Infrastructure | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Mexico Cancels Floating Storage and Regasification Tender for Southern Gas Supply

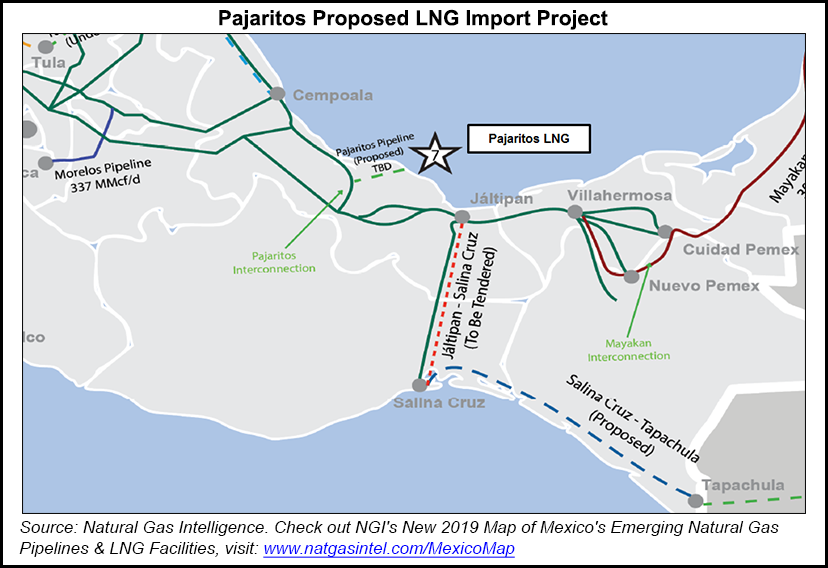

The tender for a 600 MMcf/d floating storage and regasification unit (FSRU) in the Pajaritos port in the southern Gulf of the Mexican state of Veracruz has been called off, sources have told NGI’s Mexico GPI.

Last July, the marketing subsidiary of Petróleos Mexicanos (Pemex), Mex Gas Supply SL, launched the tender to design, install and operate the FSRU for five years. Up to a dozen companies reportedly expressed interest.

As originally planned, the Pajaritos FSRU would have required 2.5 million metric tons/year (mmty) of liquified natural gas (LNG), while an extra 2 mmty would have been purchased on a quarterly basis as needed.

Pemex would have been the anchor client.

Pemex’s new CEO Octavio Romero Oropeza reportedly said it was a national priority to explore and produce domestic gas, and so in light of this the FSRU was no longer needed.

The Pajaritos FSRU had been planned to ease gas shortages in the southeast of the country, especially on Yucatan peninsula, where the 485-mile Mayakan pipeline supplies five Comision Federal de Electricidad (CFE) combined-cycle power plants.

CFE has indicated that it seeks to halt all LNG imports. Last year, its fuel marketing affiliate pulled out of jointly launching the Pajaritos tender with Pemex, arguing that it was not needed given the imminent start-up of new pipelines including the Sur de Texas-Tuxpan line, leaving Pemex as the sole participant.

The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline, a 60-40 joint venture between TransCanada Corp. and Infraestructura Energetica, better known as IEnova, runs from South Texas to the Mexican port of Tuxpan and is scheduled to come online in 1Q2019.

The Cempoala compressor station reversal project is also slated to finish in the first half of 2019, and is considered crucial to providing the security of gas supply to Mexico’s south.

Pajaritos would have been the country’s fourth LNG import option. Mexico’s two active LNG terminals are the 700 MMcf/d Altamira terminal on the Gulf Coast and the 500 MMcf/d Manzanillo on the Pacific. The country relies on them for system balancing.

The Energia Costa Azul (ECA) terminal located in Baja California state on the Pacific Coast, owned by a local subsidiary of Sempra Energy, sees almost no demand and is now being evaluated as a liquefaction project for exports to Asian markets.

Genscape Inc. senior natural gas analyst Rick Margolin said in a September presentation that the company was forecasting LNG imports to Mexico to drop from levels at the time of around 600 MMcf/d to under 200 MMcf/d beginning in April 2019.

Gross natural gas production in Mexico has fallen by about 42% since peaking at 6.52 Bcf/d in 2009, according to Pemex data, but the new government says it will double production by 2024 to 5.7 Bcf/d, driven by associated gas, as part of an eventual plan to slow the need for imported gas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |