Continued Mexico Natural Gas Market Growth Said Necessary for Local Price Index Formation

A local price index for natural gas in Mexico will develop over time, but it will likely depend on increased production of domestic natural gas resources, a group of experts said earlier this month.

“My perception is that we won’t have local price indexes any time soon,” said Ternium México’s Gerardo Rojas, energy strategy developer for the steel producer. “I think for it to happen we still need more local production and competition.”

He was part of a panel at Industry Exchange’s 4th Mexico Infrastructure Projects Forum held in Monterrey, Mexico.

Santa Fe Gas LLC’s Jorge Vera, business development and marketing manager, agreed. “There is a huge push on the part of the new government to increase natural gas. We see production more in the medium term, and that could lead to the creation of indexes. We need to start getting out more associated gas, but it will take time.”

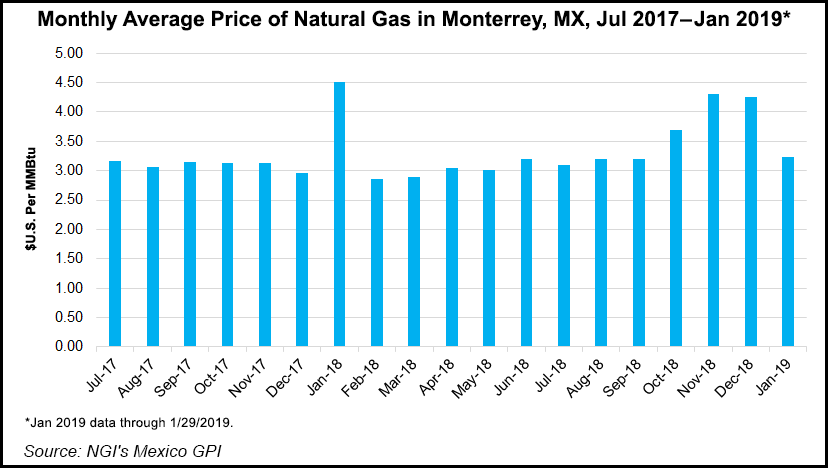

Due to Mexico’s growing reliance on pipeline imports from the United States, transactions in Mexico are typically priced using a U.S. benchmark such as Henry Hub or Houston Ship Channel, plus the cost of transporting the molecule.

NGI has been publishing spot market indexes in the United States and Canada since 1988, and it plans to do the same in Mexico, once trading in that market becomes more liquid. In the meantime, NGI is publishing delivered natural gas prices into Mexico based on U.S.-based prices plus transportation. For more information on NGI’s emerging Mexico price survey efforts, please contact Pat Rau at (347) 385-8412, Dexter Steis at (703) 318-8848, or mexico@naturalgasintel.com.

The new government of Andrés Manuel López Obrador aims to increase domestic gas production by 50% in six years, but gross production in Mexico has fallen by about 42% since peaking at 6.52 Bcf/d in 2009, according to data from state oil company Petróleos Mexicanos (Pemex). Consultancy OPIS PointLogic expects Mexico production to fall by a further 0.5 Bcf/d in the next five years.

Many at the conference suggested that reversing declining gas production depends on developing the country’s unconventional resources. Mexico’s proved, probable and possible, i.e. 3P, gas reserves have fallen by half since 2010, from 61.24 Tcf to 30.02 Tcf, but the Sabinas, Burro-Picachos, Burgos and Tampico-Misantla basins contain an estimated 141 Tcf of prospective unconventional gas resources, per government estimates.

López Obrador has said that he is opposed to hydraulic fracturing (fracking), although the budget for this year at Pemex includes 3.35 billion pesos, or about $170 million, for three unconventional pilot projects in Burro-Picachos, Tampico-Misantla and Burgos. Unconventional development requires horizontal drilling combined with fracking to stimulate the release of oil and gas from shale and tight resources.

“We need to solve this issue of ”energy dependence,’” said Clúster EnergÃa Coahuila’s Rogerio Ramos, executive director of the energy group. “But at the same time, we have heard the president say we will not have fracking. It’s very hard to see how one thing is compatible with the other. Because the biggest part of our natural gas reserves consists of unconventionals that need hydraulic stimulation. We hope that eventually this will get the green light.”

One possible detriment to new gas exploration and production is the freezing of energy auctions by the current government. Mexico awarded 110 oil and gas contracts through bid rounds between 2015 and 2018, but López Obrador has suspended the rounds for three years. He has said they will only resume once the already awarded projects start producing.

In December, Energy Minister RocÃo Nahle confirmed that the suspensions include bid rounds 3.2 and 3.3, which were supposed to occur in February. Round 3.3 would have been the first auction in Mexico’s history to offer blocks targeting unconventional oil and gas resources.

The suspended round 3.3 “was for unconventionals, and we expected $2-3 billion in investment, but unfortunately we are putting this aside,” said Ramón Farias Cadena, undersecretary of the Comisión de EnergÃa de Tamaulipas. “And the suspension of the electricity auctions also gives us uncertainty around some wind projects that were all ready to go.

“We want to help the government and give them information so that the auctions can go ahead and they can reconsider their position. Especially in terms of gas, where we’ve talked about having our own gas and our own reserves that we can manage as a national policy.”

For 2019, Pemex plans to focus upstream investment on shallow water and onshore conventional fields in the southeastern states of Veracruz, Tabasco and Campeche, as well as onshore conventional fields in northern Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |