Natural Gas Futures Rebound on Weather, Storage Support; Spot Gas Mixed

With weather models trending colder for late February/early March, a supportive storage report was enough to boost natural gas futures prices Thursday. The Nymex March gas contract settled 6.1 cents higher at $2.697, while April rose 5.5 cents to $2.724.

Spot gas prices were mixed as conditions were expected to warm across the Ohio Valley and Northeast during the next few days, but also with rain and snow along a frontal boundary between cold central U.S. air and the warming eastern U.S. air. The West, meanwhile, was forecast to remain cool to cold as various weather systems track through the region, although a steep sell-off in that region sent the NGI Spot Gas National Avg. down 45 cents to $3.08.

The wintry mix of conditions currently in place was set to become more solidly cold across the country beginning late next week, with weather models showing increasingly frigid air for Feb. 28-March 7. Radiant Solutions observed colder trends in both the six- to 10-day and 11-15 day outlook periods in its updated forecasts early Thursday.

The latest forecast trends included a “large cold change” from the Midwest toward the East in the six- to 10-day outlook, coming in response to “model trends over the past 24 hours but also on a polar air flow directed by a blocking ridge near Alaska.

“Rounds of strong cold are filtered into the Midcontinent, and strong belows are forecast in Chicago for the mid to late period when temperatures drop back into the single digits for lows,” the forecaster said. “Confidence is lowered on diverging models, especially in the early half of the period in the Midwest, South and East.”

As for the 11-15 day, Radiant forecast colder temperatures across the eastern half of the Lower 48, with the blocking ridge over Alaska lingering at least through the early part of the period. “As a result, rounds of colder air will continue to be sent southward through the Eastern Half, and much to strong belows are common in the period composite from the Plains toward the East Coast,” the firm said.

The midday Global Forecast System lost a little demand for late next week but remained cold Feb. 28-March 7, overall losing five to six heating degree days compared to Wednesday night’s data, according to NatGasWeather.

With the outlook after March 7 looking “messy,” the firm said the cold camp has the burden of proving significant cold. The market’s open after the weekend could be determined on if the weather maps are able to prove it. “To close the week, bears hope to again test $2.55, while bulls hope to retake $2.70.”

Meanwhile, early expectations for next week’s Energy Information Administration (EIA) storage report are for a draw in the 170s Bcf to 180s Bcf, which would widen storage deficits even further.

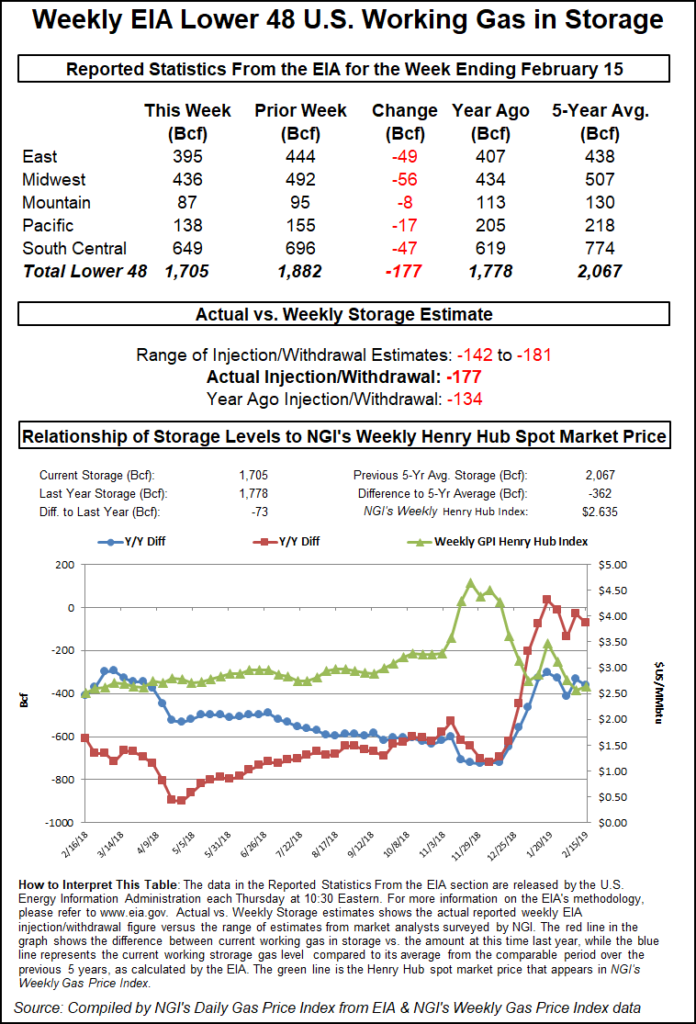

On Thursday, the EIA reported a 177 Bcf withdrawal from natural gas storage inventories for the week ending Feb. 15, 5 Bcf more than the highest estimate ahead of the report and a whopping 35 Bcf more than the lowest projection.

The storage number came in well above both last year’s 134 Bcf withdrawal for the week and the five-year average pull of 148 Bcf.

Bespoke Weather Services, which had projected a 172 Bcf draw, said it viewed the larger pull as potentially an implicit revision of a few prior EIA prints that were significantly looser.

“Last week, we did see production and imports down with burns tightening and liquefied natural gas exports ramping — a perfect blend of bullish data for this miss,” Bespoke chief meteorologist Jacob Meisel said.

The reported withdrawal confirms that storage levels will easily dip below 1.2 Tcf and potentially 1.1 Tcf, and that at these price levels, balances are rapidly tightening, according to Bespoke.

“With weather likely to remain supportive, this number confirms that $2.75 is in play for the March contract into the end of the week and allows us to maintain our slightly bullish sentiment,” Meisel said.

Broken down by region, the EIA reported a 49 Bcf withdrawal in the East, a 56 Bcf pull in the Midwest, a 47 Bcf draw in the South Central and a 17 Bcf pull in the Pacific.

The draw in the Pacific was a bullish surprise to some market analysts on Enelyst, an energy chat room hosted by The Desk. The hefty drawdown was seen as likely leading to increased volatility in a market that has already seen significant swings in recent weeks due to strong demand.

Working gas in storage as of Feb. 15 stood at 1,705 Bcf, 73 Bcf below last year and 362 Bcf below the five-year average.

Despite the expanding deficits, production is expected to recover from recent freeze-offs and maintenance-induced declines. While the growth is not expected to match the robust levels of 2018, and tight pipeline capacity in some regions could present some obstacles to the market, April prices are still at a risk for a sharp decline, according to EBW Analytics Group.

Structural oversupply — partially hidden by the year-over-year storage deficit that is largely a relic of low early November storage figures and partly due to colder winter weather — will push year-over-year comparisons toward a burgeoning surplus, the firm said. Weather-driven demand is also highly unlikely to match April 2018’s record-breaking cold.

“These pieces form a bearish picture, suggesting prices below $2.50 if downward pressure is not eroded sufficiently by near-term cold,” EBW CEO Andy Weissman said.

Cash Tanks in West

Taking a look at spot gas markets across the country, most pricing hubs shifted very little as traders appeared content holding prices relatively steady until a clearer weather pattern emerges.

Thursday started off chilly across the Midwest and Northeast, as well as over Texas into the South as a weather system tracks through the country, according to NatGasWeather. The West and Plains was cool to cold, while remaining unsettled.

High pressure was forecast to rapidly build across the South and East through the weekend, however, and where conditions are expected to become unseasonably mild over the Ohio Valley and Northeast. Daytime highs were forecast in the 40s and 50s, and even warmer conditions were forecast across the Southeast and Mid-Atlantic Coast, where highs were expected to reach the 70s and 80s, the firm said.

Despite the coming mild break, Northeast markets strengthened Thursday. Transco Zone 6 Non-NY jumped 13.5 cents to $2.75, and Algonquin Citygate shot up 43.5 cents to $3.375.

Appalachia prices were up less than a dime, and even smaller increases of less than a nickel were seen in the Southeast.

Next-day gas prices in Louisiana barely budged, as did those in the Midwest. In the Midcontinent, Enable East was down a dime to $2.50, but Southern Star jumped 17 cents to $2.705 due to increased flow restrictions being put in place beginning Thursday.

Southern Star Central Gas Pipeline Inc. posted an update to the impact of a force majeure on its line segment 130 in Kansas that has been in effect since mid-June. Beginning Feb. 22 and ending Feb. 25, Southern Star will shut out or constrain multiple interconnects along the line segment. The most significant of these locations are the Cheyenne Plains Sand Dune interconnect and the KGST Alden interconnect.

Cheyenne Plains has delivered 90 MMcf/d on average (max 170 MMcf/d) onto Southern Star during the last 30 days. In a similar period, KGST Alden has received 45 MMcf/d on average (max 87 MMcf/d), according to Genscape Inc.

“Overall, these constraints will cut 90 MMcf/d in gas flows into Southern Star’s Production Zone,” Genscape natural gas analyst Dominic Eggerman said.

There are various options for reroutes from other parts of Southern Star’s system, including from line segment 490 to the north of segment 130. While no end date for this force majeure has been announced, “Southern Star has gradually been restoring line capacity over this extended period. Furthermore, weather within the region is forecast to fall within season averages,” Eggerman said.

Over in West Texas, prices came tumbling down in response to the steep declines on the West Coast. El Paso Permian plunged nearly 20 cents to $1.795.

In California, SoCal Citygate next-day gas tumbled more than $9 to $12.945, while Malin dropped nearly $3 to $5.38.

Rockies pricing hubs posted losses of nearly $3 at several pricing locations, while Kingsgate shed a bit more to average $5.27.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |