Markets | NGI All News Access | NGI Data

Natural Gas Shrugs Off Record Arctic Blast; Pipes Brace for Frosty Conditions

For a market dominated by weather, the polar blast sweeping across the eastern half of the country arrived too little too late for natural gas traders eyeing the extended mild break on tap beginning this weekend. The Nymex March gas contract, on its first day in the prompt-month position, slipped 4.9 cents to $2.854 on Wednesday, even as temperatures in Chicago plunged more than 20 degrees below zero earlier in the day. The April gas contract was down 3.9 cents to $2.808.

Spot gas prices were mixed but notably lower in some areas that had already endured the worst of the Arctic air. Chicago Citygates next-day gas shed more than $2 as temperatures were expected to steadily climb during the next few days, reaching the mid-40s by Sunday. The NGI Spot Gas National Avg. dropped 13.5 cents to $4.265.

On the futures front, prices were lower throughout most of Wednesday’s session, as weather models lost several gas-weighted degree days for the next couple of weeks. The midday data was milder trending with this weekend’s and next week’s break across the southern and eastern halves of the country, although it continued to trend colder with a system expected across the northern United States late next week, according to NatGasWeather.

Next week’s weather system is forecast to send low temperatures back as low as minus 20 degrees in the northern United States for a swing back to strong national demand, the firm said. A brief break over the East forecast around Feb. 10-11 was expected to swing national demand lower before another cold shot follows across the Midwest and Northeast Feb. 12-14.

“Overall, the pattern would be cold enough to impress with the polar blast this week and also with a couple decent cold shots Feb. 7-9 and Feb. 12-14,” NatGasWeather said. “It’s just the mild break over the South and East this weekend into early next week is a demand killer and really stands out.”

With bears firmly in control, the firm pegged the next level of support at $2.80.

As peak cold is expected to fade in the coming weeks, intense scrutiny will be placed on the evolution of long-range weather forecasts, according to Mobius Risk Group. For reference, the second half of February was remarkably warm in 2018, and continuing a colder-than-normal pattern this year would lead to comparably steeper drawdowns in storage inventories.

“While it is almost a certainty that this summer’s storage build will be larger than last year, a deficit heading into injection season would soften the blow of year/year looseness,” Mobius analysts said. “A path toward a 1-1.1 Tcf end-of-March would likely drive bulls to the forefront, and conversely a path to 1.3 or greater would either cause prices to remain range-bound between $2.75 and $3.00, or alternatively test support at $2.75 if the end-of-March total were to test 1.5 Tcf.”

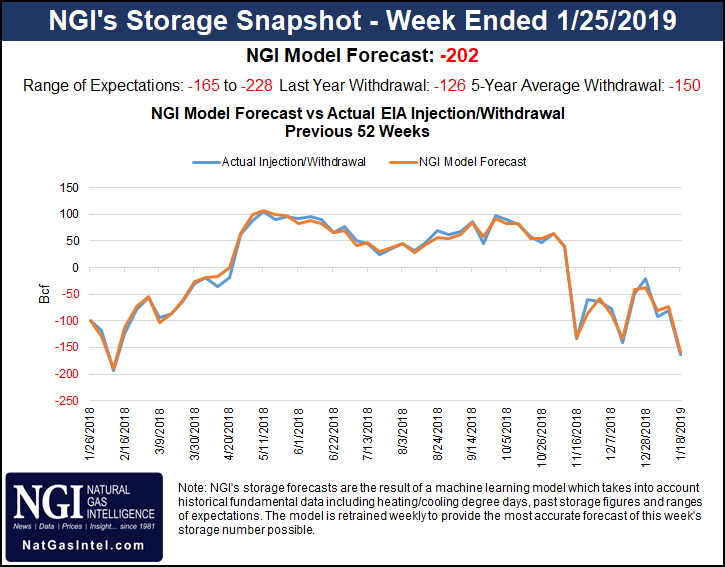

Estimates for Thursday’s Energy Information Administration (EIA) storage report point to a withdrawal in the mid to high 180 Bcf range, which compares with last year’s 126 Bcf draw and the five-year average draw of 150 Bcf.

A Bloomberg survey of 10 market participants had a withdrawal range of 165 to 228 Bcf, with a median of 197 Bcf. A Reuters survey of 20 analysts showed a range of 165 to 207 Bcf, with a median of 189 Bcf. Kyle Cooper of IAF Advisors projected a 188 Bcf pull, EBW Analytics expected a 186 Bcf draw and Bespoke Weather Services called for a 189 Bcf pull. Intercontinental Exchange settled Wednesday at a 184 Bcf withdrawal.

Last week, EIA reported a 163 Bcf withdrawal that left inventories as of Jan. 18 at 2,370 Bcf, 33 Bcf above year-ago levels and 305 Bcf below the five-year average.

As for weather for the latter part of February, forecasters are watching key patterns. “We have to keep watch on the Pacific North American (PNA), as models are showing a negative PNA right now,” Radiant Solutions meteorologist Bradley Harvey said on Enelyst, an energy chat room hosted by The Desk. “This is the ridge near the Aleutians in the northern Pacific, trough over western North America and warmer ridging over the Southeast United States.” If the tropical forcing is correct and influential, the firm could see that setup change to leave more of the Eastern half colder and perhaps not as cold in the West.

Spot Gas Mixed As Polar Air Sweeps Nation

For now, the bone-chilling weather boosted prices at several pricing locations across the country, although other locales slipped after the worst of the biting conditions was in the rear view mirror. Still, with temperatures setting new records across the country, several pipeline operators across the country prepared for the icy conditions.

Consumers Energy, which supplies natural gas to 4.1 million customers in Michigan across 45 counties, on Wednesday called for voluntary reductions following an unexpected fire at a compressor station (CS) in Southeast Michigan. The fire involving equipment at the Ray Natural Gas CS in Macomb County is being investigated after it erupted around mid-morning. The fire was contained, and there were no injuries. However, all gas flow from the CS was shut in until safety and damage assessments can be completed.

Consumers was activating two of its 15 underground gas peaking storage fields in Northville and St. Clair to help deliver supply to customers. In addition, the company “has reached out to its largest business customers to reduce gas usage” while the incident is investigated.

In Appalachia, where production only recently bounced back from the freeze-offs of the last week or so, more were anticipated. Southwestern Energy Co. spokesperson Jennifer Stewart said Tuesday as temperatures were beginning to plummet, production in West Virginia and Pennsylvania was flowing at normal rates. Heating equipment staged in its operating areas, she added, would be employed to mitigate the impact of “any freezing events if they occur.”

Seneca Resources Corp., which has operations that stretch from western to eastern Pennsylvania, where temperatures were expected to reach some of their lowest points in two decades, was prepared.

“Standard procedure is to have certain equipment on location or on call during winter operations,” spokesman Rob Boulware said. “We have forced air heaters that can be deployed as needed, as well as glycol wrap units that are used to thaw frozen lines. We have steam gun crews available if necessary. We also use permanent heat trace in some of locations.”

EQT Corp., the nation’s largest gas producer, was also girding for the cold. The firm indicated on Tuesday that it was implementing standard protocols to handle chilly winter weather that regularly daunts the region and planned to be in constant contact with crews in the field to ensure their safety.

In North Dakota, meanwhile, where temperatures were expected to drop more than 30 degrees below zero in some parts of the state, one of the Bakken Shale’s largest producers was keeping a close eye on the weather. “We consistently make preparations for very cold temperatures,” Continental Resources Inc. spokesperson Kristin Thomas said, adding that personnel were among the company’s highest priorities this week.

Other operators also appeared prepared for the deep freeze. Williams representative Christopher Stockton said “we’ve been operating in the Northeast for more than 50 years, so we are certainly accustomed to cold weather operations.” Still, the company was taking precautions this week. For example, workers are manning certain midstream facilities that aren’t typically staffed to ensure a quick response if necessary, Stockton said.

Williams’ 10,000-mile Transcontinental Gas Pipe Line (aka Transco), which runs from South Texas to New York City, declared an operational flow order on Wednesday to ensure system integrity, maintain safe operations, manage imbalances and handle volatility until further notice as the cold was poised to hold its grip through Thursday.

On the pricing front, Chicago Citygates spot gas prices plunged $2.465 to $4.99, but Consumers Energy jumped 94 cents to $4.10.

Prices in the Midcontinent fell as much as 80.5 cents at Northern Border Ventura, which landed at $6.33, but then jumped as much as 40.5 cents at Northern Natural Demarc, which hit $4.19.

Northeast prices, meanwhile, were mostly a sea of red as New England pricing hubs shed $1 or so, while points along the Transco pipeline tumbled further. The exception was Transco Zone 6 NY, where next-day gas climbed more than $1 to $12.505.

Markets in the Rockies and California also strengthened, with solid gains of 20-40 cents common across those regions. Opal was up 31 cents to $3.69, and Malin rose 20.5 cents to $3.60.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |