Markets | NGI All News Access | NGI Data

February Bidweek Dips as Bone-Rattling Polar Vortex No Match for Ample Natural Gas Inventory

After a decidedly mild December and a tepid start to 2019, natural gas price bulls were hoping the return of polar vortex cold in the back half of January would help drive strong gains during February bidweek.

They were wrong, as strong production, ample storage supplies and a forecasted nationwide warm-up all teamed to push NGI’s fixed price February Bidweek National Avg. to $3.235/MMBtu, $1.08 below January’s $4.315 average, and 99.5 cents below February 2018’s $4.230.

Meanwhile, an extraordinarily bone-chilling, record-level freeze to close out the month couldn’t even reinvigorate the futures market. After some ups and downs along the way, the February Nymex futures contract rolled off the board at $2.950, on the wrong side of $3 from the bulls’ perspective. The March contract finished Friday at $2.734, down 8 cents from Thursday’s regular session close.

The cold that battered the Lower 48 in January’s final days was impressive by almost any measure. AccuWeather said it shattered records and that six U.S. states experienced temperatures colder than the South Pole. But with storage risks largely mitigated and analysts viewing the market as oversupplied heading into the 2019 injection season, the short-term cold — however intense — failed to inspire much bullish momentum for February bidweek or for the remaining winter futures contracts.

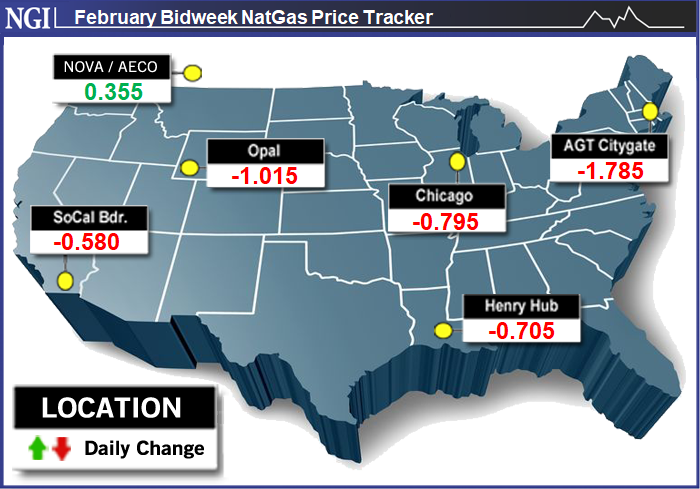

Scanning February Bidweek’s landscape by region, double-digit declines at individual price points ruled the day, with 60-cent drops from January’s price level commonplace, and a number of $1-plus and even a couple of $2-plus slides mixed in.

In the Gulf area, Tennessee Zone 0 South logged a $2.835 average, down 69 cents from January, while NGPL TexOk in East Texas dropped 60.5 cents to $2.770. The Henry Hub was marching to the same beat, coming in 70.5 cents lighter at $2.950.

Areas in the Southeast, which were some of the only spots to miss out on January’s polar vortex, saw some of the steepest February bidweek declines. Transco Zone 5 came off $2.605 to average $4.755.

In the northeast, Algonquin Citygate declined $1.785 to average $7.560, with Transco Zone 6 NY dropping $1.265 to $7.110, and non-NY coming off $2.770 to $4.385. Looking at the Appalachian producing zone, Tennessee Zone 4 Marcellus declined 58.5 cents to average $2.720 and Transco-Leidy Line dropped 60.5 cents to $2.775.

Looking beyond the great January freeze, two of the hardest hit regions — the Midcontinent and Midwest — followed in line with the nation’s declines. Dawn dropped 73.5 cents to $3.000. Panhandle Eastern averaged $2.680, down 48 cents.

In the Rockies and West, the red slashes continued on the trend. Opal dropped $1.015 to average $3.415, while SoCal Citygate was the biggest loser for February bidweek, carving off $3.145 to average $4.710.

Over in the natural gas futures’ arena, the prompt month’s relatively weak finish was partly a result of a “complete reversal” in the outlook for early February temperatures, noted EBW Analytics Group CEO Andy Weissman.

“Record-breaking cold in the immediate term, a large withdrawal” in the upcoming Energy Information Administration (EIA) storage report for the week ended Feb. 1, “and potential for very cold weather to return in late February may help support the March natural gas contract, but the broader trend for gas is likely lower as the market focuses on a bearish spring outlook,” Weissman said.

A fall-off in demand coinciding with the transition from extreme late-January cold to milder early February conditions could weaken physical prices and in turn put downward pressure on the March contract, according to the analyst.

“Although February is still likely to be a cold month overall, the warm shift breaks bullish momentum, allows salt storage to reload inventories and takes any lingering chances of a supply crunch off the table,” Weissman said. “Budding bullish momentum” from when weather models were projecting sustained cold in February has been “replaced by an ultra-warm start to the month.

“Importantly, the break allows salt storage operators — a key source of near-term supply that is helping prevent a run-up in spot prices and Nymex futures — to reload inventories,” he said. Earlier in the winter storage operators had been “more selective in releasing gas” due to larger deficits, but with the combination of more slack in inventories and warm weather in early February “salt storage operators may be more willing to offer large quantities of gas and quell bullish momentum.”

Looking further into February, current weather models are strikingly similar to models at this time last year, according to Radiant Solutions. “If you remember, we had a strong Southeast ridge that never went away, and we ended up much warmer than pre-month expectations,” meteorologist Bradley Harvey said Wednesday on Enelyst, an energy chat room hosted by The Desk.

From a teleconnection perspective, this is very much a positive Tropical Northern Hemisphere and negative Pacific North American (PNA) regime, which can produce a warmer South and sometimes East scenario, the forecaster said. That being said, the firm believes it has good reason to question the durability of this pattern.

“The tropical setup is very opposite from what we saw last year, and historical cases like this suggest the colder positive PNA as being the typical response,” Harvey said.

This indicates a lower confidence in the persistence of the pattern projected in current weather models. The setup for this year should be colder in the eastern half of the country versus what is projected in the 11-15 Day models and beyond that. “That lowers our confidence,” Harvey said.

If the model holds, however, Radiant would almost certainly need to reduce its projected gas-weighted degree days for February. “But for those reasons discussed above, we are remaining skeptical of a February 2018 repeat.”

With European weather models already catching onto trends that can increase high end cold risks through mid-February, Bespoke Weather Services said it is looking for more support at the front of the strip moving forward. Current models appear too warm in the long range given Nino climatology and eventual progression of the Madden-Julian Oscillation, and though some gas-weighted degree days have fallen off in the short term, “those can be made up by colder trends later in February.

“Additionally, the strip remains relatively supportive with March gas trading below the summer strip; with enough cold risks, we can see that at least catch more of a bid in the coming couple of weeks and potentially progress back towards the $3 level,” Bespoke chief meteorologist Jacob Meisel said.

From a technical standpoint, in its first few days as the prompt month the March contract has been testing longer-term support around $2.700-2.800, according to Powerhouse President Elaine Levin. Come Groundhog Day, the bulls may need the little rodent to see his shadow this year to hold prices at this level, she said.

If bulls fail to hold the $2.700-2.800 support area then “you’re talking about going back down to those lows toward $2.500. We’ll have to see, but it does appear that our cold weather fireworks are behind us for now. It’s a question of whether we’ll see buying off longer-term support,” Levin said. “…If we get those six more weeks of winter, we’ll get a better shot at support holding. Punxsutawney Phil to the rescue.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |