U.S-Canada Natural Gas Trade Slowed Through September, Says DOE

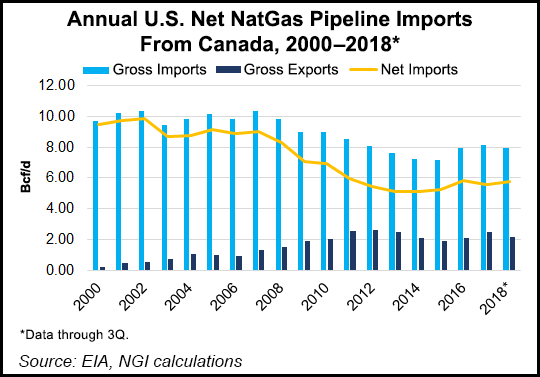

Natural gas trade slowed in both directions between Canada and the United States during the first nine months of 2018, according to a report from the U.S. Department of Energy (DOE).

Canadian pipeline exports dropped by 2.2% to 2.25 Tcf in the first three-quarters of 2018, down from 2.3 Tcf in the same period of 2017. DOE said U.S. exports to Canada shrank 15.2% to 587.6 Bcf, down from 693.2 Bcf during the same time frames.

Prices also fell on gas flows in both cross-border directions.

Canadian exports fetched an average $2.25/MMBtu in the first three-quarters of 2018, down 10.8% from $2.53/MMBtu in the same period of 2017. The average price at the border for U.S. exports to Canada dropped by 2.5% to $3.02/MMBtu in the first nine months of 2018, down from $3.09/MMBtu in the same period of 2017.

The DOE report reflects higher prices for U.S. pipeline exports due to a trade pattern. American gas flows to the highest value Canadian destinations in Ontario, Quebec and the Atlantic provinces. Canadian exports go to variable markets across the continent.

Canadian industry participants and observers attribute the erosion of sales volumes and prices to supply and transportation developments on both sides of the international border. Both countries increasingly rely on their own gas.

Cross-country pipeline toll cuts are sharpening the competitive edge of production from Alberta and British Columbia, enabling them to recapture eastern Canadian markets from U.S. exports.

In the U.S., strong Appalachian output from the Marcellus and Utica formations squeezes Canadian gas out of markets in the northeastern states.

But the trade report shows that unlike Canadian gas merchants, U.S. exporters are making gains because they have alternative, higher-priced growth outlets: Mexico and the overseas liquefied natural gas (LNG) market.

Total U.S. exports hit 2.6 Tcf or 9.5 Bcf/d in first three-quarters 2018, up 14% from 2.28 Tcf or 8.4 Bcf/d in the same period of 2017. American exports to Mexico grew 11.2% to 1.25 Tcf or 4.6 Bcf/d. LNG exports jumped 64% to 762.5 Bcf or 4.6 Bcf/d.

Prices fetched at the Mexican border by U.S. gas averaged $3.16/MMBtu in the first nine months of 2018, down 2.7% from $3.24/MMBtu a year earlier, but 4% higher than sales to Canada.

American LNG shipments averaged $4.72/MMBtu in first three-quarters of 2018, marking a 1.5% improvement from $4.65/MMBtu in the same period of 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |