E&P | Infrastructure | LNG | Markets | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

E&Ps, OFS Sectors Likely Cautious in 2019, but LNG, Offshore Looking Stronger

U.S. upstream operators appear cautiously optimistic about 2019, as Lower 48 natural gas makes its way overseas and new Permian Basin infrastructure reduces constraints, but the mantra of returns over growth may continue, according to energy industry prognosticators.

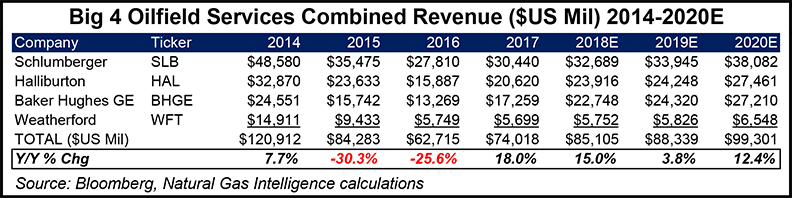

Bellwether Schlumberger Ltd., the No. 1 global oilfield services (OFS) operator, issued its 4Q2018 results Friday, setting the tone for the earnings season and outlook for the year. First out of the gate was Kinder Morgan Inc., which issued its results on Wednesday.

Schlumberger’s earnings report will be followed next Tuesday by Halliburton Co., the second largest global OFS and No. 1 pressure pumping company in North America.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |