Natural Gas Rally Grinds to Halt on Milder-Trending Outlooks; Spot Gas Slips

One of the last likely hoorahs for natural gas futures in the dwindling weeks of winter came to an abrupt stop Wednesday after a flip in American weather models painted a milder end to February, and moved more in line with European guidance that had already caught onto the less intimidating cold. The Nymex March gas futures contract fell 11.3 cents to settle at $2.575, while April slipped 8.4 cents to $2.621.

Spot gas prices, meanwhile, slid for another day in markets outside of the western United States, although most losses were limited to less than a dime. With substantial gains in California and the Rockies, however, the NGI Spot Gas National Avg. rose 10 cents to $3.235.

The general weakness in cash prices is expected to reverse course ahead of the weekend as wintry conditions were seen returning to the Midwest and eastern United States with a storm system set to bring rain, ice and snow to the regions, according to NatGasWeather. Another blast of frigid air in store for next week was forecast to send overnight temperatures down to the minus 10s to 20s in northern areas and to the 20s to 40s over the South, the firm said.

The bitter conditions had Genscape Inc. looking for a few days of 110 Bcf/d-plus demand next week, according to the firm’s latest daily supply and demand forecasts.

“Lower 48 demand is expected to start ticking up by this weekend and crest the 100 Bcf/d mark,” Genscape senior natural gas analyst Rick Margolin said. “Currently, the forecast suggests demand could rise to a peak near 112 Bcf/d” by next Tuesday (Feb. 19).

Most of the gains are expected to occur in the Energy Information Administration’s (EIA) East storage region, “where demand is forecast to add more than 4 Bcf/d by next Tuesday. “Midwest and South Central markets could see about 3 Bcf/d of additional demand, while Pacific and Mountain markets pick up 1-2 Bcf/d above current levels,” Margolin said.

A milder shift for the following week, however, is what had futures traders seeing red on Wednesday. While Nymex front months strengthened on Tuesday after the midday Global Forecast System (GFS) model trended colder, prices then sold off after hours once the European model didn’t agree and trended milder, NatGasWeather said.

As the firm noted late Tuesday, one of the models was wrong, and the overnight GFS proved to be the loser as it trended notably milder by finally seeing a stronger/milder ridge over the East Feb. 22-26, one that the European model already was locking onto Tuesday. The midday GFS model confirmed the trend and shifted even milder with it.

“The data still advertises several strong cold shots sweeping across the country starting this weekend and through much of next week for strong national demand, just not as frigid compared to earlier in the week,” NatGasWeather said.

The Nymex March contract plunged as low as $2.558 but then bounced a bit after failing to clear the $2.55 major technical support level.

With solid cold for next week focused across the Midwest into the South, this should help keep gas-weighted degree days (GWDD) around average through the end of February, with colder risks, according to Bespoke Weather Services. Additionally, the Madden-Julian Oscillation remains favorable for negative North Atlantic Oscillation development and a westerly wind burst is forming, “meaning volatile models can shoot back colder too, but confidence is lower.

“Our sentiment is back to neutral in a natural gas market that remains incredibly heavy,” Bespoke chief meteorologist Jacob Meisel said.

With bearish trends easily pushing gas prices beyond Bespoke’s key $2.60-2.62 support level, the firm said GWDDs need to stabilize first in order for prices to bounce. It continues to see GWDD losses get sold more heavily than GWDD gains, “as the market remains concerned about oversupply with previously loose balances,” Meisel said.

Thursday’s EIA data will likely confirm this with what Bespoke expects will be a loose 82 Bcf withdrawal, “though this is a bit tighter than market expectations, and we expect data tightening up from there, leading us still to believe on average weather, March is cheap under $2.60.”

Other market estimates are also pointing to a withdrawal in the 80 Bcf range. A Bloomberg survey of 11 market participants had a draw range of 77-106 Bcf, with a median draw of 82 Bcf. A Reuters survey of 21 analysts had the same range, with a median of 84 Bcf. A poll by The Wall Street Journal of 10 analysts showed an average pull of 85 Bcf. Kyle Cooper of IAF Advisors projected an 88 Bcf pull, and EBW Analytics pegged the draw at 83 Bcf. NGI estimated a 73 Bcf withdrawal.

NGI started publishing gas storage withdrawal estimates earlier this month using a machine learning model that takes into account historical fundamental data, including heating/cooling degree days, past storage figures and ranges of expectations.

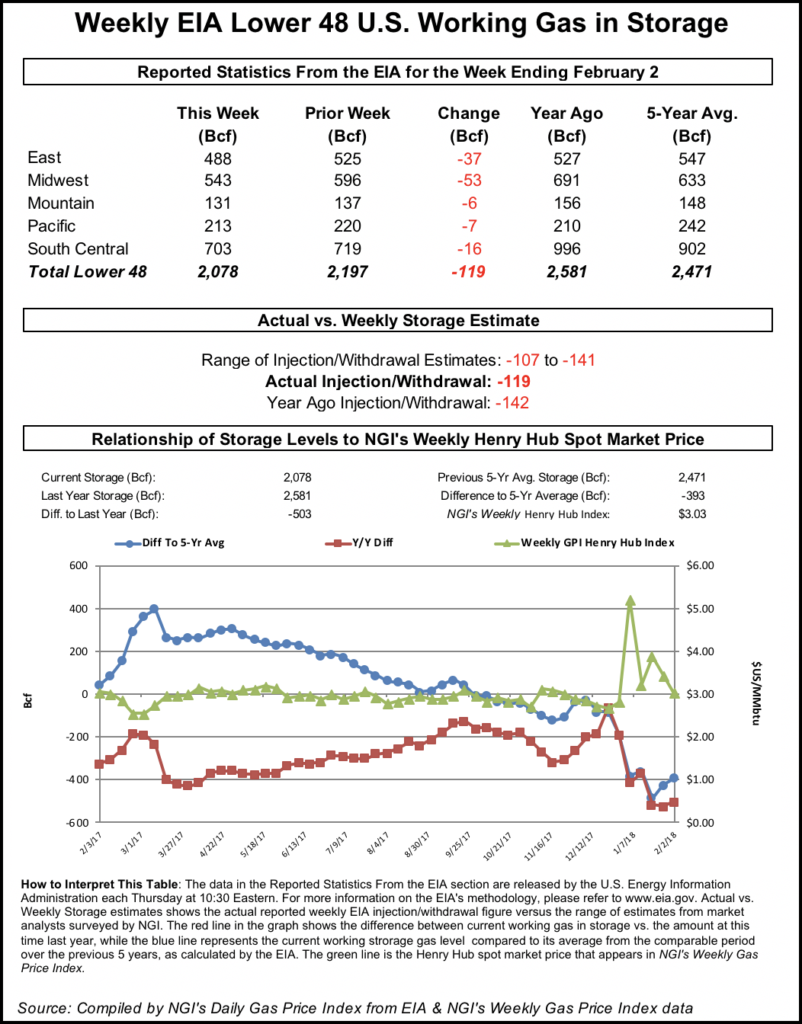

A storage draw in the 80 Bcf range would compare to last year’s 183 Bcf withdrawal for the week and a five-year average draw of 160 Bcf, according to EIA. Last week, the government agency reported a 237 Bcf draw for the week ending Feb. 1, leaving inventories at 2,095 Bcf, 135 Bcf below last year and 415 Bcf below the five-year average.

Looking ahead, as winter recedes by mid- to late March, falling spot market demand is likely to undercut natural gas futures, according to EBW. February-to-date spot market prices at Henry Hub have averaged $2.64/MMBtu (as of Wednesday’s trading) and by mid-March, weather-driven demand is likely to fall another 10 Bcf relative to even last week’s depressed levels.

Furthermore, while fast-cycling storage operators stepped in last week to buy gas ahead of late-February cold, salt storage refill demand is likely to wane dramatically against a weaker spring outlook, “potentially depriving the market of much-needed support,” EBW CEO Andy Weissman said.

Spot Gas Sinks Further

Spot gas prices continued to grind lower Wednesday as rather comfortable temperatures have set up shop across much of the United States. The exception was out West, where weather remains chilly with precipitation likely through next week, according to NatGasWeather.

In California, SoCal Citygate next-day gas jumped $4.49 to $10.73, and Malin rose $3.185 to $8.745.

Kern River in the Rockies climbed $3.30 to $8.61, while Northwest Sumas continued to come off highs not seen since last fall following a blast on Westcoast Transmission, averaging about $13.72 lower at $11.81.

Prices were down no more than a dime at most pricing hubs across Texas and Louisiana, with Henry Hub sliding 6 cents to $2.61.

On the pipeline front, ANR Pipeline continued to operate under a force majeure at the Jena Southbound compressor station in Louisiana, which could cut up to 320 MMcf/d of flow for gas days through Monday (Feb. 18). The force majeure in the Southeast Southern Segment (Zone 2) was due to unexpected and uncontrollable repairs on the compressor station, according to ANR.

A notice on the pipeline’s website indicated that operational capacity at the location would be reduced by down to 850 MMcf/d for the duration of the event, however, nominations are showing higher flows for gas days Feb. 12 and 13, according to Genscape.

Small losses of less than a dime were also seen across the Midcontinent and Midwest, where Chicago Citygate dropped about a nickel to $2.57.

In Appalachia, Columbia Gas next-day gas dropped 6.5 cents to $2.42, a loss that was in line with other points in the region and in much of the Northeast. Algonquin Citygate, however, shot up 34.5 cents to $3.75.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |