NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Natural Gas Forwards Plunge Despite Approaching Polar Blast; AECO Posts Modest Gain

Even as the natural gas market is on the brink of yet another polar front expected to begin on Friday, natural gas forward prices plunged in striking fashion between Jan. 17 and 23 as warmer risks for the first part of February showed up in earlier weather models. February natural gas prices dropped 62 cents on average, and March fell 30 cents on average, according to NGI’s Forward Look.

Although the latest weather data turned more frigid for the first part of next month, the damage to natural gas prices was already done as a massive sell-off at the front of the curve sent the Nymex February gas futures contract below $3. The prompt month plunged some 43 cents between Jan. 17 and 23 to $2.98, before a rebound on Thursday. March fell a quarter to $2.922.

As for the latest weather outlooks, Wednesday’s overnight weather model guidance gradually ticked cold risks higher, showing that late Week 2 into early Week 3 a negative Eastern Pacific Oscillation (EPO) could reform upstream to deliver significant cold shots into the center of the country, according to Bespoke Weather Services. Meanwhile, a neutral to trending negative North Atlantic Oscillation could allow for cold to eventually push into the East, “even if there is a period between Days 12-14 where warmth is able to return to portions of the East,” the forecaster said.

“The intensity of the medium-range cold shot remained quite strong, and we now forecast four days in a row with gas-weighted degree days above 40, indicating a draw approaching 300 Bcf is increasingly likely for the week ending early Feb. 1,” Bespoke chief meteorologist Jacob Meisel said.

There should be some moderation beyond this, “but such strong cold can often be stubborn, and the return of the negative EPO is supported by more favorable tropical forcing orientation that has us believe forecasts are able to cool more easily into mid-February too,” Meisel said.

Earlier in the week, weather guidance had indicated that polar air would retreat into southern Canada during the first week of February, leading to the steep slide in gas prices.

Midday data, meanwhile, was even more bullish as the Global Forecast System (GFS) model trended colder across the northern United States Feb. 4-8, seeing cold unwilling to give up ground, according to NatGasWeather. The GFS ensemble added an impressive nearly 20 heating degree days compared to Wednesday’s runs, the firm said.

Mobius Risk Group cautioned that the dramatic sell-off at the start of the week would likely not continue for long as cold was once again set to blanket the eastern half of the country beginning Friday, and weather models over the Martin Luther King, Jr. holiday weekend held onto the trend of sustained cold. Analysts were puzzled at the early-week action since the warmer trends were showing up in data that lacked agreement from other more reliable weather models and due to “the massive cold air mass setting up in Western Canada at the end of the run.”

Looking ahead to the rest of this week, the next several Energy Information Administration (EIA) storage reports suggest bears will have to face an aggressive counter attack by bulls, according to Mobius. “Although early, it appears the current week (to be reflected in the Jan. 31 EIA report) may post a 200 Bcf-plus withdrawal and the subsequent week should seen even greater demand as heating degree days are forecast to be 30 greater week/week.”

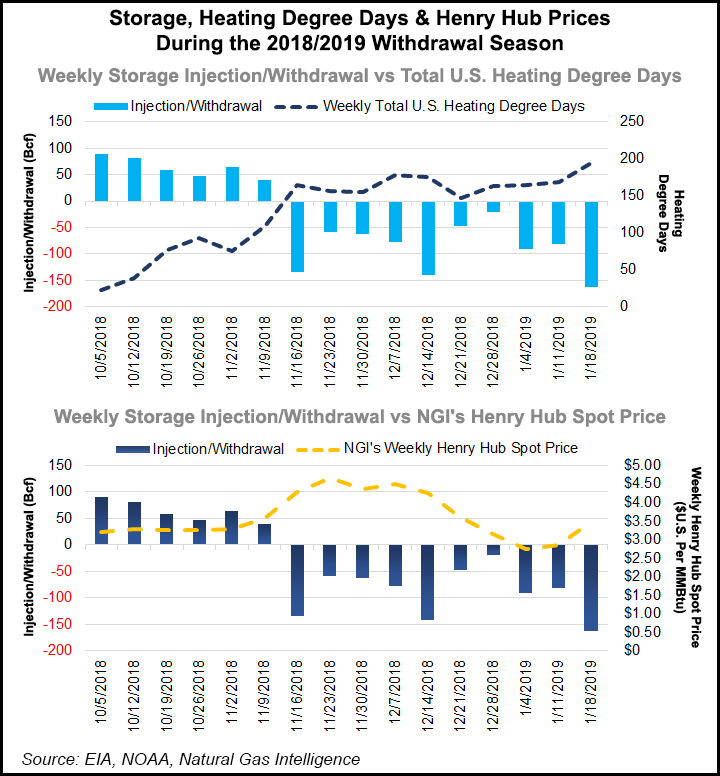

On Thursday, the EIA reported a slightly larger-than-expected 163 Bcf withdrawal from storage inventories for the week ending Jan. 18. That withdrawal fell on the bullish side of major surveys but was bearish versus the five-year average 185 Bcf pull and the 273 Bcf withdrawal EIA recorded in the year-ago period.

The reported build was just 1 Bcf away from Bespoke’s estimate, and the firm said that although the market did not initially appear particularly impressed with this number, “with cold weather only confined to the East on the week and a large draw both in the Midwest and in the South Central, we see this print as indicating significant upside risk on any return of colder weather into the middle of February.”

With a colder February, Bespoke’s end-of-season expectations have dipped below 1.2 Tcf and can fall further if forecasts cool more than expected. “We of course need cold risks on model guidance to rally, but we expect those to build over the coming week and support prices,” Meisel said.

Total Lower 48 working gas in underground storage stood at 2,370 Bcf, 305 Bcf (11.4%) below the five-year average but 33 Bcf (1.4%) higher than last year’s stocks, according to EIA.

By region, the largest withdrawal occurred in the Midwest at 56 Bcf, while 54 Bcf was pulled in the East. The Pacific region withdrew 11 Bcf for the week, while 6 Bcf was pulled from Mountain region stocks. The South Central saw a net 38 Bcf withdrawal, including 29 Bcf from nonsalt and 8 Bcf from salt stocks, according to EIA.

Once again, the salt draw surprised some market observers as the injections that have occurred in the last four weeks have now reversed. “Seems the refill and empty cycle of the most active salt facilities is going to get figured out,” Wood Mackenzie natural gas analyst Gabriel Harris said on Enelyst, a social media platform hosted by The Desk.

Mobius looked for salt withdrawals to also factor into next week’s EIA report as the steep sell-off at the top of the week left the Nymex February contract at a discount to Henry Hub spot prices.

Production freeze-offs were also expected to influence next week’s storage data, even though market observers on Enelyst noted that this withdrawal season has been the weakest in the last six seasons. “Withdrawals have averaged 4-5 Bcf/d lower than last year on similar degree days. So that is the big reason prices have declined even with the cold end to January,” Harris said.

With a far milder end of December and early January, the natural gas market has a much larger buffer in storage, according to Bespoke. But with cold on tap for the end of the month and early February, that buffer erodes.

“It isn’t in itself a reason to worry yet if the market is banking on warmth returning later Week 2 into Week 3. Sustain cold through February, and that’s a totally different story. The market better hope it’s right that this cold isn’t sustained,” Meisel said.

After an initially muted reaction to the EIA’s storage report, the Nymex February gas contract went on to settle Thursday at $3.099, up 11.9 cents. March rose 7.6 cents to $2.998.

Northeast Rally Grinds to Halt

The impressive rally that Northeast gas forward markets had achieved during the last two weeks came to an abrupt halt during the Jan. 17-23 period as traders appeared confident in the warmer outlooks for February and in the much-improved storage picture.

While most markets saw declines of well under $1, Northeast pricing hubs plunged as much as nearly $2 at the front of the forward curve. Transco Zone 6 Non-NY February dropped $1.89 to $5.675, and March slid 37 cents to $3.29, according to Forward Look. The rest of the curve slipped less than a dime.

At New England’s Algonquin Citygates, February was down $1.68 to $8.529, March was down 53 cents to $5.935, and the rest of the curve was down no more than 8 cents.

In Appalachia, Dominion South February fell 52 cents from Jan. 17-23 to reach $2.656, and March dropped 31 cents to $2.611. Prices across the rest of the curve slid a nickel or less. Elsewhere in the region, Tetco M-2, 30 Receipt forward prices remained immune to the volatility occurring in the cash market following Monday’s explosion on the Texas Eastern Transmission Co. (Tetco) system.

In the aftermath of the blast, north-to-south capacity through the Berne, OH, compressor on the 30-inch diameter line dropped to zero starting Wednesday. Capacity at downstream compressors on the 30-inch line remained at 700 MMcf/d as of Wednesday, but this is “irrelevant” given the lack of flows through Berne, according to Genscape natural gas analyst Josh Garcia.

Pipeline operator Enbridge Inc. continues to issue statements regarding the incident. As of Wednesday, personnel had begun work to help further secure the site in preparation for investigation and maintenance activities, including isolating the other two natural gas pipelines in the right of way as an added safety measure, which allows crews the ability to safely investigate the integrity of those two pipelines prior to returning them to service.

Workers also were conducting air, soil and water monitoring on site and performing survey work in support of the investigation and return-to-service plan, a statement on Enbridge’s website said.

While there was still no estimated timeline to return the pipeline to service, Texas Eastern M-2, 30 Receipt February prices fell 56 cents to $2.605, and March dropped 33 cents to $2.572, Forward Look data show. These moves lower are slightly more pronounced than those in the Nymex, but in line with several other pricing hubs across the country.

On the West Coast, SoCal Citygate February was down 74 cents from Jan. 17-23 to $4.673, March was down 59 cents to $3.785 and the summer was down an impressive 33 cents to $3.84.

AECO in the Black

In an otherwise sea of black, Western Canadian forward prices were a ray of light as demand in the region has increased while provincial production has taken some hits with freeze-offs, according to Genscape Inc.

The bullish backdrop has led to an increase in cash basis pricing this month so far, and the impact is seen in forward pricing as well. NOVA/AECO C February prices edged up 3 cents from Jan. 17-23 to reach $1.395, and March climbed 4 cents to $1.222, according to Forward Look.

The modest strength comes as so far this month, the province is consuming an average 6.31 Bcf/d. This is a record for January and perpetuates a 12-year trend for each January to come in higher than the year prior, according to Genscape.

“This year’s January demand levels are all the more notable in light of the fact temperatures in the province have been averaging about 3 degrees Fahrenheit warmer than normal. On a weather-adjusted basis, demand is averaging more than 0.24 Bcf/d stronger than January 2018’s weather-normalized rate,” senior natural gas analyst Rick Margolin said.

Structural growth in Alberta demand is evident in every month and season of the calendar year due to ongoing growth of the oil sands sector, population growth and fuel switching in the power sector, Genscape said.

Production is also coming in lower. Month-to-date volumes are averaging 12.26 Bcf/d, about 20 MMcf/d below the same time in 2018. Current Alberta production volumes are recovering from earlier-month freeze-offs, though — as anticipated — recovery has been somewhat slow as another cold front moved through the province at the end of last week, the firm said.

“Current production is coming in just under 12.5 Bcf/d, which is about 0.2 Bcf/d below the 30-day average prior to the current round of freeze-offs starting around Jan. 7. Since that time, we estimate 9.14 Bcf of provincial production has been choked back, averaging 0.57 Bcf/d and reaching a single-day high (Jan. 9) as high as 1.02 Bcf/d,” Margolin said.

Exports from the province, meanwhile, are essentially flat to January 2018. This has enabled the province’s storage inventories to recover somewhat, according to Genscape. Alberta entered the winter with storage inventories flirting with five-year lows. Inventories have since recovered to now sit well within the middle of the five-year range, the firm said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |