E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

WPX Cutting 2019 Capex, Selling Permian-Focused WhiteWater Stakes

WPX Energy Inc., which three months ago set 2019 capital spending plans geared to $65/bbl West Texas Intermediate, slashed capital expenditures (capex) by 23% to track within an average $50 oil price, cutting two rigs that were slated to run through the year.

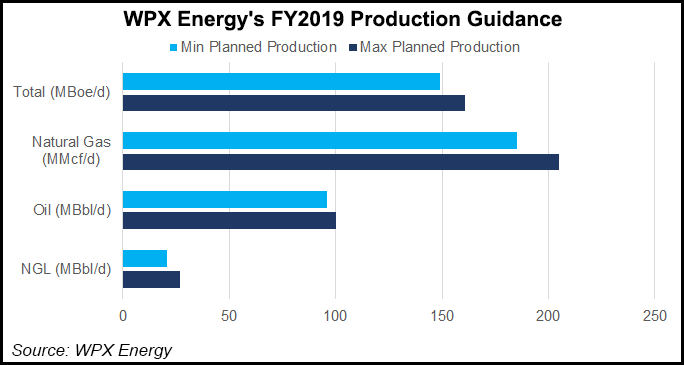

The Tulsa-based independent now estimates output this year will average 149,000-161,000 boe/d, down about 6% from the original forecast. The guidance implies 5-10% production growth overall from 4Q2018 to 4Q2019.

Capex was reduced 23% from the prior midpoint estimate to $1.10-1.28 billion from $1.55 billion. WPX is also dropping two rigs from its original 10-rig program, with plans to run on average five rigs in the Permian Basin and three in the Williston Basin for the balance of 2019.

“We’ve worked hard over the past few years to position the company to spend within cash flows in a $50 world and still deliver nice growth,” CEO Rick Muncrief said Monday. “We’re also going to keep our balance sheet strong, continue the technical work that’s driving savings and cost efficiencies, and maintain the optionality we have with our two producing assets and our midstream ownership.”

WPX has 42,575 b/d of oil hedged this year with fixed price swaps at a weighted average price of $53.65/bbl and 7,321 b/d with collars at a weighted average price of $50 for the floor and $60.19 for the ceiling. WPX also has 108,470 MMBtu/d of natural gas hedged at a weighted average price of $3.07/MMBtu.

WPX also has agreements in hand worth more than $200 million to sell assets in West Texas by the end of March, which would help shore up capex for the year.

In one deal, WPX is selling its Nine Mile Draw assets in Reeves County, which include roughly 5,600 net acres and 1,500 boe/d of production. Some of the proceeds would be used to purchase 14,000 acres in its Stateline operations in the Permian Delaware sub-basin.

“The acreage will provide economic returns through speed of development, facilitating longer laterals, right of way access, and revenue associated with infrastructure like roads, water and electricity,” COO Clay Gaspar said.

WPX is also selling a 20% equity interest in WhiteWater Midstream LLC’s Agua Blanca natural gas pipeline in the Permian to First Infrastructure Capital Advisors LLC.

Agua Blanca, with initial capacity of 1.4 Bcf/d, services the Delaware via 90 miles of 36-inch diameter pipeline and 70 miles of smaller diameter pipeline crossing portions of Culberson, Loving, Pecos, Reeves, Ward and Winkler counties.

In related news, First Infrastructure agreed to buy the entire WhiteWater system from financial sponsors Denham Capital Management and Ridgemont Equity Partners for an undisclosed amount. WhiteWater management would remain on board.

WhiteWater, founded in 2016, is working with Targa Resources Corp. and two other operators to develop the 2 Bcf/d Whistler Pipeline Project, which could deliver up to 7 Bcf/d from the Permian to Gulf Coast markets and beyond.

WhiteWater is also holding an open season through Feb. 15 to test support in Steady Eddy, a 24-inch diameter gas pipeline that would connect to multiple points in Eddy County, NM, in the heart of the state’s Permian activity, to delivery points in Culberson County, which is in the Texas portion of the massive play.

“WhiteWater is committed to continuing to partner with shippers in the Delaware Basin,” CEO Christer Rundlof said. “Our new sponsor has a long investment horizon that will allow us to continue to manage the asset for the long term.”

First Infrastructure managing partner Dan Shapiro said WhiteWater had created “a unique cornerstone infrastructure asset that maximizes natural gas takeaway options for producers in the Delaware Basin. We look forward to working closely with the team to invest significant capital in expansions of the Agua Blanca system, other natural gas residue, natural gas liquids and complementary energy infrastructure projects.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |