NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Sub-Freezing Conditions ‘Not Impressive Enough’ as Natural Gas Forwards Tumble

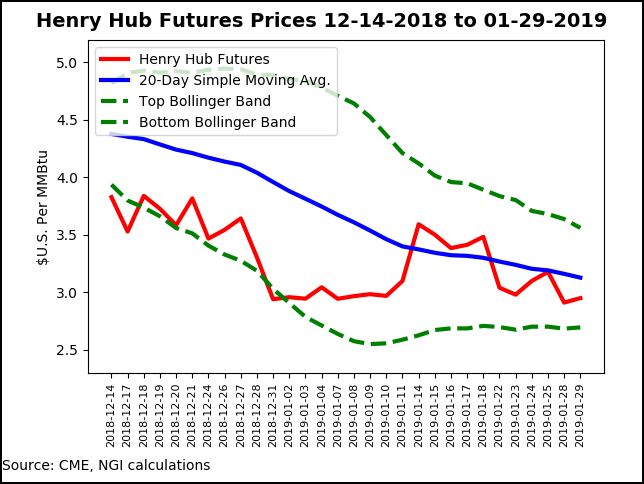

Even as temperatures in the country’s midsection plunged as much as 20 degrees below zero in some areas at mid-week, natural gas forward prices brushed off the brutal cold as only a temporary blip in an otherwise milder outlook for February. February forward prices fell by an average 32 cents between Jan. 24 and 29, while March prices dropped an average 9 cents, according to NGI’s Forward Look.

The declines in most forward markets were in line with the Nymex futures curve, where the Henry Hub February contract lost about 15 cents to expire Tuesday at $2.95, and March shed nearly 10 cents to hit $2.903. Far steeper losses in the Northeast led to more substantial national declines.

The majority of the week’s sell-off occurred Monday, as a much milder-than-expected set-up for next week spelled deep trouble for gas prices, despite the Arctic blast then looming. The Nymex February contract plunged more than 25 cents, and the March contract dropped about 20 cents.

Despite rallying ahead of Tuesday’s expiry, the coveted $3 handle remained out of reach for Nymex gas. That’s largely because the most intense cold was set to ease by the weekend, and the latest weather guidance showed a decline in gas-weighted degree days (GWDD) for the next couple of weeks.

There still looks to be another significant shot of cold weather around Feb. 7 and 8 that could add support for prices, and some cold may linger from there, but it mainly would be in the western half of the country per recent guidance, according to Bespoke Weather Services. Any trough would likely struggle to propagate eastward as models showed the tropical forcing signal break down.

“In this weak Nino environment, we are skeptical of a prolonged negative Pacific North American teleconnection pattern undercutting any negative Eastern Pacific Oscillation and preventing the potential for more widespread cold being reached, especially with tropical forcing trending more favorable,” Bespoke chief meteorologist Jacob Meisel said. Although “models warmed, they could easily reverse those trends.”

The mid-day data was milder trending with this weekend’s and next week’s break across the southern and eastern halves of the country, although it continued to trend colder with a weather system expected across the northern United States late next week, according to NatGasWeather.

Overall, the Global Forecast System data added back numerous heating degree days compared to Tuesday night’s run, but it still maintained the timeline of major weather features to impact the United States into mid-February, NatGasWeather said.

“So, while a record-breaking Arctic blast continues across the Midwest, Ohio Valley and Northeast, it’s clearly not enough to impress the natural gas markets as they want sustained cold, and that’s where the coming milder break arriving this weekend has really disappointed.”

And while cash potentially may firm up a bit as power burns and demand spike on the current cold shot, spot prices are expected to quickly retreat. Bespoke said it is doubtful that cash would provide much support to the gas strip.

In addition, production continues to creep higher, and Canadian imports are up quite a bit, while liquefied natural gas exports initially appear solidly lower, the firm said. “While these trends may be temporary, they make it harder to rally.”

Genscape Inc. daily pipe production estimates as of Tuesday showed Lower 48 volumes climbing to around 85.8 Bcf/d, up nearly 2.3 Bcf/d from a recent low of 83.52 Bcf/d recorded Jan. 21. The largest recovery in volumes was from the Northeast, which increased by more than 1.5 Bcf/d, with large upticks out of Ohio and Southwest Pennsylvania.

“Those areas are recovering from freeze-offs and restoration of partial service on the exploded Tetco 30-inch diameter mainline,” Genscape senior natural gas analyst Rick Margolin said. He noted, however, the recovery may be stunted by the current round of cold.

With natural gas prices continuing to slide early Wednesday, EBW Analytics said the weakness was ominous. “By this weekend, demand is expected to fall by more than 25 Bcf/d from today’s peak. Even if widespread freeze-offs occur, this steep decline is likely to put significant further downward price pressure on the March contract,” CEO Andy Weissman said.

The Nymex March gas futures contract settled Wednesday at $2.854, down 4.9 cents on the day.

Meanwhile, the forward curve for March through November is almost completely flat, with a roughly 10-cent spread between the two contracts. “This eliminates any incentive for marketers to retain gas in storage.”

Storage continued to make headlines as a more than 700 Bcf deficit to historical levels was quickly erased because of milder weather in December and early January. The dramatic improvement in gas stocks even led to a 33 Bcf supply surplus versus the year-ago period as of the Energy Information Administration (EIA) storage report issued Jan. 24.

That overhang was expected to revert back to a year/year shortfall, however, after the Thursday (Jan. 31) EIA report. Estimates were calling for a withdrawal in the mid- to high 180 Bcf range, which compares with last year’s 126 Bcf draw and the five-year average draw of 150 Bcf.

Looking ahead, the possibility of a 200 Bcf-plus storage withdrawal will be closely followed, particularly since peak winter cold will begin to fade thereafter, regardless of the delta versus normal, according to Mobius Risk Group. A draw of more than 200 Bcf in next week’s EIA report (Feb. 7) would expand the year/year shortfall to more than 100 Bcf, and some early estimates have the draw coming in at around 250 Bcf.

Meanwhile, intense scrutiny will be placed on the evolution of long-range weather forecasts over the next week, Mobius said. For reference, the second half of February was remarkably warm in 2018, and continuing a colder-than-normal pattern this year would lead to further deficit expansion.

“While it is almost a certainty that this summer’s storage build will be larger than last year, a deficit heading into injection season would soften the blow of year/year looseness,” Mobius analysts said. “A path toward a 1-1.1 Tcf end-of-March would likely drive bulls to the forefront, and conversely a path to 1.3 or greater would either cause prices to remain range-bound between $2.75 and $3.00, or alternatively test support at $2.75 if the end-of-March total were to test 1.5 Tcf.”

Northeast Extends Steep Losses

For the second week in a row, Northeast forward markets posted the most significant losses across the country. With losses of more than $1 common across the region, the market appeared not to give much weight to the dangerous polar air that moved across the Midwest and Ohio Valley.

National demand was expected to be exceptionally strong through Friday because of the impressive Arctic blast, and demand was expected to be aided by overnight temperatures forecast in the 20s and 30s into the South and Southeast, according to NatGasWeather.

Conditions were forecast to rapidly warm this weekend through the middle of next week as the polar air eroded, giving way to above-normal temperatures. Highs were forecast to reach into the 40s and 50s from Chicago to New York City and into the 60s and 70s over the southern United States, the firm said.

“There will be cold air across the West and Plains next week for locally strong demand, but the natural gas markets will have to wait until late next week for the next strong cold blast to race across the Great Lakes and Northeast,” NatGasWeather said. “This system has trended colder compared to what the data showed early in the week, as lows are likely to again drop into the minus 20s to 20s across the northern United States for a swing back to strong national demand.”

With the mild break on tap, the premium-priced New England markets retreated during the Jan. 24-29 period. Algonquin Citygates February prices slid $1 to $7.645, and March fell 17 cents to $5.846, according to Forward Look. Summer (April-October) prices, meanwhile, jumped 17 cents to $3.09.

Transco Zone 6 Non-NY February plunged $1.53 during that time to $4.445, and March lost 22 cents to $3.146. Summer, however, rose a nickel to $2.69.

Transco Zone 5 in the Southeast posted the largest declines at the front of the curve as February tumbled $2.46 to $3.995. March was down 22 cents to $3.266, and the summer edged up a nickel to $2.97.

Forward prices also weakened in the Midwest, where overnight temperatures were expected to test record lows, although losses were more muted. Chicago Citygates February fell 8 cents from Jan. 24-29 to reach $3.19, March dropped a dime to $2.823 and the summer was steady at $2.64, Forward Look data show.

A handful of pricing locations in the West ended the week in the black. Northwest Sumas February jumped 11 cents to $3.553, and March picked up a penny to hit $2.684. Unlike most other pricing hubs, however, summer prices fell a nickel to $2.10.

A similar trend played out at PG&E Citygate, where February rose 10 cents to $3.633, March climbed a penny to $3.268 and the summer tumbled 12 cents to $3.21.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |