Markets | Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

LNG Export Growth May Add Twist to Perplexing South Central Storage Behavior

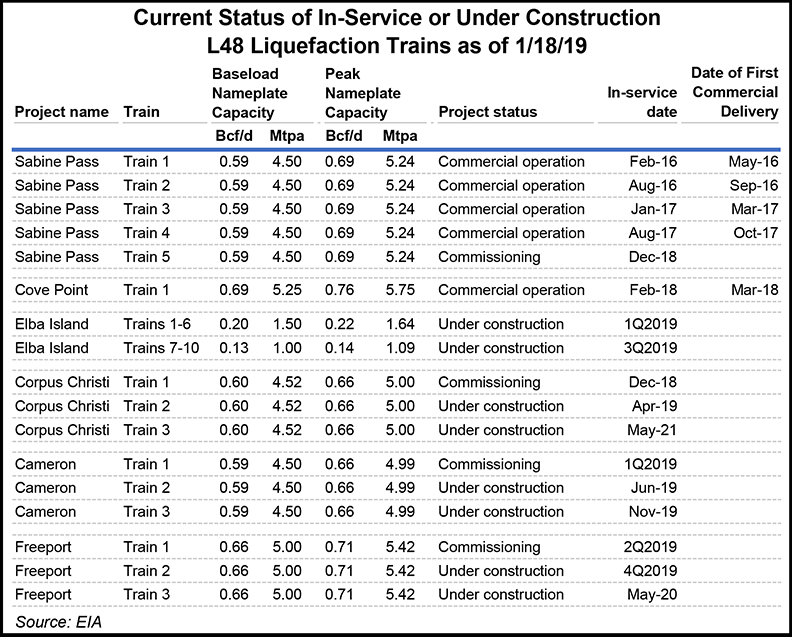

A watershed year for U.S. liquefied natural gas (LNG) export capacity in 2019 could lead to changes in storage behavior in a region where a lack of transparent intrastate pipeline flow data has left market observers without a firm grasp on activity, according to analysts.

Based on planned project completions, export capacity is set to essentially double this year as more than 4 Bcf/d of capacity is expected to begin commercial operation, with the majority on the Gulf Coast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |