Markets | Infrastructure | NGI All News Access

EIA Reports 177 Bcf Storage Draw, March Natural Gas Tacks on More Gains

The Energy Information Administration (EIA) reported a 177 Bcf withdrawal from natural gas storage inventories for the week ending Feb. 15, 5 Bcf more than the highest estimate ahead of the report and a whopping 35 Bcf more than the lowest projection.

Natural gas prices, which were already a few cents higher before the report’s 10:30 a.m. ET release, tacked on another couple of cents after the print hit the screen. By 11 a.m., the Nymex March gas futures contract had trimmed some of those gains, trading at $2.677, up about 4 cents.

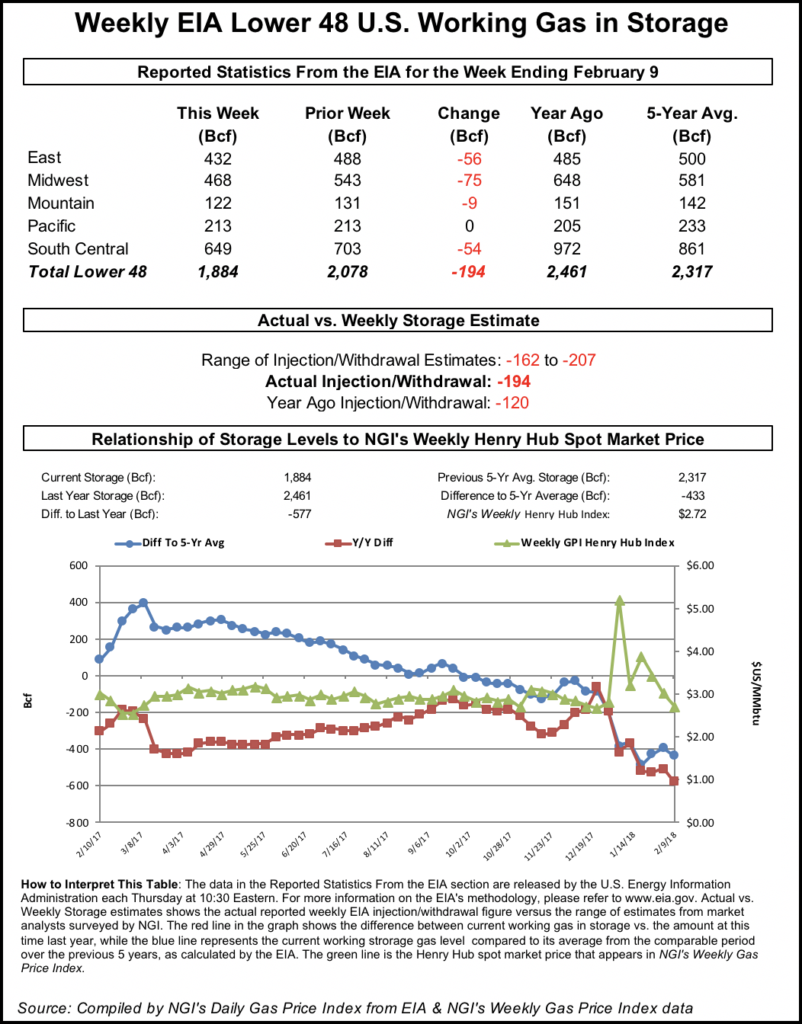

The storage number came in well above both last year’s 134 Bcf withdrawal for the week and the five-year average pull of 148 Bcf.

Bespoke Weather Services, which had projected a 172 Bcf draw, said it viewed the larger pull as potentially an implicit revision of a few prior EIA prints that were significantly looser.

“Last week, we did see production and imports down with burns tightening and liquefied natural gas exports ramping — a perfect blend of bullish data for this miss,” Bespoke chief meteorologist Jacob Meisel said.

The reported withdrawal confirms that storage levels will easily dip below 1.2 Tcf and potentially 1.1 Tcf, and that at these price levels, balances are rapidly tightening, according to Bespoke. “With weather likely to remain supportive, this number confirms that $2.75 is in play for the March contract into the end of the week and allows us to maintain our slightly bullish sentiment,” Meisel said.

Broken down by region, the EIA reported a 49 Bcf withdrawal in the East, a 56 Bcf pull in the Midwest, a 47 Bcf draw in the South Central and a 17 Bcf pull in the Pacific.

The draw in the Pacific was a bullish surprise to some market analysts on Enelyst, an energy chat room hosted by The Desk. The hefty drawdown was seen as likely leading to increased volatility in a market that has already seen significant swings in recent weeks due to strong demand.

Working gas in storage as of Feb. 15 stood at 1,705 Bcf, 73 Bcf below last year and 362 Bcf below the five-year average.

Despite the growing deficits, analysts remain confident in production’s ability to refill storage this summer. Already, production is about 9 Bcf/d higher year/year and is expected to grow even further, especially once the summer gets under way. Before then, supplies will ramp up once cold weather abates, particularly in the Rockies, where more than 0.5 Bcf/d of production remains offline due to freeze-offs.

The latest weather outlooks show cold lingering into at least the first week of March. The overnight weather data trended slightly colder with the Global Forecast System data adding seven to eight heating degree days (HDD) and the European model adding five to six HDDs, according to NatGasWeather. A large portion of the colder trend was for Feb. 27-March 5, although what happens March 7-10 “is uncertain as some of the data favors cold holding over much of the country while a second camp favors cold easing and temperatures moderating towards normal.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |