Market Looking Past Polar Vortex as Natural Gas Futures, Cash Slide

A bearish government storage report, combined with forecasts showing too little cold too late in the season, pressured natural gas futures lower Thursday.

Meanwhile, after polar vortex temperatures helped inflate day-ahead prices in the Midwest and East earlier this week, the prospect of much warmer conditions by the weekend let the air out of the cash market; the NGI Spot Gas National Avg. dropped $1.080 to $3.185/MMBtu.

The March Nymex futures contract slipped 4.0 cents to settle at $2.814 Thursday after trading as high as $2.918 and as low as $2.802. Contracts further along the strip sold off by a similar amount. April shed 4.3 cents to $2.765.

The March contract has been drifting back into longer-term support in the $2.700-2.800 area, Powerhouse President Elaine Levin told NGI.

“If you get through that then you’re talking about going back down to those lows toward $2.500,” Levin said. “We’ll have to see, but it does appear that our cold weather fireworks are behind us for now. It’s a question of whether we’ll see buying off longer-term support.”

As for the weather outlook, she pointed to cold showing up in the eight- to 14-day period following milder conditions expected over the weekend and next week.

“I wouldn’t say it’s a disaster,” Levin said. “I don’t know what the groundhog’s going to say. It doesn’t look like winter’s over, but the polar vortex is, for where it matters.”

Showing stronger cold across the northern United States Feb. 8-14, the afternoon European model Thursday added 12.5 heating degree days (HDD) compared to its Wednesday night run and 11.5 HDDs versus data from 24 hours prior, according to NatGasWeather.

“This matched the colder trending” Global Forecast System data from midday Thursday, with both models “now showing HDDs solidly above the 30-year normal Feb. 8-14,” NatGasWeather said. “…Overall, still a relatively bullish pattern the next two weeks if it wasn’t for the mild spell this weekend into early next week.”

Bulls will need to hold $2.80 for the March contract in order to regain any momentum, according to the forecaster.

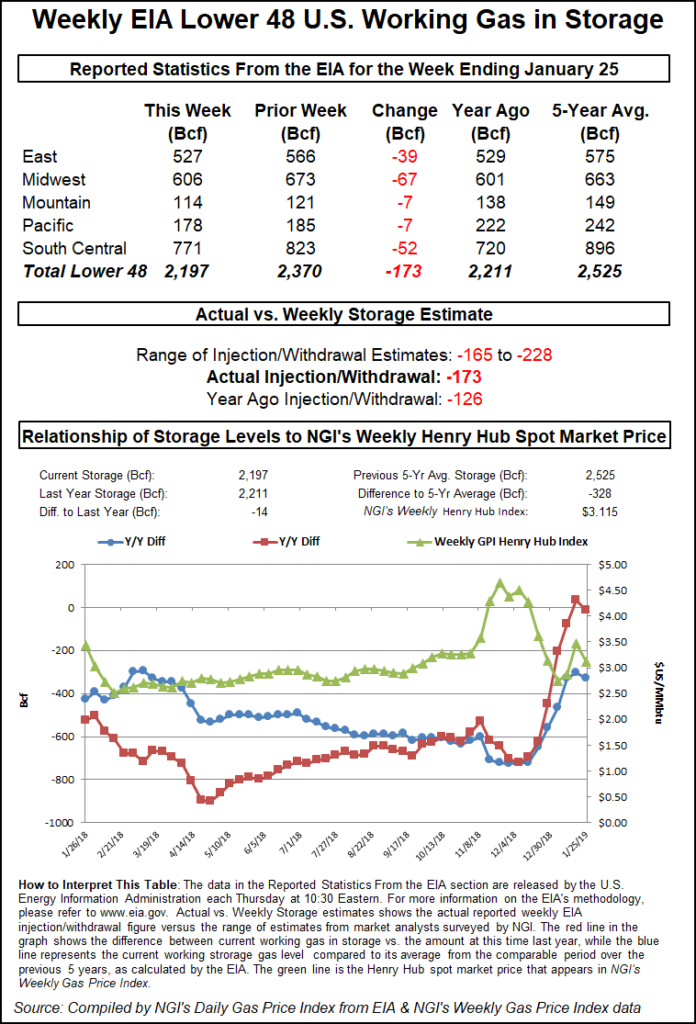

The Energy Information Administration reported a 173 Bcf withdrawal in its weekly natural gas storage report Thursday, a bearish surprise that prompted a modest sell-off in the futures market.

The 173 Bcf pull from U.S. gas stocks for the week ended Jan. 25 compares to a 126 Bcf draw recorded in the year-ago period and a five-year average draw of 150 Bcf. While larger than average, the actual figure comes in well below most estimates.

As the figure crossed trading screens at 10:30 a.m. ET, the March Nymex futures contract took an immediate hit, though not an especially pronounced one. After trading around $2.850-2.870 in the hour leading up to the report, the front month quickly sold off to as low as $2.811 before climbing back up to around $2.830-2.840 over the next few minutes.

By 11 a.m. ET, March was trading around $2.835, down a few pennies from the pre-report trade and down about 2.0 cents from Wednesday’s settle.

Prior to Thursday’s report, estimates had pointed to a withdrawal in the mid to high 180s Bcf range. As of Wednesday a Bloomberg survey had produced a median of 197 Bcf, while a Reuters survey pointed to a 189 Bcf pull. Intercontinental Exchange futures settled Wednesday at a 184 Bcf withdrawal.

Based on discussions over energy chat service Enelyst immediately following the report, the withdrawal in the East region came in lighter than market participants had expected. Meanwhile, some market watchers expressed skepticism over the number, with Genscape Inc. analyst Eric Fell suggesting it might be a true-up following a larger-than-expected pull reported last week.

Other potential factors Enelyst participants used to explain the low draw included higher wind and coal power burns during the week, as well as potential demand impacts from the Martin Luther King Jr. holiday.

Total working gas in underground storage stood at 2,197 Bcf as of Jan. 25, 14 Bcf (0.6%) below year-ago stocks and 328 Bcf (13.0%) below the five-year average, according to EIA.

By region, the Midwest posted the largest withdrawal on the week at 67 Bcf, while 39 Bcf was pulled from East stocks. Both the Mountain and Pacific regions recorded a 7 Bcf withdrawal on the week. In the South Central, EIA reported a 52 Bcf withdrawal, including 17 Bcf pulled from salt stocks and 35 Bcf withdrawn from nonsalt.

Looking at the supply picture, Genscape’s latest Lower 48 production estimate showed supply dipping below 84 Bcf/d Thursday, down 1.5 Bcf/d day/day, with freeze-offs impacting more than 2 Bcf/d of production. While subject to upward revisions, the production declines included “substantial” drops in the East, Rockies and Texas.

“In the East, pipeline sample production in Northeast Pennsylvania is down more than 0.4 Bcf/d, with the brunt of the declines coming from Bradford County, where Tennessee Gas Pipeline has the largest presence,” Genscape senior natural gas analyst Rick Margolin said.

Ohio production was down 0.42 Bcf/d in Thursday’s pipeline sample, which Margolin attributed largely to a “cessation of deliveries” into the Rockies Express Pipeline (REX) from MarkWest’s Seneca plant. He pointed to recent notices from REX warning of reduced operational flexibility due to the extreme cold in its Zone 3.

“West Virginia production has been hovering around the 5 Bcf/d mark the past couple days, about 0.26 Bcf/d below the 30-day average prior to this cold blast,” Margolin said.

Easing Temps Temper Cash

With the most intense polar vortex temperatures hitting much of the country Wednesday and Thursday and expected to moderate from there, it didn’t take long for day-ahead prices to sell off sharply from the elevated basis levels observed earlier in the week. In the Midwest, Chicago Citygate posted a steep discount for a second straight day, plunging $2.215 to $2.775. Northern Natural Ventura plummeted $3.780 to average $2.925.

The record-setting cold that hammered the country this week was expected to loosen its grip late Thursday and Friday, “but still with brutally cold conditions across the Midwest, Ohio Valley and Northeast,” according to NatGasWeather, who said lows Thursday night were on track to again range from negative 40 degrees to the single digits, delivering “very strong demand.

“However, rapid warming is still on track for this weekend into early next week as highs rebound into the 40s and 50s across the Great Lakes to Northeast, with very comfortable 60s and 70s across the southern U.S., locally 80s for Texas and Florida,” the forecaster said. “This will ease national demand to much lighter than normal levels Saturday through Wednesday, even though it will remain quite cold across the Mountain West and Plains.”

Genscape models Thursday showed Lower 48 demand retreating from the peaks established during this week’s extreme polar vortex temperatures. The firm modeled demand for Thursday at 124 Bcf/d, down from 131 Bcf/d as cold temperatures were starting to exit the Midwest and as “eastern demand markets are generally showing resiliency with only a smattering” of operational flow orders or other deliverability issues.

EIA Midwest region demand was tracking toward 32.9 Bcf/d for Thursday, down more than 4.6 Bcf/d from Wednesday’s total, including a 1 Bcf/d drop in the Chicago metro area, according to Genscape analysts Matthew McDowell and Anthony Ferrara.

“After the second record-breaking demand day in the Chicago metro area, timely cycle data has showed pipeline-reported deliveries coming in at 4.5 Bcf/d” compared to Wednesday’s all-time record 5.5 Bcf/d, the analysts said. “Deliveries from Alliance and ANR have fallen off to support this lower number.”

HDDs are forecast to fall back to seasonal norms and “even trend warmer than average through the weekend, which could tighten basis back to pre-polar vortex levels.”

The magnitude of Northeast discounts rivaled those recorded in the Midwest Thursday. Radiant Solutions was calling for much below normal conditions along the Interstate 95 corridor Thursday to flip to much above normal temperatures by the end of the weekend, including highs in the 50s and 60s from Washington, DC, to Boston.

Transco Zone 6 NY dropped $6.650 to $5.855, while further upstream in Appalachia, Texas Eastern M-3, Delivery gave up $4.235 to $4.030.

The declines in the Northeast and Appalachia came as Texas Eastern Transmission (Tetco) declared a force majeure for an unplanned outage on its 36-inch diameter system at the Marietta Compressor Station in Marietta, PA, Thursday.

Genscape analyst Josh Garcia estimated that the outage would restrict about 0.4 Bcf/d of eastbound flows to the eastern portion of Tetco’s M-3 zone.

“This event comes as westbound flows in the M-2 zone remain constrained following last week’s explosion on Tetco’s 30-inch diameter mainline,” Garcia said.

Meanwhile, points throughout the Gulf Coast, Rockies and California also posted discounts Thursday. In Texas, Waha tumbled 28.5 cents to $2.080, while Tennessee Zone 0 South shed 13.0 cents to $2.715.

Valley Crossing Pipeline LLC’s filing with FERC this week seeking to start up its Border Crossing Project suggests an increase in U.S. pipeline exports to Mexico could be imminent, according to Margolin. On Wednesday Valley Crossing wrote to the Federal Energy Regulatory Commission seeking authorization by Feb. 8 to start service on the project facilities.

Genscape projects that the Sur de Texas-Tuxpan pipeline, which Valley Crossing will feed, will start operations by mid-February.

“Together these systems will enable Mexico to reduce LNG sendout with U.S. sourced gas instead. This will also presumably reduce the number of U.S.-sourced LNG cargoes making their way to Mexico,” Margolin said. “While we expect the in-service of the Valley Crossing and Sur de Texas systems will give a boost to total U.S. exports, we expect the impact to South Texas exports to be short-lived as additional infrastructure in Mexico coming online over the next several months will enable increased Permian supply to make its way into the market instead.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |