E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

BHGE Rebuilds Backlog, Sees LNG Projects Sanctioned ‘Faster than Expected’

In its first full year as a combined company, Baker Hughes, a GE company (BHGE) began to rebuild its backlog and switch into growth mode, delivering nearly $7 billion in equipment orders during the fourth quarter, the most for any period in almost three years.

CEO Lorenzo Simonelli led a conference call with his management team on Thursday to discuss the results for 2018, a year that he called one of significant change and progress. Majority shareholder General Electric reduced its ownership last November from 62.5% to 50.4%, giving the company some running room in an increasingly competitive oilfield services (OFS) space.

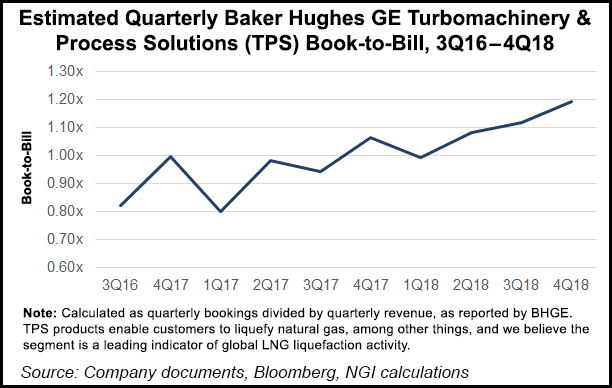

Orders for the quarter were $6.88 million, up 20% sequentially and 21% year/year. The sequential increase resulted from higher volume across all product companies, driven primarily by Oilfield Equipment (OE) and Turbomachinery & Process Solutions (TPS). Equipment orders increased 44% sequentially, and service orders were up 4%. The total book-to-bill ratio in the quarter was 1:1; the equipment book-to-bill ratio in the quarter was 1:2.

During 4Q2018, orders for OE were up 88%, TPS increased 37%, digital solutions climbed 6% and OFS rose 1%. The year/year growth was driven by equipment orders in the longer cycle businesses, which were up 44% versus 4Q2017, CFO Brian Worrell said. Total orders for the full year nearly hit $24 billion.

Many oil and gas-related enterprises are lamenting the downturn in oil prices during the fourth quarter, which upended budgets for 2018, and BHGE is no different.

“The fourth quarter was a reminder of the volatility in our industry,” Simonelli said. “U.S. production surprised to the upside, and we saw completions activity in North America, specifically in the Permian Basin, drop significantly…2018 marks the first time since 2015 that crude oil prices ended the year lower than at the beginning of the year.”

The areas “most impacted” by the recent steep decline in crude prices, he said, “are the more traditional transactional markets in the U.S. and Canada. We expect the activity slowdown and pricing deteriorations in these markets in the first half of 2019 to negatively impact our well construction product lines. We expect the market for artificial lift and production chemicals to remain stable.”

Going forward, “North America is definitely more challenging,” Simonelli said. “We saw that happen during the course of the fourth quarter, and we’ll see that continue in the first half of 2019…The one area where there’s a lot of activity is LNG…”

BHGE estimates that longer term, LNG capacity could reach about 550 million metric tons/year (mmty), with an estimated 5% compound annual growth rate “from now until 2030, driven by power generation and consumption in some of the emerging markets…India, China.”

Project sanctioning is difficult to determine, but it is “accelerating faster than we anticipated. We now see an opportunity for considerably more LNG projects reaching final investment decision in 2019, including the recently announced LNG Canada project.”

During the fourth quarter, BHGE secured an award to provide modular turbocompressor technology for LNG Canada’s liquefaction plant in Kitimat, British Columbia.

There’s the potential, Simonelli said, for up to 100 mmty of new LNG capacity to be sanctioned worldwide by the end of this year.

The North American OFS business grew 17% in 2018, versus rig count growth of 13%. Internationally, revenue grew 9%, compared to rig count growth of 4%.

In its first full year as a separate company, operating income was $382 million in 4Q2018, up 35% sequentially, with earnings per share of 28 cents. Free cash flow was $876 million, which included $111 million of restructuring, legal, and deal-related cash outflows and $214 million of net capital expenditures.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |