Infrastructure | E&P | NGI All News Access

Domestic Natural Gas Rig Count Down Three in Latest BHGE Tally

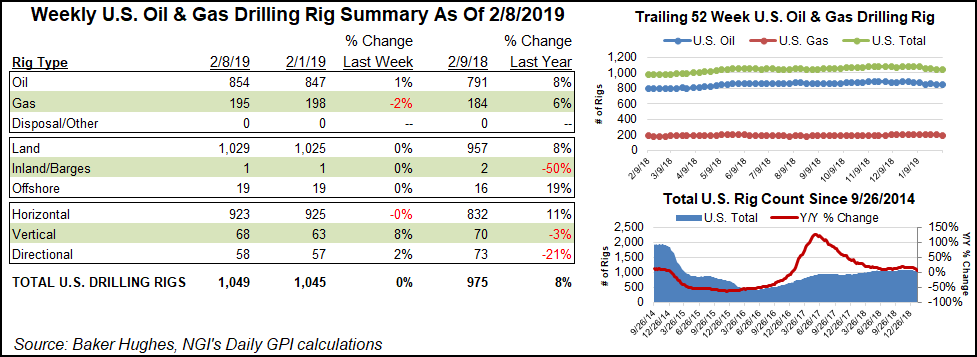

U.S. operators dropped three natural gas rigs week/week as of Friday (Feb. 8), but seven more went to work on oil prospects, based on the latest tally by Baker Hughes Inc., a GE company.

The weekly rig count showed Texas was down three rigs and New Mexico was off one, while Alaska and California each raised four rigs and Wyoming added one.

According to BHGE’s North American rotary rig count, 1,289 total rigs were running in the United States and Canada for the week, a net gain of one from a week earlier, but down 11 from a year ago.

The United States raised four rigs overall to end the week at 1,049, with a total of seven oil rigs raised and three gas rigs dropped. Of the U.S. total, 1,029 were working land, one was in inland waters and 19 rigs were active in the Gulf of Mexico (GOM).

The U.S. oil rig count stood at 854 for the week, 63 more than a year ago, and there were 195 active gas rigs, which was 11 higher. There are three more rigs working now in the GOM than a year ago.

Canada’s rig count in the latest tally stood at 240, down three rigs from a week earlier and off 85 year/year.

Horizontal rigs were the equipment of choice in the United States at 923, off two for the week but 91 more than a year ago. There also were 68 vertical rigs in operation, a gain of five week/week but down two year/year. In addition, 58 directional rigs were working, which was one higher from a week earlier but down 15 year/year.

A deep dive of the Baker Hughes data for U.S. unconventional basins showed a total of 873 rigs in operation, down two for the week but 9% higher than a week earlier.

Most of the Lower 48 plays reported a static rig count week/week. However, the Ardmore Woodford in Oklahoma gained two rigs to end at five, while the Eagle Ford Shale added one to end at 82.

The Permian, the most active basin of the country, reported that one rig was dropped in the Delaware sub-basin to bring its total to 272, while the Midland sub-basin added one to total 201. Three rigs also were dropped in “other” Permian plays to end at five.

According to NGI’s rig count data year/year for other U.S. basins/formations for the week ended Friday, the San Juan Basin, which straddles New Mexico and Colorado, has seen a 50% increase to its rig count, but only to three, while the Powder River Basin has registered a 25% jump to 20.

NGI data showed California’s overall rig count was off 29% from a year ago at 10, while the Green River Basin fell 17%, also to 10. The Piceance Basin rig count was down 13% year/year at seven.

Houston-based Patterson-UTI Energy Inc., which supplies onshore drilling and pressure pumping equipment, said it has idled three U.S. fracture fleets since the start of the year and tabled rig upgrades that lack term contracts. The oilfield services firm’s rig count averaged 183 in the final quarter of 2018, up five from the third quarter, but when oil prices collapsed, some of the exploration and production customers began to release rigs, CEO Andy Hendricks said during a conference call Thursday.

“Recently, with the sharp rebound in oil prices above $50, we have seen an improvement in operator sentiment,” but the rig count is expected to be off in the first quarter, averaging around 174 rigs. “We could still go down from where we currently are operating 175 rigs,” dropping another six or seven. “But we don’t anticipate this going below the upper 160s…

“We’ve seen some change in sentiment, and so we’re just going to have to see how this plays out. Not all the operators have finalized their plans and so I would say this is still fluid.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |