrictions on private participation in the upstream sector will also limit production. Last week, López Obrador said he is halting all new joint ventures (JV) with Pemex, following a decision in December that the government would stop new oil and gas auctions for at least three years. This could mean, for example, that Pemex would not be able to count on the experience of a private sector partner to explore the gas-rich Ixachi field.

“Halting oil auctions will severely limit any increase in private oil production over the coming five-to-10 years,” Glossop said. “It could also have a knock-on impact on Pemex. Any profit-share arrangements that would’ve taken place will no longer happen, which will further exacerbate its financial troubles.”

Given these restraints, natural gas imports from the United States are expected to grow through this year, in line with longer term trends. Natural gas exports via pipeline from the United States into Mexico grew 11.2% year/year during the first nine months of 2018, to 4.6 Bcf/d.

Cooling Economy

Mexico’s gross domestic product, or GDP, expanded by 0.2% in 4Q2018 compared to the previous quarter, slightly lower than initial projections of 0.3%, according to the official statistics agency.

GDP grew by 1.8% in 4Q2018 compared with the same quarter in 2017. Full year growth was 2.0%. The GDP figures are the first to be released since López Obrador took office in early December.

On Monday, Goldman Sachs cut its growth forecast for Mexico for 2019 to 1.5%, from 1.7%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |