Infrastructure | E&P | NGI All News Access

U.S. Natural Gas Patch Adds One Rig, 15 Oil Rigs Dropped, Says BHGE

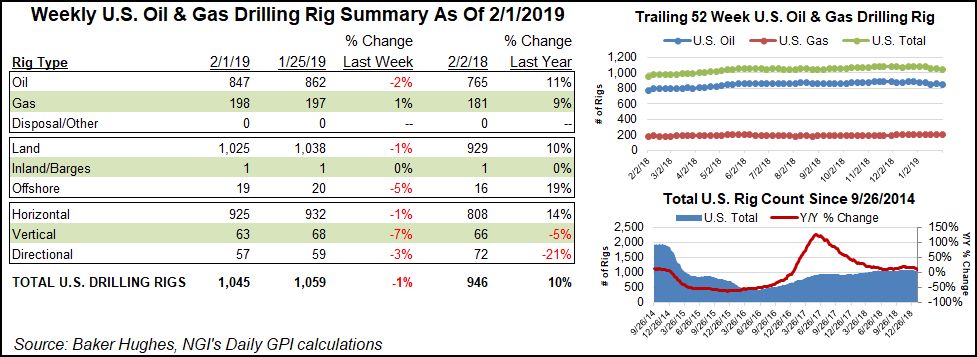

The domestic natural gas rig count gained by one for the week ended Friday (Feb. 1), but the oilpatch took a hit, dropping 14 for the week, bringing the overall U.S. tally to 1,045, according to Baker Hughes, a GE company (BHGE).

The U.S. count still is sharply ahead of the same week a year ago, when there were 99 fewer rigs overall in operation. At the end of the week, BHGE said there were 1,025 U.S. land rigs digging for oil and gas, along with one drilling in inland waters and 19 working the offshore.

Meanwhile, Alberta’s decision last Wednesday to ease mandatory oil production cuts may have led Canadian operators to hoist 11 more rigs as of Friday to bring its total to 232, versus 342 a year ago.

Overall, the North America count stood at 1,288, flat from a year ago and down three week/week, according to BHGE.

In the United States, 847 oil rigs were in operation, versus 765 a year ago, with 198 plowing natural gas fields, up from 181 a year earlier. Most of the domestic rigs are horizontals at 925, compared with 808 in the year-ago week. The directional rig count year/year has declined to 57 from 72, and the vertical count was at 63 versus 66 a year earlier.

North Dakota was the only state to gain a rig for the week to end at 58, compared with 45 running a year earlier.

Several big producing states, including California, Colorado, New Mexico, Ohio, Pennsylvania, West Virginia and Wyoming held steady for the week.

Meanwhile, five states lost rigs, with Texas down three week/week, but it still claimed the most at 514, compared with 465 a year ago. Oklahoma released four rigs from a week earlier, but it was the second most popular place to drill in the Lower 48 with 122 rigs, five more than a year ago.

Louisiana dropped one rig to end at 62, and Alaska dropped four to end at seven. Kansas lost its only rig.

By play, the Permian Basin tops all others, with the Delaware sub-basin running the most rigs in the country running at 273. Another 200 were at work in the twin Midland sub-basin and eight more were running in other Permian formations, according to calculations compiled using data from NGI and BHGE.

The Eagle Ford Shale, mostly being developed in South Texas, had the second highest number of rigs running at 81, while the Marcellus Shale had 63. In the Cana Woodford of Oklahoma there were 61 rigs in operation, mostly within the SCOOP and STACK, aka the South Central Oklahoma Oil Province and the Sooner Trend of the Anadarko basin, mostly in Canadian and Kingfisher counties.

The Williston Basin, home to the Bakken Shale, had 58 rigs working as of Friday, while the gas-heavy Haynesville Shale was running 54. There also were 31 rigs in operation in the Denver-Julesburg Basin/Niobrara formation, and 19 running in the Utica Shale. Ten rigs were in operation within the Mississippian Lime and five were working in the Granite Wash.

Helmerich & Payne Inc. (H&P), which fabricates high-performance drilling rigs, aka super-specs, has reduced its 2019 capital spending by 20% and cut back upgrades to the flagship systems because exploration and production customers are concerned about where oil prices are headed, management said last Wednesday.

The drop in oil prices in 4Q2018 has scuttled 2019 budgets, for now at least, for some exploration and production (E&P) companies. Demand for super-spec rigs in 1Q2019 “has softened largely due to oil price uncertainty and our customers’ aim to spend within cash flow,” CEO John Lindsay said.

The “recent lack of clear direction in crude prices is injecting an amount of uncertainty into some of our customers’ drilling plans for 2019,” CFO Mark Smith said. The slowing cadence of super-spec upgrades has created “a commensurate reduction in our planned capital expenditures for the year.”

H&P has more than 70 customers split about 50/50 between public and private E&Ps, Lindsay said. “However, more than 80% of our active rigs are working for publicly traded E&P companies. Discussions with several customers regarding their capex outlook indicates a mix of increasing, decreasing and flat spending budgets. However, the consistent theme is discipline, principally, keeping 2019 spending within cash flow.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |