Markets | NGI All News Access | NGI Data

Weekly Prices Mostly Lower as Spring Arrives Early; West Volatile on Localized Cold

Despite mostly mild weather across the United States this week, some localized frigid air in the West led to extreme volatility in that region. Prices for the Feb. 4-8 period spiked nearly $20 in the Rockies and more than $10 in California as demand hit record levels. Elsewhere, however, temperatures turned springlike and led to a substantial sell-off, especially in Northeast markets. The NGI Weekly National Avg. ultimately rose 59 cents to $3.525.

Out West, Northwest Sumas weekly prices shot up $19.44 to $24.21, a level not seen since November, when early-season cold fueled demand at the same time that southbound flows on Enbridge Inc.’s Westcoast Transmission were restricted following an explosion. This time around, although restrictions had largely been lifted on Westcoast, western Canada was dealing with record cold and needed to keep supplies to meet its own needs.

In California, SoCal Citygate weekly prices jumped $10.325 to $13.975 as unplanned repairs continued at Southern California Gas’ (SoCalGas) Aliso Canyon storage facility, which is cutting a third of its withdrawal capacity.

SoCalGas retroactively announced that these repairs had been ongoing for about a week, limiting withdrawal capacity by about 420 MMcf/d, according to Genscape Inc. SoCalGas has stated that it is repairing aboveground piping at the facility, and that the end date for this work is still to be determined.

“Aliso Canyon’s infrastructure has been under intense scrutiny by state regulators since the four-month leak that began in October 2015, which altered the southern California gas market’s dynamics,” Genscape natural gas analyst Joe Bernardi said.

Cold weather and limited supply initially led to SoCalGas issuing a call for voluntary electric generation curtailments. Later, the company announced it was also implementing non-voluntary curtailments in order to maintain system integrity, having deemed imports and withdrawals (including those from Aliso Canyon) insufficient, Genscape said.

Over in the Northeast, Algonquin Citygate weekly prices plunged $1.805 to $3.48, and Transco Zone 6 NY tumbled $1.725 to $2.565. The steep drop-off occurred as daytime temperatures reached the 50s and 60s this past week, after dipping into the single digits just days earlier.

Losses throughout Appalachia were mostly in the 20- to 30-cent range, while most other regions saw more muted losses of 10 to 20 cents.

Futures Mostly Bearish, But Cold Temps Ahead

As for futures, this week’s trading action was rather choppy as prices tried a couple of times to get off the ground, with only modest success. The Nymex March gas contract ultimately lost 7.7 cents during the Feb. 4-8 period.

Market sentiment was already trending rather bearish at the start of the week as weather models could not come to agreement on the intensity of a pair of cold weather systems set to move across the country beginning this weekend. The March contract slid more than 7 cents on Monday, but then held mostly steady on Tuesday and Wednesday.

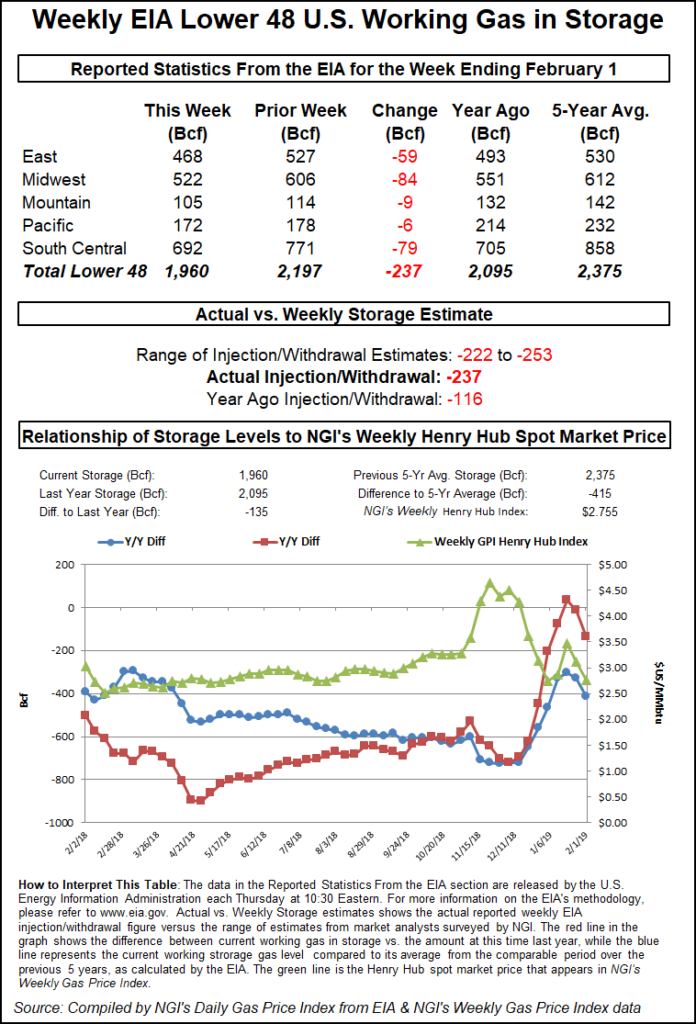

Bears then gained the upper hand on Thursday after the Energy Information Administration (EIA) reported a 237 Bcf withdrawal from storage inventories for the week ending Feb. 1. The reported draw came in about 10 Bcf below consensus, delivering a sharp blow to a market expecting a steeper drawdown given the reporting week featured the coldest weather of the winter so far.

Inventories fell to 1,960 Bcf, 135 Bcf below last year and 415 Bcf below the five-year average, according to EIA.

Still, that’s not to say last week’s polar blast didn’t leave a lasting impression. Nicor Gas broke some of its records during the biting conditions, delivering more than 4.8 Bcf to its 2.2 million customers throughout northern Illinois. This is the single largest delivery of natural gas in the company’s history and surpassed previous records set during the 2014 polar vortex.

The frigid air also led to record send-out from Excelerate Energy LP’s Northeast Gateway Deepwater Terminal offshore Boston. As strong demand in pipeline-constrained New England soared, the terminal reached a peak send-out flow rate of more than 800,000 MMBtu/d on Feb. 1, a first for the terminal.

The operation was completed by two of Excelerate’s floating storage regasification units (FSRU), discharging in parallel through offshore buoys. At a flow rate of 800,000 MMBtu/d, this represents roughly the average gas demand of power generators during recent January-February periods, the company said.

And Williams said it also set a delivery record on its Transcontinental Gas Pipe Line (aka Transco), the nation’s largest-volume natural gas transmission system. Transco delivered a record-breaking 15.68 MMDth on Jan. 21, surpassing the previous high that was set on Jan. 5, 2018. The Transco system, which stretches from South Texas to New York City, also established a new three-day market area delivery record, averaging 15.30 MMDth from Jan. 30 to Feb. 1.

Looking ahead, the coming weather pattern is expected to continue dropping gas stocks toward 1.3-1.4 Tcf by winter’s end, NatGasWeather said. Specifically, deficits are likely to tighten back to around 330 Bcf next week because of very warm southern and eastern United States temperatures this past week. Deficits are likely to again increase in the weeks after since five-year average draws will be much smaller and easier to exceed with just modest cold shots.

The long-range pattern remained favorable enough for significant cold from the Midwest that could flood into the East, as the signal remained for a weak negative North Atlantic Oscillation that could suppress any southeastern ridge in the medium term and allow cold to return, according to Bespoke Weather Services.

“This actually fits better with our ideas in that tropical forcing should become more favorable for cold through the second half of the month, so we would look for the Week 2 and Week 3 forecasts to continue cooling into the weekend,” Bespoke chief meteorologist Jacob Meisel said.

The team at WeatherAmerica agreed that there is “some measure of hope” that a cold-driven, snow-producing storm may affect the Ohio Valley, Mid-Atlantic and New England states late next week. The first in a sequence of three storms is expected to generally track into southern Colorado and from there to the East/Northeast.

“I would rate a one in three chance at the middle cyclone in the series turning into a Colorado/Trinidad ”B’ event, with redevelopment off the Virginia Capes on Saturday. There is decent support on this scenario from the European and American model ensembles, as both versions turn the system into a Grand Banks vortex in Week 2. If so, cold air would probably reach into Dixie and the Eastern Seaboard,” WeatherAmerica chief meteorologist Larry Cosgrove said.

The sharp drop in temperatures over the middle of the nation are a reminder that the calendar end of winter is still more than five weeks away. But after repeated flubs from the numerical models on the advance and extent of Arctic air and snow cover, it’s no wonder the market is hesitant to put up any meaningful gains.

Still, Bespoke’s sentiment has ticked back slightly bullish. Although a solid number of gas-weighted degree days (GWDD) were lost overnight Thursday, the firm is beginning to see evidence of liquefied natural gas exports set to return as balances tighten up on this short-term cold shot. Additionally, long-range cold risks have been increasing as models are better picking up on the impact of a “Phase 8-1 propagation” in the Madden Julian Oscillation, and it expects those trends to continue during the weekend.

Meanwhile, the European weather model trended even colder in its Friday afternoon run, adding a hefty 20 heating degree days compared to Thursday night’s run and 10 HDDs compared to Thursday afternoon, according to NatGasWeather.

“Whether the data holds this trend through the weekend is where the danger lies,” the firm said.

The Nymex March gas futures contract went on to settle Friday at $2.583, up 3.2 cents, and it continued to strengthen after the session ended. It reached a high of $2.62 at presstime.

Spot Gas Retreats As Cold Eases

Spot gas prices across most the country slid into the red Friday as the cold air that swept over the Midwest and into the southern and eastern United States through the weekend was expected to dissipate by Sunday, paving the way for far milder temperatures. The West, meanwhile, was expected to be unsettled and cool to cold, according to forecasts.

Still, it was the West that posted the steepest price drops, as market hubs across California and the Rockies shed several dollars but still remained among the highest priced in the nation after setting records in recent days.

PG&E Citygate spot gas fell about $3.325 to $14.385.

Meanwhile, Nova Gas Transmission Ltd. (NGTL) in Alberta experienced an unexpected flow reduction Thursday in its export capacity to the southwest. This disruption trickled down through the U.S. Pacific Northwest to Pacific Gas & Electric Corp. (PG&E), which has massively ramped up its storage withdrawals, according to Genscape Inc.

Subsequently, PG&E Citygate basis skyrocketed Thursday to a new record high for this decade at $15.11 before tightening Friday.

Farther south, SoCal Citygate spot gas fell $2.345 to about $16 even as Southern California demand remained exceptionally high at around 3.8 Bcf/d for Friday, which is down slightly from recent days when it was running at around 4.0 Bcf/d, according to Genscape.

“That 3.8 Bcf/d is still more than 33% higher than the January average,” Genscape natural gas analyst Bernardi said.

Meanwhile, the frigid air was forecast to continue through part of the week, and Aliso Canyon’s withdrawal capacity remains limited because of unplanned repairs.

Across the northern border in Canada, Alberta demand was still peaking from exceptionally cold weather stationed over the province, which has led to more than 4.4 Bcf of production lost to freeze-offs, Genscape said.

“NGTL’s export capacity to Foothills, BC, dropped to 88.5% of firm, translating to a about 450 MMcf/d drop in Foothills’ deliveries to Gas Transmission Northwest (GTN) at the Kingsgate border point, relative to the previous two-week average. GTN then distributed the effects of this cut with a roughly 350 MMcf/d decrease in its deliveries to Pacific Gas & Electric at Malin, along with a roughly 60 MMcf/d drop in deliveries to Northwest Pipeline at Stanfield,” Bernardi said.

Kingsgate spot gas dropped $4.335 Friday to average $14.315 as a return to more normal temperatures in the Rockies was expected during the weekend.

Elsewhere across the country, Northeast market hubs were among the only ones in the black on Friday. New England’s Algonquin Citygate jumped $2.175 to $5.05, while Transco Zone 6 NY rose just 14 cents to $2.70.

Prices across the Southeast and into Louisiana were mostly down less than a nickel, while Midcontinent prices tumbled as little as 4 cents and as much as 82 cents. Midwest pricing hubs posted more uniform declines of 5-15 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |