Centennial Testing More Permian Delaware Zones, Prowling for More Bolt-Ons

Centennial Resource Development Inc., which has placed its flag in the Permian Basin’s Delaware formation, plans to pursue more bolt-on acquisitions this year and continue to explore additional horizons across existing acreage with a lower rig count and reduced spending.

CEO Mark G. Papa helmed a quarterly conference call on Tuesday to discuss exploration and production (E&P) results for the Denver-based independent. He also issued a cautious strategy for 2019 in light of the wild oil price swings in late 2018.

Among other things, capital expenditures (capex) have been reduced by 15% to $845 million, and the rig count is falling to ensure the balance sheet remains strong. Even so, oil output, which increased 81% year/year in 2018, is still forecast to be 12% higher this year.

Average output increased in 2018 year/year by 92% to 61,082 boe/d, with oil volumes rising to 34,737 b/d. Oil volumes in the final quarter climbed 11% sequentially to 39,987 b/d.

“Centennial had a strong year accomplishing our operational goals,” Papa said. “We stayed within our original capex budget, hit our production targets, added takeaway capacity and maintained cost control. Importantly, we ended the year with a strong balance sheet while adding high-quality inventory.”

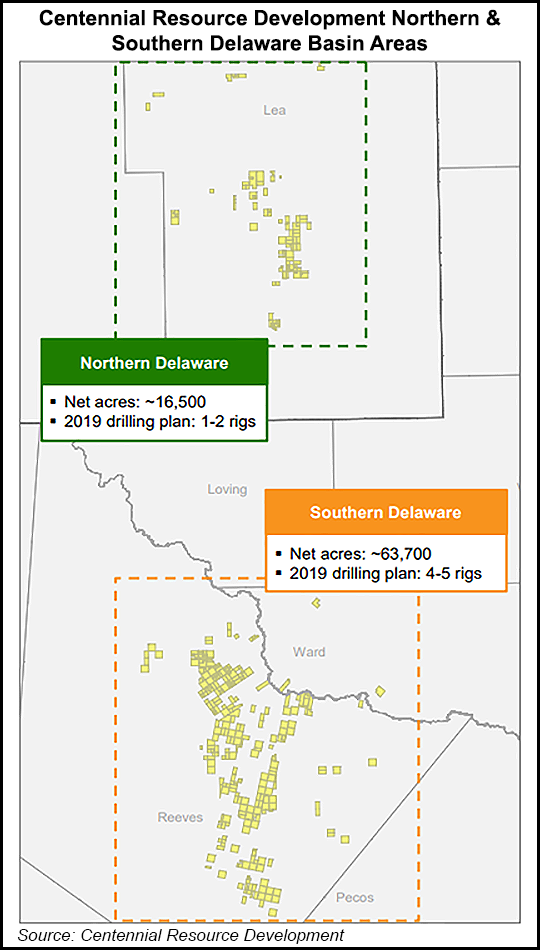

Centennial trained its talents last year on delineating and testing zones in the northern and southern Delaware, which extends from West Texas into southeastern New Mexico.

In Reeves County, TX, the company confirmed the Third Bone Spring Sand interval, which added more drilling locations, and in New Mexico’s Lea County, Centennial recorded strong results from multiple zones, including the Avalon, First Bone Spring, Second Bone Spring and Wolfcamp A. Additionally, 9,000 net acres were added through bolt-ons and organic leasing.

“Last year was exceptional from an inventory replacement standpoint,” Papa said. “We added over 300 quality locations compared to 82 wells drilled in 2018…without issuing equity or exceeding our total capital expenditure budget…”

During the fourth quarter, eight “distinct intervals” were reported across the Delaware. In Lea County, the Raider Federal 301H in the First Bone Spring Sand and the 101H well in the Avalon Shale were drilled with 4,250-foot laterals. Initial production (IP) rates over 30 days for the 301H were 1,729 boe/d (84% oil), while the 101H reported 1,260 boe/d (76% oil).

“The Raider Federal wells, which were follow-up tests to our Pirate State discovery, successfully delineated this portion of our acreage and proved-up new zones in the First Bone Spring and Avalon,” said Papa. “Having confirmed these intervals, we expect to achieve comparable drilling results on this acreage in the future.”

Also in New Mexico, the Airstream 24 State Com 502H was completed in early January targeting the Second Bone Spring with a 10,000-foot effective lateral and an IP of 2,385 boe/d (83% oil).

“The Airstream produced over 52,000 bbl of oil during its first 30 days…our best New Mexico oil well to date,” said Papa. “We’ve drilled approximately 20 wells since integrating this asset in late 2017, and essentially all have either met or exceeded our expectations.”

The Barracuda B U47H in Reeves County was drilled with an effective lateral of 9,800 feet in the Upper Wolfcamp A interval with an IP of 1,807 boe/d (83% oil). In the Miramar acreage, the Wolfman C45H, completed in the Wolfcamp C with an effective lateral length of 7,900 feet, delivered an IP of 2,038 boe/d (46% oil).

And in the southernmost portion of its Reeves County acreage position, the Mercedes L49H was drilled with a 4,800-foot effective lateral targeting the Wolfcamp B interval, recording an IP of 1,058 boe/d (85% oil).

“The Wolfman and Mercedes wells were strong delineation tests,” Papa said. “These wells increase our confidence level in the potential upside of lower Wolfcamp zones on our acreage. The Mercedes well is especially encouraging; it’s our first Wolfcamp B result in the very southern portion of our Reeves County acreage. This sets us up for further inventory expansion in the area.”

Total capex last year was $997 million, with drilling and completion (D&C) taking the bulk at $766 million. Facilities, infrastructure and other expenses totaled $201 million for the year, with an additional $30 million spent on land.

“Overall, the team showed tremendous capital discipline during 2018,” Papa said. “We hit the mid-point of our original D&C guidance and stayed within our overall capital expenditure ranges provided last February.”.

Centennial’s plan is to keep the focus on maintaining a strong balance sheet, so it has reduced its operated rig program to six, down one from 2018.

“In today’s relatively weak commodity price environment, we value balance sheet protection and financial discipline more than production growth,” Papa said. “We are preserving our inventory with the goal of resuming Centennial’s growth trajectory when the macro environment improves.”

This year the plan is to run four-five rigs in Reeves County, with the remaining rig(s) working in Lea County.

Net income was nearly flat year/year in the fourth quarter at $30.98 million (12 cents/share) from $30.53 million (12 cents). Total operating expenses increased to $173.7 million from $117.8 million.

Net income for 2018 increased from 2017 to $199.9 million (76 cents/share) from $75.5 million (32 cents). From 2017, operating expenses increased to $608.3 million from $324.6 million.

Centennial reported a 40% increase in year-end 2018 total proved reserves to 262 million boe, 54% oil, 26% natural gas and 20% natural gas liquids. Proved developed reserves improved by 55% to 117 million boe, 44% of total proved reserves. For 2018, the organic reserve replacement ratio was 421%.

Proved developed finding and development cost totaled $14.65/boe in 2018, with drillbit finding and development costs averaging $10.06/boe.

As of Monday (Feb. 25), crude basis swaps represented 21% of expected production at the mid-point of guidance at a weighted average price of minus $6.88/bbl.

“In addition to securing crude oil takeaway, Centennial is one of the few mid-cap E&Ps to secure egress out of the Permian Basin for essentially all of its residue natural gas volumes,” said Papa. “As a result, we have not experienced any material amounts of natural gas flaring to date and do not expect to in the future.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |