Bears Take Control as Natural Gas Futures Tumble 10-Plus Cents; Spot Gas Rises

It just wasn’t meant to be for natural gas bulls hoping the upcoming cold weather systems would be enough to rally prices as the peak days of winter wind down. The Nymex March gas futures contract lost 11.1 cents to settle Thursday at $2.551. April fell 8.5 cents to $2.572.

Spot gas prices, however, strengthened as colder air began circulating across the country’s midsection on its way to the East Coast. The NGI Spot Gas National Avg. rose 50.5 cents to $4.10.

Despite the bump in spot gas prices, overall market sentiment is decidedly bearish and especially so after the one-two punch of warmer-trending weather data and a smaller-than-expected storage withdrawal. With storage supply fears firmly erased from the minds of traders, Thursday’s Nymex action saw the March/April spread flip to negative.

The first flip in the so-called widow-maker spread occurred in early-morning trading as the European weather model — which had been the coldest in recent days — trimmed a huge chunk of demand from its forecast. The American Global Forecast System (GFS) and the European model had been at odds regarding the intensity of a pair of weather systems moving into the country beginning this weekend.

Wednesday’s GFS weather model trended much colder, but it too turned milder in its midday run, according to NatGasWeather. “Both important weather models continue to show numerous cold shots sweeping across the country the next two weeks; it’s just the mild breaks in between over the South and East really stand out. Clearly, the natural gas markets didn’t want to see any slack in demand.”

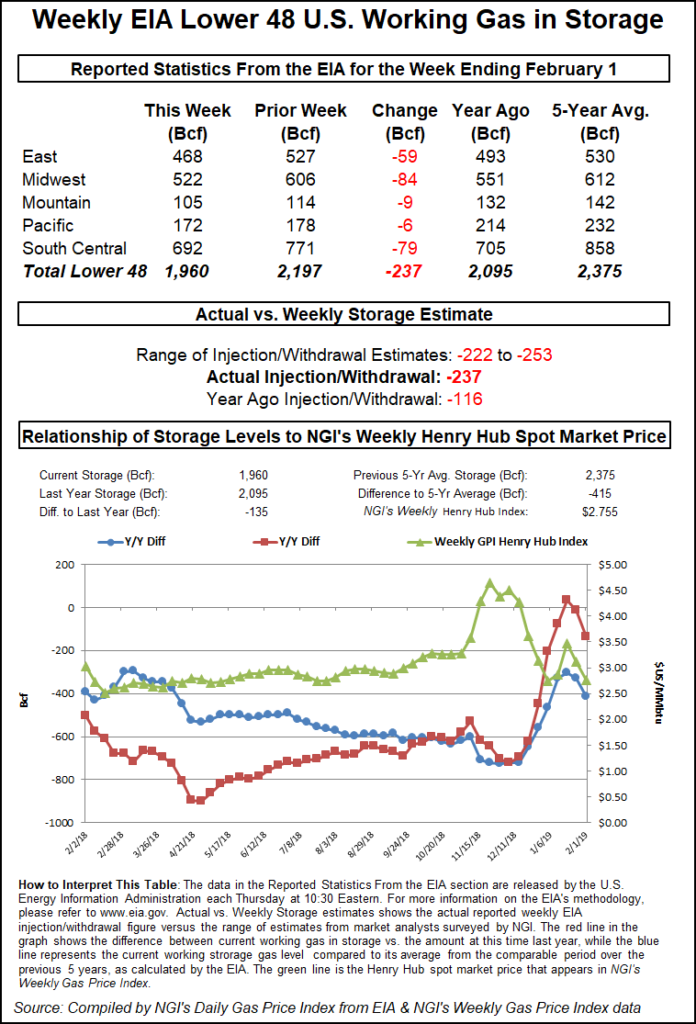

Meanwhile, the Energy Information Administration reported a 237 Bcf withdrawal from storage inventories for the week ending Feb. 1. The reported draw came in 10 Bcf higher than consensus and sent the Nymex March contract down a couple of cents soon after the print hit the screen.

“This came in bearish to market expectations and reflects a market that did not really tighten at all last week, despite severe cold across the Midwest. Modeling indicated bearish risks with the number today, though after a very surprising bearish miss last week, we were looking for an implicit revision,” Bespoke Weather Services chief meteorologist Jacob Meisel said.

Instead, the gas market remains quite loose and will struggle to bounce without clear evidence of tightening in daily supply/demand balances and more bullish weather. March gas at under $2.60 “still seems cheap given lingering cold risks and plummeting imports this week, but this is certainly a bearish EIA number that will limit upside at the front of the gas strip moving forward,” Meisel said.

Broken down by region, the Midwest reported an 84 Bcf withdrawal, the second largest pull ever for that region. A 79 Bcf draw was reported in the South Central and a 59 Bcf draw was reported in the East. Both the Mountain and Pacific regions reported pulls of less than 10 Bcf, according to EIA.

Total working gas in storage as of Feb. 1 stood at 1,960 Bcf, 135 Bcf below last year and 415 Bcf below the five-year average, EIA said.

Ahead of the report, most market participants had called for a withdrawal in the 240-250 Bcf range. Last year, the EIA reported a pull of 116 Bcf for the same week, and the five-year average draw stands at 150 Bcf.

Some market observers said the reported draws in the Midwest and South Central region appeared low but struggled to determine the reason for such a miss, although many wondered about the impact of liquefied natural gas (LNG) demand as exports were low for the reporting week and so far this week as well.

“LNG exports are a big part of demand now. A 3 Bcf/d drop is significant. I have heard LNG people say it is on contract and not flexible, but the trading shops set up around these things tell me otherwise,” Wood Mackenzie natural gas analyst Gabe Harris said on Enelyst, an energy social media platform hosted by The Desk.

Genscape Inc. reported earlier this week that since Sunday, deliveries headed to Cheniere Energy Inc.’s Sabine Pass LNG swiftly declined to 770 MMcfd for Wednesday gas day, a drop of nearly 2.5 Bcf/d from a previous average of 3.2 Bcf from the week prior. Nominations showed declines in deliveries across all systems feeding Sabine Pass.

Kyle Cooper of IAF Advisors indicated that heavy fog in the area had prevented ships from entering or leaving the terminal. As such, storage tanks filled and then had to shut down. Now that the fog has cleared, flows should increase once ships draw down storage, he said.

Looking ahead, the net result of the coming weather pattern is to continue to drop supplies towards 1.3-1.4 Tcf by winter’s end, according to NatGasWeather. Specifically, while deficits to the five-year average dropped to 415 Bcf off today’s EIA report, they should move back toward 330 Bcf after next week’s report comes in much lighter than the five-year average due to the very warm southern and eastern United States temperatures this past week, it said.

Looming Cold Boosts Cash

Spot gas prices rose across the majority of the country Thursday as a strong cold blast over the Midwest with ice, snow and rain was forecast to spread south and east, according to NatGasWeather. The storm was expected to send low temperatures across the northern United States once again below zero in some locales and to as high as the 20s, with lows of teens to 30s into Texas and the South.

“It will remain warm over the East for one more day until much colder air arrives Friday-Saturday, aiding a swing back to strong national demand. A brief break is expected over the Great Lakes and East early next week before another cold shot arrives midweek,” the forecaster said.

Even with some of the coldest weather of the winter on tap for the Midwest and East in the coming days, it was once again the West gas markets that recorded the most substantial gains as chilly, wet weather blankets that region. The recent price volatility has resulted in near all-time record highs, some of which is being driven by an unplanned, ongoing repair at Southern California Gas’ (SoCalGas) Aliso Canyon storage facility.

Unplanned maintenance at Aliso Canyon is cutting a third of its withdrawal capacity, according to Genscape Inc. SoCalGas retroactively announced that these repairs have been ongoing for nearly a week, limiting withdrawal capacity by about 420 MMcf/d. The company stated that it is repairing aboveground piping at the facility, and that the end date for this work is still to be determined.

“Aliso Canyon’s infrastructure has been under intense scrutiny by state regulators since the four-month leak that began in October 2015, which altered the southern California gas market’s dynamics,” Genscape natural gas analyst Joseph Bernardi said.

Cold weather and limited supply initially led to SoCalGas issuing a call for voluntary electric generation curtailments. Later, the company announced it was also implementing non-voluntary curtailments in order to maintain system integrity, having deemed imports and withdrawals (including those from Aliso Canyon) insufficient.

After setting a new year-to-date high for Wednesday’s flow date, SoCal Citygate basis more than doubled to hit $17.78 for Thursday flow. That mark is the highest since last August and the fourth highest ever. SoCal Border basis hit $7.60, its third-highest mark this decade, per NGI data.

While SoCal Citygate spot gas fell $2 to $18.34 in trading for Friday flow, the SoCal Border Avg. rose more than $4.25 to $14.41.

Over in the equally volatile Rockies, Kern River next-day gas shot up $7.44 to $17.49, while Opal tacked on $6.73 to reach $17.43. Regional prices have been especially volatile in recent days since Pacific Northwest demand has spiked to multi-year highs due to well below-normal temperatures.

The frigid conditions have cut into production as volumes since Jan. 31 have fallen by an additional 0.2 Bcf/d with lingering cold and snow making recovery from freeze-offs slow, particularly in basins west of the Continental Divide, Bernardi said.

In the Midwest, small gains of around a nickel or so were the norm, while Midcontinent prices were up as little as 8.5 cents and as much as 83.5 cents.

Transco Zone 6 non-NY spot gas climbed 12 cents to $2.585, and Algonquin Citygate spot gas rose 19 cents to $2.875.

Meanwhile, overall Lower 48 production on Wednesday was revised up to breach 85 Bcf/d for the first time this month, according to Genscape. Production revised to 85.24 Bcf/d, marking an increase of nearly 1.8 Bcf/d from Jan. 31, when production had sunk to a 134-day low on freeze-offs and widespread operational outages.

The vast majority of the increases (1.7 Bcf/d) are from the Northeast, supplemented by nearly 240 MMcf/d higher output from the Midcontinent. The gains would be higher but for lower output in the Rockies, Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |