E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Drops Four Natural Gas Rigs; Oil Count Plummets

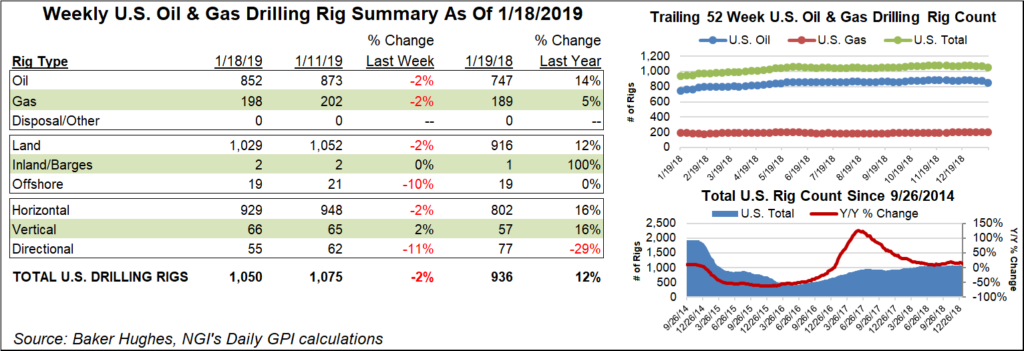

The United States dropped four natural gas rigs to finish at 198 for the week ended Friday (Jan. 18) as oil-directed activity pulled back sharply, according to data from Baker Hughes, a GE Company (BHGE).

A whopping 25 total domestic rigs were dropped, to hit 1,050 rigs, driven by 21 oil-directed rigs exiting the patch. Despite the declines, the U.S. drilling count still finished 114 units ahead of the 936 rigs running at this time last year, BHGE data show.

The pullback in activity was focused on land, where 23 units packed up shop, while two rigs departed the Gulf of Mexico. A total 19 horizontal units departed, along with seven directional units. One vertical unit returned to action, according to BHGE.

In Canada, 25 rigs — all oil-directed — rejoined the patch, putting its rig count at 209 for the week, still lagging the 325 rigs running a year ago. The combined North American rig count finished the week at 1,259, down two units from the 1,261 rigs in the year-ago period.

BHGE’s breakdown of weekly changes by state showed a sharp pullback in activity in Texas and Oklahoma. Texas dropped 11 rigs to end the week at 521, while Oklahoma saw 10 rigs pack up, dropping to 126. California dropped three rigs, Kansas and Louisiana each dropped two, while Colorado and Pennsylvania each dropped one.

Also among states, Alaska, New Mexico, North Dakota, Ohio, West Virginia and Wyoming each added one rig to their respective tallies.

Among plays, the Permian Basin in West Texas and southeastern New Mexico dropped seven rigs on the week to end at 481, versus 409 a year ago. The Granite Wash saw three rigs dropped for the week, while the Mississippian Lime’s rig count dropped by two.

The Cana Woodford posted the largest weekly increase among plays at five, raising its total to 62 (71 a year ago). The Ardmore Woodford, along with the Eagle Ford, Haynesville and Marcellus shales, each added one rig for the week.

The drilling declines follow a major slump in crude prices that saw West Texas Intermediate futures drop into the low $40s/bbl in late December. Prices have since rebounded somewhat, trading above $53/bbl as of Friday afternoon, but still sit far below highs above $70/bbl set back in October.

Recent oil price volatility has made exploration and production (E&P) companies skittish, and the uncertainty around their spending plans may delay the broad-based recovery expected only three months ago, Schlumberger Ltd. CEO Paal Kibsgaard said Friday.

During a conference call with investors to discuss fourth quarter and full-year results, as well as provide some perspective on what the No. 1 oilfield services company is hearing from E&P customers, Kibsgaard noted that some E&Ps already have reduced their capital expenditure plans for 2019.

Recent discussions offer “clear signs that E&P investments are starting to normalize and reflect a more sustainable financial stewardship of the global resource base. For the North America land E&P operators, this means that future investments will likely be much closer to the level that can be covered by free cash flow.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |