E&P | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Mexico’s CNH Approves $7.6B Development Plan for Offshore Project

Mexico’s Comisión Nacional de Hidrocarburos (CNH) has approved a development plan by Fieldwood Energy E&P Mexico S de RL for the Ichalkil and Pokoch shallow water fields in Campeche Bay.

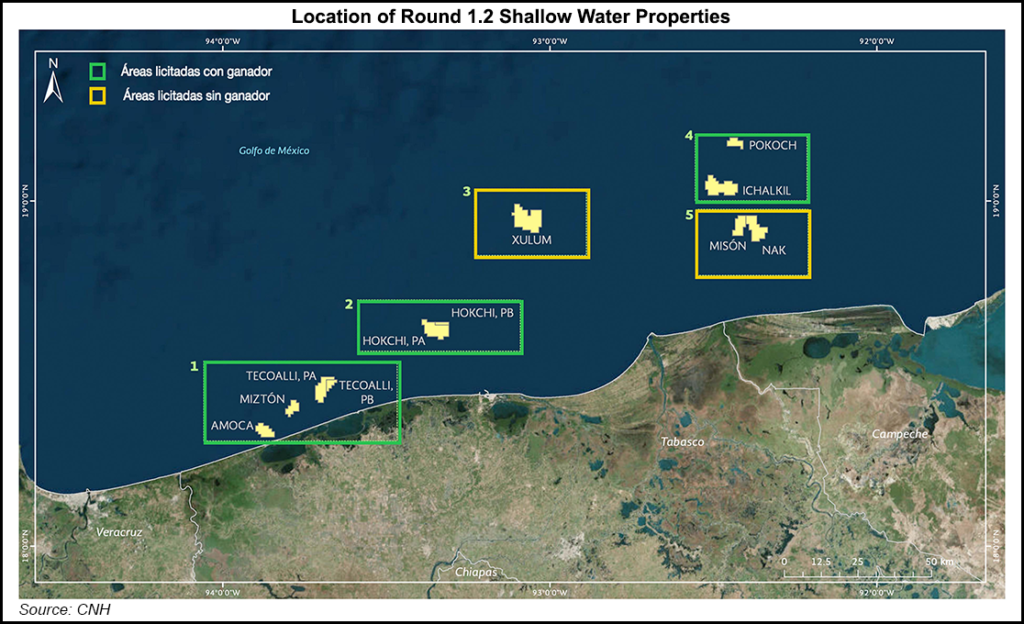

The fields pertain to Block 4, an area in which CNH awarded a 20-year production-sharing contract to Fieldwood and its Mexico-based joint-venture partner Petrobal SAPI de CV in the Round 1.2 bidding process in 2015.

The consortium plans to invest $7.58 billion and drill 19 production wells at the block from 2021-2040.

Fieldwood is a subsidiary of Riverstone Holdings LLC, an energy-focused private investment firm. Petrobal is a unit of Mexican conglomerate Grupo BAL. Fieldwood and Petrobal each hold a 50% stake in Block 4, for which production levels of oil and natural gas are expected to peak in 2026 at around 104,000 b/d and just under 160 MMcf/d, respectively.

Combined, uncertified proved plus probable or 2P reserves at Ichalkil and Pokoch stand at 455 million bbl oil and 567 Bcf natural gas. Once the reserves are certified, Ichalkil-Pokoch would become Mexico’s fifth-largest field in terms of 2P oil reserves, CNH Commissioner Gaspar Franco said.

The only fields with more 2P reserves are Akal (1.59 billion bbl), Maloob (1.22 billion bbl), Ayatsil (1.04 billion bbl), and Zaap (593 million bbl).

With the approval in late January, all three offshore projects awarded through Round 1.2, along with the Block 7 project awarded in Round 1.1, have obtained the green light for development. The other Round 1.2 projects comprise Hokchi Energy’s Block 2 and Eni SpA’s Block 1, each of which secured approval in 2018 for their development.

Block 2, which contains the Hokchi field, is expected to hit an oil production plateau of 28,000 b/d, while the Amoca, Miztón and Tecoalli fields at Eni’s block 1 are expected to peak at a combined 90,000 b/d.

This would make Ichalkil-Pokoch the largest producer of the Round 1.2 projects, Franco said.

Commissioner Hector Moreira called Block 4 “spectacular for the country.” Operating income over the project’s lifespan is expected to total $21.3 billion, with 85% (about $18 billion) going to the state.

About 110 contracts have been awarded through bid rounds, migrated oilfield services contracts and farmout tenders conducted under the framework of Mexico’s 2013 constitutional energy reform. The reform ended the upstream monopoly formerly held by state oil company Petróleos Mexicanos (Pemex).

“Hopefully the bid rounds are reactivated,” ommissioner Sergio Pimentel said, in reference to a three-year suspension of the rounds imposed by President Andrés Manuel López Obrador.

“Today we have good news, but if we stop exploration activity, the bad news will come over the medium to long-term. If exploratory activity in the country doesn’t continue, there will be a major slowdown.”

López Obrador has said the tenders will not resume until projects awarded through previous rounds start producing. Pemex, which still supplies essentially all of Mexico’s hydrocarbon output, reported crude production of 1.9 million b/d in November from a peak of 3.4 million b/d in 2004. Gross natural gas output averaged 3.76 Bcf/d, down from a high of 6.52 Bcf/d attained in 2009.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 | ISSN © 2158-8023 |