Infrastructure | E&P | NGI All News Access | Permian Basin

NGL Energy Reports Progress on Permian Produced Water Infrastructure

NGL Energy Partners LP reported continued progress with a pair of pipelines to transport produced water from the Permian Basin’s Delaware sub-basin and a nearly 50% increase in total revenue for its latest quarter.

CEO Mike Krimbill said the Delaware on both sides of the Texas-New Mexico border continued to be the most attractive area for the Tulsa-based partnership to operate for several reasons, chief among them that the sub-basin has the highest water-to-crude ratios. He added that the partnership expects produced water volumes from the Delaware to exceed 10 million barrels/day over the next five years.

The Delaware also has the lowest commodity price risk and ratio of flowback to produced water, as well as decades of drilling locations and “relatively little infrastructure currently in place, which lends itself to pipeline midstream type opportunities,” Krimbill said during a quarterly earnings call Monday to discuss fiscal third quarter results.

The partnership’s four business segments are crude oil logistics, water solutions, liquids and refined products and renewables.

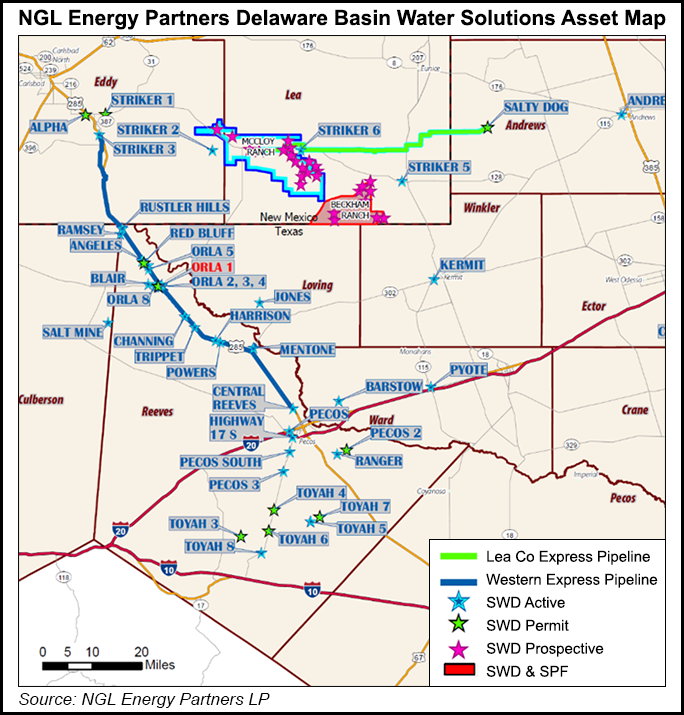

Krimbill said the segment of the Western Express Pipeline between Orla and Mentone, TX, is in service and the second phase of the pipeline to the Texas-New Mexico state line would enter service by August. The partnership is still waiting on state and federal approvals for the third phase of the pipeline, which would extend it to Loving, NM. The entire pipeline is expected to enter service later in 2019.

Meanwhile, Krimbill said the partnership has received all of the necessary approvals to secure rights-of-way for its Lea County Express Pipeline through New Mexico’s Permian, and expects to enter the pipeline into service by July. The partnership has already started drilling disposal wells in Andrews County in West Texas, near the endpoint of the pipeline.

CFO Trey Karlovich said volumes on the 550-mile Grand Mesa Pipeline, which connects the Denver-Julesburg Basin in Colorado to Cushing, OK, averaged 129,000 b/d in 3Q2019, up from 106,000 b/d in the year-ago quarter. He said the partnership expects volumes to continue near the latest level into fiscal 4Q2019.

In the water solutions segment, volumes averaged about 1 million barrels/day in 3Q2019. “Permian volumes were relatively flat this quarter compared to the prior quarter, as we saw some slowdown toward the end of the year on completion activity due to weather and the completion of well workovers at some of our facilities,” Karlovich said.

During the quarter, the partnership completed the sale of its saltwater disposal business in the Bakken Shale to an affiliate of Tallgrass Energy LP for $91 million. It also expects to complete the sale of its South Pecos assets in Texas by the end of March. A subsidiary of WaterBridge Resources LLC agreed to purchase the South Pecos assets for $238.8 million last December.

Karlovich said the water solutions segment would likely see lower results in 4Q2019 as a result of the divestitures, “however, we are expected volume growth to continue across our system, notably in our core Delaware basin position, which should make up for these sales in the next couple of quarters.” The CFO said the partnership is expecting water volumes to average between 1.0-1.1 million barrels/day during 4Q2019 pro forma for the asset sales.

Net income was $110.8 million (65 cents/unit) in 3Q2019, compared with net income of $56.3 million (33 cents) in the year-ago quarter. Total revenues increased 46.4% year/year to $6.38 billion.

Revenue for refined products and renewables increased 63% from a year ago to $4.8 billion in 3Q2019, while crude oil logistics revenue grew 29% to $751.2 million. Revenue for water solutions rose 17.9% to $75.5 million. Gains in those three segments more than offset a 1.3% decline in the liquids business, which saw revenue of $749.4 million in 3Q2019, down from $759.6 million in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |