Markets | Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

LNG Buyers Hungry For Henry Hub-Indexed Contracts; Oil Still Favored

Old habits die hard when it comes to the preferred method of pricing for offtakers of liquefied natural gas (LNG), as most buyers of the super-chilled fuel continue to opt for oil-linked long-term contracts.

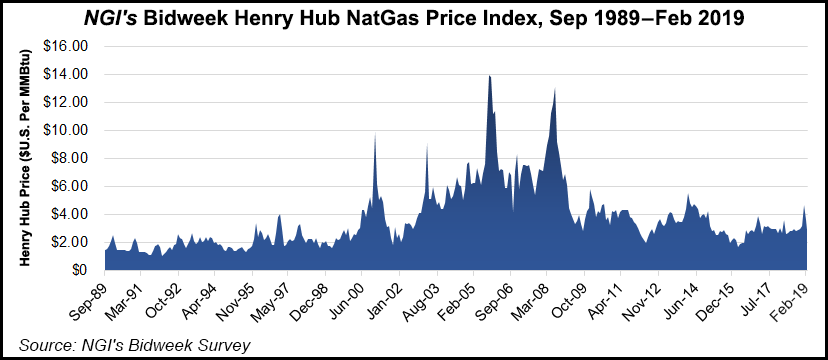

Even as the United States is set to become the third largest LNG exporter in the world this year and current strip prices indicate sub-$3/MMBtu for years to come, there is a disposition among purchasers to do what they have done in the past, according to Cheniere Energy Inc.’s Oliver Tuckerman, vice president, commercial structuring.

LNG purchase agreements historically have been linked to oil, but volatility often has resulted in higher import prices. In more recent months, however, lower oil prices have depressed import prices, and some analysts have suggested the oil-gas ratio might make offtakers more hesitant to sign 20-year deals. The exposure to the erratic swings in oil has pushed some buyers to seek other pricing options.

![]()

“At some point, oil is going to start smelling like tobacco,” Tuckerman said last week at the Platts 18th Annual LNG Conference in Houston.

NGI’s Patrick Rau, director of Strategy & Research, agreed that pricing LNG on a natural gas- rather than an oil-linked basis “is generally more preferable, everything else being equal, since global crude oil supply or demand shocks may have nothing to do with the world natural gas market.”

And while Platts’ Japan Korea Marker (JKM) is the benchmark price assessment for spot physical cargoes delivered ex-ship into Japan, South Korea, China and Taiwan, the infancy of the emerging global market has led to volatility that is unattractive for U.S. developers.

“JKM volatility will come down in the next few years, but right now, we’re sticking to Henry Hub,” said Freeport LNG’s Brad Phillips, director of strategy and research.

The New York Mercantile Exchange Henry Hub contract has two main advantages versus the JKM listing, according to Rau. “One, it has a much longer history and is more liquid. But the other is Henry Hub has a clear physical delivery point, at a very well-established hub. That’s not the case for the JKM price, so Henry Hub is a more effective hedging tool, particularly for free-on-board contracts.”

NGI last month launched its U.S. LNG Export Tracker, and accompanying Natural Gas Volumes historical chart, to provide its readers a more comprehensive view of the burgeoning LNG market. The new LNG Tracker will enable readers to get a headstart on when various LNG trains enter their commissioning and commercial operation stages, as well as show any significant changes in feed gas deliveries from factors like planned maintenance or unplanned outages. “Such things certainly can have an impact on domestic spot market prices,” Rau said.

Most U.S. LNG export projects have been contracted on pricing terms directly linked to Henry Hub, or under a hybrid pricing mechanism with links to Henry Hub. For example, Cheniere’s long-term sales and purchase agreements (SPA) reflect a purchase price for LNG that is indexed to the monthly Henry Hub price, plus a fee.

Still, developers recognize there is work to do to convince customers of the cost benefits of domestic LNG as global supply begins competing for demand. “We spend a lot of time going around the world, doing tutorials” to convince buyers about the reliability of U.S. gas, but “there is an entrenched camp of buyers who prefer to price as they have in the past,” Tuckerman said.

That’s not to say Cheniere hasn’t had luck in finding buyers. In December, the developer secured a SPA with Petronas LNG Ltd. (PLL), a subsidiary of Malaysia’s state-owned Petroliam Nasional Berhad, aka Petronas. The deal was seen as advancing the buildout of a sixth train at the company’s Sabine Pass facility, which has been exporting gas overseas since 2016.

The sixth train has been fully permitted and Cheniere signed an engineering, procurement and construction (EPC) contract last fall with Bechtel Oil, Gas and Chemicals Inc. A final investment decision (FID) is expected this year.

NextDecade Corp. executives said offering a variety of pricing options is what customers at its planned Rio Grande LNG facility find attractive. The company expects Brent-linked contracts to comprise “a major portion of first volumes” at its Gulf Coast project, although contracts are also being offered at pricing points that include Henry Hub, Agua Dulce and Waha.

The Woodlands, TX-based company plans to announce by the end of March initial contracts to support up to three trains at its Gulf Coast export project, with a final environmental impact statement from the Federal Energy Regulatory Commission expected in April and a final decision from regulators in July. An FID could be announced by the end of September. Final EPC bids for the project are due April 22, and NextDecade expects contracts to be finalized in the second half of the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |