Infrastructure | E&P | NGI All News Access

U.S. Rig Count Rebounds on Gains in Permian, Williston, Northeast

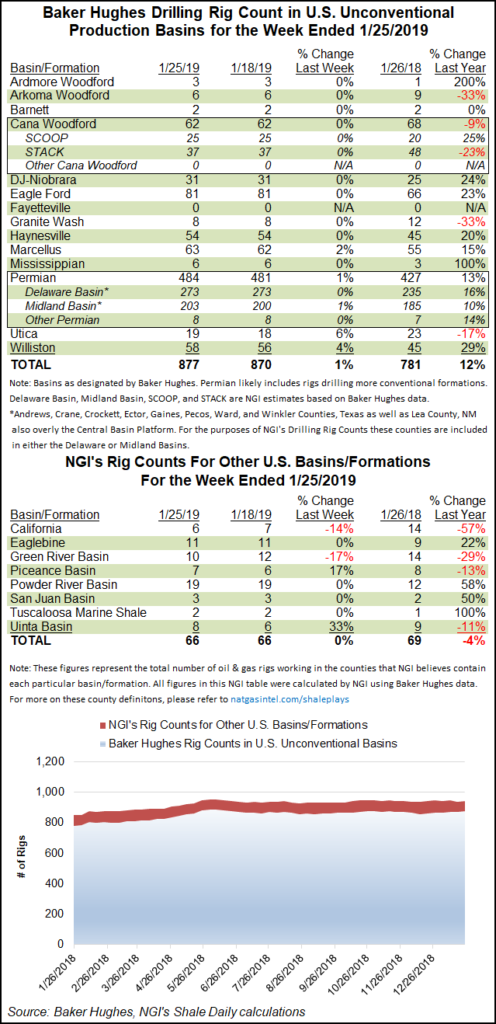

The U.S. rig count rebounded to add nine rigs for the week ended Friday (Jan. 25), including gains in the Permian and Williston basins, and in the Northeast, according data from Baker Hughes, a GE Company (BHGE).

The United States ended the week at 1,059 rigs, up 112 from last year. The week’s gains partially reversed the 25-rig drop BHGE recorded in its domestic tally a week earlier.

The return of 10 oil-directed rigs offset the departure of one gas rig. Land drilling activity grew by nine units, while the Gulf of Mexico added one rig to offset one rig departing inland waters. Four directional units returned to action, along with three horizontal rigs and two vertical, according to BHGE.

Canada added a total 23 rigs to its tally for the week, including 18 oil-directed and five gas-directed. The Canadian rig count still lags its year-ago total by 106 units. The combined North American rig count climbed to 1,291, up six from the 1,285 units running in the year-ago period.

Among plays, the Permian led with three rigs added for the week, growing its total to 484, up from 427 a year ago. The Williston added two rigs to finish at 58, while over in the Appalachian Basin, the Marcellus and Utica shales each added one rig to reach 63 and 19 units, respectively.

Among states, the biggest movers were the two states that sit atop the Permian, as four rigs joined the patch in New Mexico, offsetting a net loss of four rigs in Texas. The growth in the Williston for the week focused in North Dakota, which added three rigs as Montana dropped one from its total, BHGE data show.

Louisiana, Utah and West Virginia each added two rigs, while Alaska, Colorado and Ohio each added one. California, Pennsylvania and Wyoming each saw a net loss of one rig for the week.

Following 23 months of consecutive growth, the Texas Petro Index (TPI) reversed in November and December in response to a sharp contraction in oil prices, with uncertainty about the direction of prices in 2019, petroleum economist Karr Ingham said.

The benchmark price for West Texas Intermediate (WTI) oil declined to $45.31/bbl in December from $67/bbl-plus in October. WTI plunged to $39.24 on Dec. 24 from a high of $71.75 on Oct. 1.

The decline in the TPI may not signal the end of expansion in the Texas upstream oil and gas economy, however.

“It has virtually always been the case that a decline in the Texas Petro Index signaled the onset of a contraction of some magnitude, but that may not be the case this time,” said Ingham, who created the index. He is petroleum economist for the Texas Alliance of Energy Producers.

“A series of geopolitical market events may have been the primary culprit in that particular price event, and the market seems to be working through those in early 2019.”

Meanwhile, oil and natural gas employment in Texas reversed from a November slump to gain 3,200 jobs in the upstream sector for the final month of the year, according to the Texas Workforce Commission.

Upstream jobs were added in the state’s oil and gas extraction sector and in support jobs for the mining industry. The employment tally does not include jobs added or lost in refining, petrochemicals, fuels wholesaling, oilfield equipment manufacturing, pipelines and gas utilities.

The December employment gains offset a 300-job decline reported a month earlier, the workforce data indicated.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |