Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

López Obrador Urged to Swallow Bitter Pill in Drive to Rescue Pemex

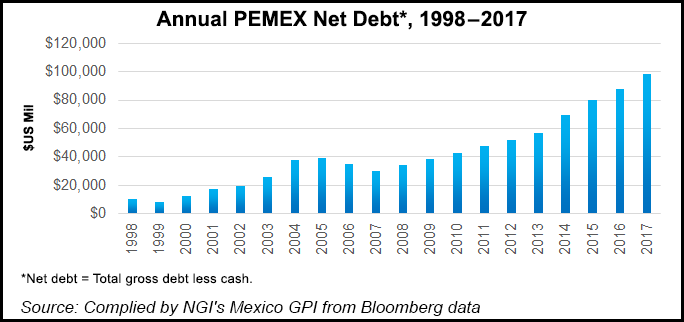

During his regular early-morning press conference on Friday, Mexican President Andrés Manuel López Obrador finally announced a long-awaited financial package intended to reverse fortunes at the national oil company Petróleos Mexicanos (Pemex), which is suffering from 15 years of production decline and is $104 billion in debt.

“Pemex will be reborn,” López Obrador said, but his bold claim was immediately challenged by a wave of criticism from international financial institutions. The new Pemex, analysts said, looks very much like the old.

Estimates of the value of the package ranged from $5.2 billion to $5.5 billion, largely depending on estimates of the peso/US dollar exchange rate applied. But, said the critics, only a relatively small amount of the package will be new money.

J.P. Morgan led the charge. Following weeks of promises to relieve the burden faced by Pemex, traditionally the government’s cash cow, “Underwhelming is an understatement,” J.P. Morgan said in a report to clients.

By J.P. Morgan’s calculations, the “extraordinary support” that López Obrador has been promising amounts to a mere $207 million this year. “Does the government understand the seriousness of the issue? And, secondly, is it willing and able to respond appropriately?”

Production of crude is by far the mainstay of Pemex income, and it fell from about 2.5 million b/d to 1.8 million b/d during the administration of President Enrique Peña from 2012 to late last year. The most recent figure, of just over 1.7 million b/d, amounts to about half of its 2004 peak.

Pemex’s CEO Octavio Romero has said that the current production strategy is to reap what remains of the relatively low-hanging fruit of the shallow waters of the Bay of Campeche that was abundantly exploited during the peak years. “We will invest where we have oil and it is very easy to extract,” Romero said.

That, say some analysts, would make sense, at least in principle. The upstream oil auctions of the 2013 energy reform have been suspended under López Obrador. But other elements of the reform could be readily put into service, Arturo Carranza, a consultant of the Mexico City office of Mercury LLC told NGI’s Mexico GPI. “In particular, a lot could be done in terms of farm-outs, associations and partnerships,” Carranza said.

But López Obrador’s fight against corruption in Pemex has cost him one of the leading executives who could best achieve his production goals. Miguel Ãngel Lozada, director of Pemex Exploración y Producción, the company’s upstream arm, was abruptly suspended without pay last week amid allegations that he was involved in the Estafa Maestra, a scam in which millions of dollars of government funds were “laundered” through academic institutions.

“With Lozada out of the way, the campaign to boost production has been left without a leader,” said Mexico Energy Intelligence’s George Baker. “No leader and very little new money.”

The package, as announced by Pemex in a document to investors, included some $70 million of fresh capital, which formed part of the federal budget for this year; the monetization of promissory notes as part of a restructuring of pensions; and a “fiscal incentive” of $600 million for this year.

Luis Miguel González, editor of the daily El Economista, pointed out in an editorial column that rescue packages are nothing new for Pemex. Indeed it has been “rescued” several times over.

“Pemex is a company that is very badly managed, run in order to be a cash cow for the public Treasury and provide a prodigious udder for thousands of vampires that attack it from the supply chain, the union and the payroll.”

Enrique Quintana, editor of daily El Financiero, warned that if the government opts for a confrontational approach in defense of the criticism of its package, then “we ought to unfold the parachutes.” Sooner or later, Quintana wrote, “that sort of attitude would lead to a major financial crisis”.

“If, on the other hand, the attitude is one of rectification with a genuine effort to commit the necessary resources and style of management that is needed to rescue Pemex, that would tell a very different story.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |