Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

National Oilwell Stomps 4Q Expectations on Strong Oilfield Equipment Orders

Houston-based National Oilwell Varco Inc. (NOV) crushed quarterly profit expectations, beating guidance and analyst estimates even as oil prices slumped, as customers accelerated oil and gas equipment deliveries before the end of the year.

Revenues during the fourth quarter increased 22% year/year and 11% sequentially to $2.4 billion. Operating profit of $87 million, or 3.6% of sales, increased 42% from 4Q2017 and climbed 19% from the third quarter.

“During 2018 our team delivered outstanding execution in a volatile operating environment by focusing on our customers’ need for solutions that improve their operating efficiencies,” CEO Clay Williams said. “Each of our operating segments delivered double-digit percent revenue increases in 2018, contributing to a 16% increase in consolidated company revenue…

“The sharp fourth quarter pull-back in commodity prices heightened uncertainty surrounding 2019 capital budgets and led to an abrupt slowdown in orders, while some of our customers chose to accelerate deliveries prior to year-end.”

Lower orders in December, combined with equipment sales pulled forward near year’s end, “will lead to lower sequential revenue during the first quarter 2019 in all three segments,” Williams said. “However, encouraged by the recent uptick in oil prices, some of our customers have recently signaled their intent to increase activity, particularly in certain international and offshore markets.”

The near-term outlook remains uncertain, but the company’s “portfolio of critical technologies to support the oil and gas industry, together with our track record of adapting quickly to changing market conditions, positions us well for any market environment.”

The wellbore technologies unit generated revenues 24% higher than in 4Q2017 and 4% higher sequentially at $884 million, outpacing domestic and global activity levels, with sales increasing 4.5% in the United States and 2.1% in international markets. The segment’s WellSite Services and Grant Prideco business units posted double-digit sequential increases supported by bookings of solids control equipment and drillpipe. Operating profit was $41 million, or 4.6%.

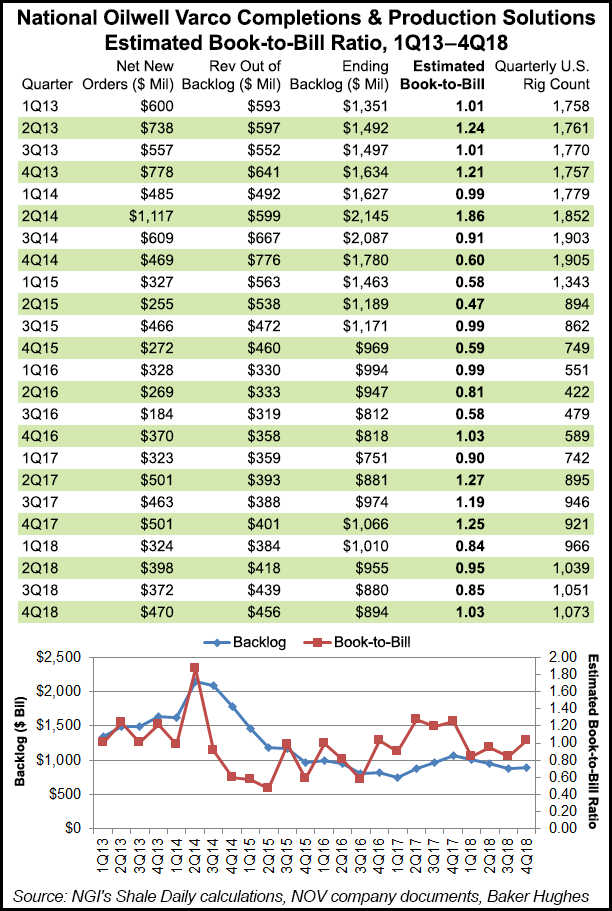

In the completion and production (C&P) solutions business, revenues increased 14% year/year and 7% from the third quarter as the result of “improved progress and deliveries on projects and continued growth in demand for coiled tubing and wireline equipment,” management said. Operating profit was $64 million, or 8.1% of sales.

New orders booked during the final quarter of 2018 totaled $470 million, representing a book-to-bill of 103% when compared to the $456 million of orders shipped from backlog. The backlog for capital equipment orders in C&P totaled $894 million at the end of the year.

The rig technologies unit generated a revenue increase of 31% year/year and 26% sequentially to $804 in the fourth quarter, which management credited to “better progress on projects, two land rig deliveries and improved aftermarket sales. Operating profit was $75 million, or 9.3%.

New rig technology orders booked during 4Q2018 totaled $119 million, representing a book-to-bill of 30% when compared to the $403 million of orders shipped from backlog. At the end of 2018, the backlog for capital equipment orders in the segment was $3.1 billion.

Expanding Technology Offerings

Management highlighted some of the technology it has developed that serves North America onshore and Gulf of Mexico producers. It said initial sales of its True-Taper XR coiled tubing were strong, as the design incorporates “fewer and shorter tapered sections, which enables better weight and strength distribution, and fewer bias welds,” management said. One customer used the coiled tubing to reach total depth on wells “that were over four miles in measured depth and had one- to two-mile laterals, success that was not possible with conventional designs.”

The Vector Series 50 SelectShift motor also had continued success during the quarter. It offers downhole adjustments of motor bend settings. At the end of 2018, the motor had been used in 56,800 feet of drilling and 675 drilling and circulating hours, with more than 148 straight mode shifts downhole, including in the Bakken Shale and Permian Basin. NOV said it is “expanding the applications and regions where the tool is run and rapidly increasing fleet size to meet high demand.”

In addition, shipments began on an advanced MPowerD managed-pressure-drilling (MPD) choke manifold and MPD control system to one of its extended-reach drilling land rigs being built in Canada. The “first-of-its-kind land rig” is to be delivered with an integrated MPD system operated from the NOV Amphion chair, “giving the driller an unprecedented overview of the drilling process, including monitoring and control of key MPD parameters and setpoints.” The manifold is built with a small footprint, while optimizing pressure control accuracy and minimizing surface friction.

On a 16-well project in New Mexico, NOV said its eVolve optimization and automation service successfully drilled an intermediate section with a wired rotary bottomhole assembly (BHA).

“Previous attempts in other wells to use a similar assembly with industry-standard data transmission had led to severe levels of vibration and the destruction of expensive BHA tools.” The performance gains reduced drilling shock and vibration, resulting in reduced failures and improved bit reliability.

Net income in 4Q2018 turned around a year ago loss to hit $15 million (3 cents/share) from a loss of $15 million (minus 1 cent). For 2018, NOV lost $22 million (minus 8 cents/share), but it was a sharp uptick from the 2017 loss of $236 million (minus 63 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |